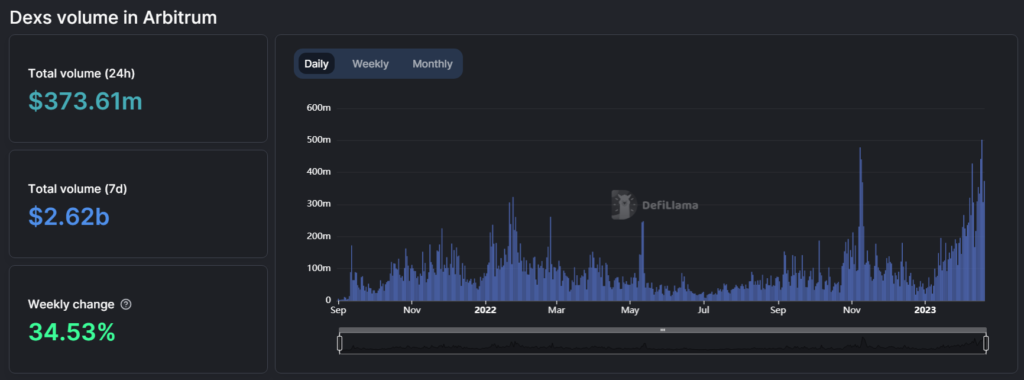

Decentralized exchange (DEX) trading volume on Arbitrum hit a new ATH of $502.2 million on Friday, surpassing the previous Nov. 8 record of $478 million transacted over a 24-hour period that happened right after the FTX collapse.

DEX dominance

In the past 24 hours, Arbitrum’s DEX trading volume surpassed well-known competitors such as Binance Smart Chain (BSC), Optimism, and Polygon. According to the data, Arbitrum recorded a volume of $373.26 million, exceeding BSC’s $272.71 million, Optimism’s $39 million, and Polygon’s $159.15 million.

Decentralized exchanges Uniswap and SushiSwap contributed most to Arbitrum’s volume, accounting for $164.06m and $122.55m, respectively. On a weekly basis, Uniswap volume has seen a growth of over 35%, while SushiSwap volume has grown over 23%.

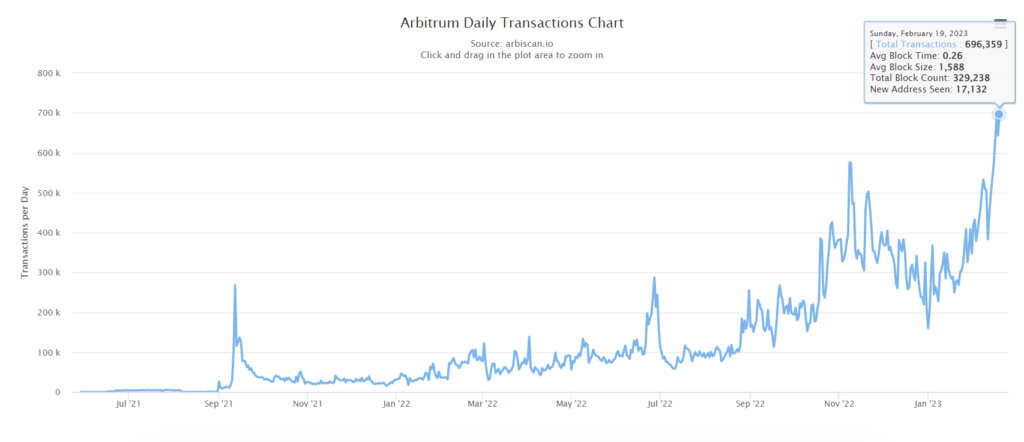

Daily transactions reach ATH

Daily transaction volume also soared on Arbitrum, reaching a new ATH of 696,359 on Feb. 19. Just two days after previously breaking the ATH on Feb. 17.

However, it still lags behind Optimism’s record of over 800,000 daily transactions, set in early January when the platform incentivized users with its NFT Quest program.

As a result of the increased activity, Arbitrum’s gas consumption rates have seen massive spikes. Per Dune Analytics, daily gas used on Arbitrum has also hit a new ATH.

A bright future for Arbitrum

Arbitrum is a layer-2 blockchain that seeks to address the scalability challenges of the Ethereum blockchain by utilizing roll-up technology.

It is being promoted as the next-generation blockchain platform and is currently among the prominent layer-2s on Ethereum, boasting a total value locked (TVL) of over $1.8 billion. Arbitrum hosts 184 protocols, including GMX, Aave, Uniswap, and others.

In addition, Wu Blockchain reported that in February, there was a steady influx of stablecoins to Arbitrum. The reporter noted that USDC’s inflow grew by 31%, while USDT and DAI increased by 45% and 68%, respectively.