Bitcoin price is being suppressed during the weekend’s final hours going into the second trading week of November. Key levels have been defined to gain perspective on BTC’s next potential move.

Bitcoin price has underlying strength

Bitcoin price has endured an onslaught of bearish pressure over the weekend as the bears have produced a 3% decline. Still, there are subtle cues within the technicals suggesting BTC has the strength to overcome its’ current demise.

Bitcoin price currently auctions at $20,987. The bears have forged a steep decline which has breached extremely oversold conditions on the Relative Strength Index (RSI). The RSI also shows a bullish divergence between the Sunday low and the recent Friday swing low near $20,666. While the obvious target for bears to aim for is the 8-day exponential moving average positioned at $20,600, the subtle divergence could be evidence of a smart money trap meant to create more upside liquidity in the coming days.

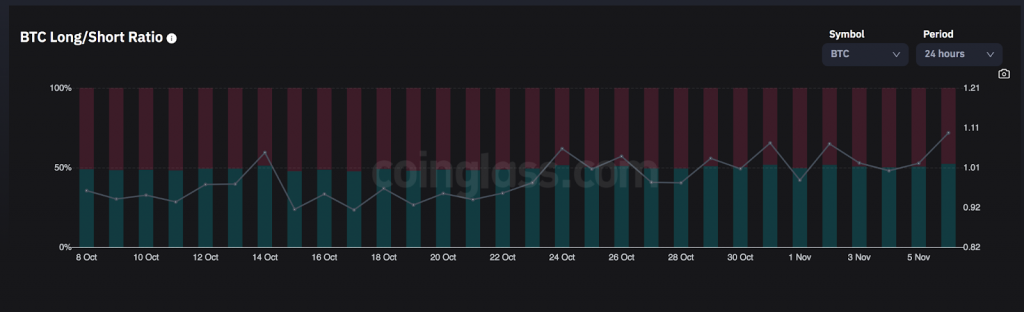

Coinglass’s Long vs. Short Ratio Indicator compounds the contrarian bullish idea for the peer-to-peer digital currency. According to the indicator, seven of every ten retail traders are currently positioned short during the current sell-off. If market conditions persist, a bear-trap reversal could occur as early as Monday morning with bullish targets near $21,600. If the bear does not capitulate at the first target, a breach of a second target at $23,400 may put the nail in the coffin.

Invalidation of the bullish thesis is a breach below the swing low at $20,800. If the bears breach this level, an additional downtrend move towards the $19,700 liquidity zone could occur, resulting in a 7% decrease from the current Bitcoin price. While a wider invalidation could be below the 21-day SMA at 20,100.