Dopex, one of the most popular options protocols, has recently announced the launch of a new type of option called “Atlantic (Long) Straddle”.

Dopex protocol launched last year and has been a pioneer in crypto options innovation since then.

Atlantic Options (AOs) allow the buyer to borrow the option writer’s collateral, which can only be borrowed under specific circumstances.

Atlantic Straddles (AS) allow users to bet on the price volatility of a cryptocurrency. Writing Atlantic Straddles means betting on low volatility, and buying Atlantic Straddles means you’re betting on high volatility.

Atlantic options open up new possibilities, allowing Dopex to develop complex strategies to make borrowing a specific asset possible without liquidation risk.

How can you use Atlantic Straddle options?

You can write an Atlantic Straddle by depositing USDC and earning a premium if you believe the token’s price will remain stable until the expiration date.

The option expiration date is always shown on the interface when you try to sell or buy an option.

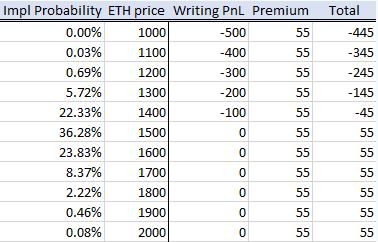

In the table below, you can see how much you will make or lose depending on the $ETH price at expiration if you write an $ETH AS at $1500:

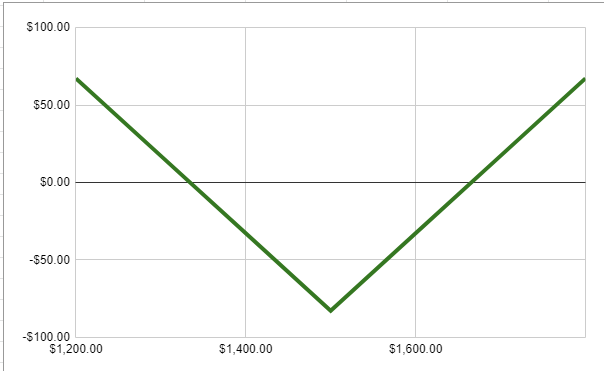

If you believe the price of a token will move more than 11% in one direction (i.e. be volatile), you buy an AS by paying a premium (which right now costs nearly 50 USDC).

The graph below shows what the PnL will be at the expiration date if you bought an Atlantic Straddle at $1500:

Atlantic Straddles sold out in just 7 minutes in the first round, with traders getting excited about the idea of being able to profit from market movements without betting on the price direction.

This is the first Atlantic options product launched by the Dopex team, and more are expected to be launched in the upcoming months.

A core Dopex team member recently stated that the protocol will also allow users to buy liquidation protection for leveraged trades, leveraged bonds, and collateralized debt positions by leveraging the power of Atlantic Options.