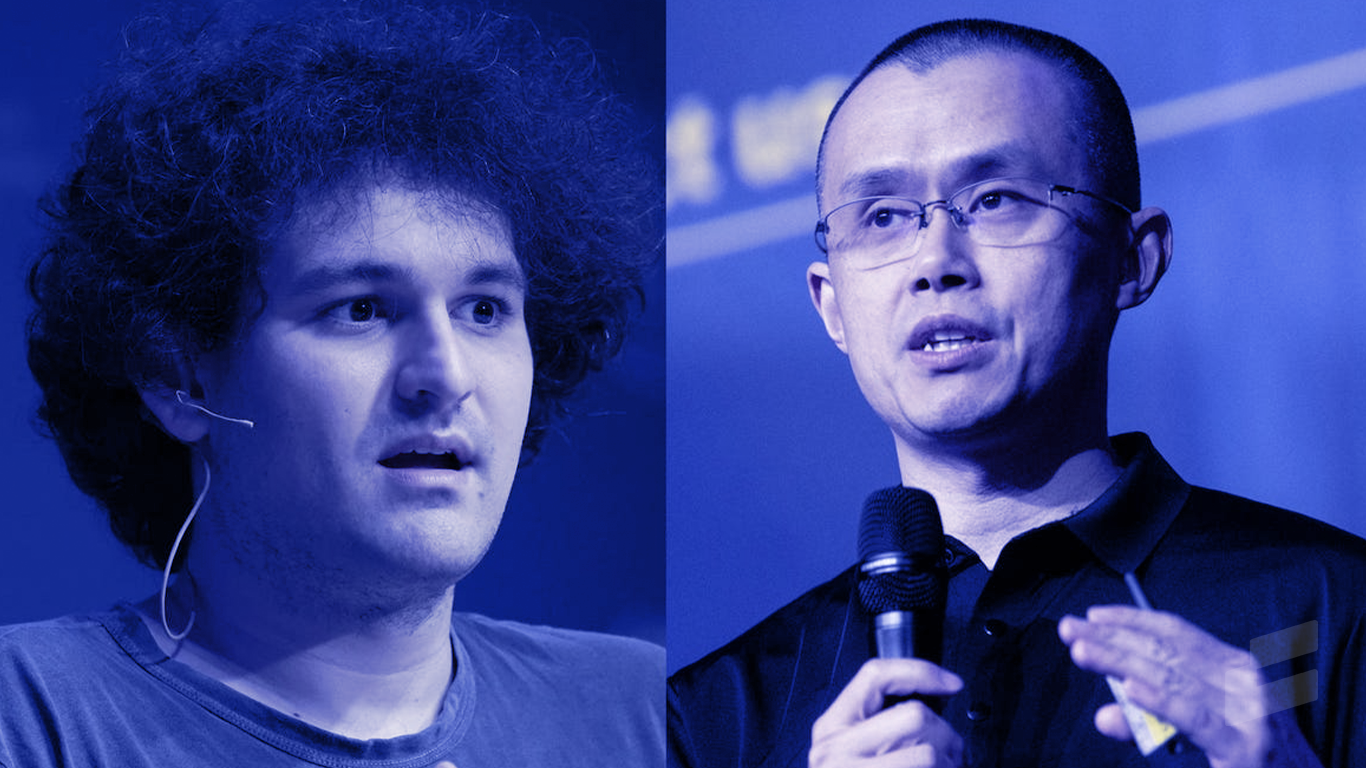

On Tuesday, Crypto exchange Binance announced that it had signed a letter of intent to buy Sam Bankman-Fried’s FTX following a liquidity crunch within the company.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ ???? Binance (@cz_binance) November 8, 2022

The deal won’t include FTX US or Binance US, the US operations of both exchanges.

“Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in,” said Bankman-Fried in a Twitter thread. “A *huge* thank you to CZ, Binance, and all of our supporters.”

This effectively ends Binance founder Changpeng Zhao and Bankman-Fried’s months-long clash over social media, which escalated two days ago after CZ revealed plans to dump all of Binance’s FTX tokens holdings over financial discrepancies on the company’s books.

Binance, the largest crypto exchange in terms of volume, is among one of the early investors in FTX. However, soon after the initial funding round, the relationship between the CEOs of the exchanges started deteriorating.

Even though the deal’s financial terms haven’t been revealed, it’s rumored to be on-par with the $32 billion valuation at which FTX raised funds earlier this year.

FTT down BIG

The market hasn’t reacted very positively to the news. FTX Token, which was already on a decline, has fallen precipitously by over 70% in the last 24 hours. It’s currently trading at around $5.13, according to Coinmarketcap data.

“It’s scary to think that FTX, which is one of the largest crypto exchanges in the world, was bitten by liquidity concerns and Binance, their biggest rival, is coming to their rescue,” said Dan Raju, CEO of Tradier, financial services provider and brokerage.

Meanwhile, the stock price of publicly traded exchange Robinhood also shed almost 20% on the acquisition news of FTX, which recently took a 7.6% stake in the company.