The successful Ethereum merge has triggered some bearish woes among investors and traders as Ethereum (ETH) drops more as each day passes by. It seems that Ethereum is having trouble in the price graph despite the successful merge. After making a target of $2,000 before the merge, ETH is now aiming for the bottom line as it trades below $1,350.

A 25% crash may soon occur

It seems that the Ethereum merge has triggered the bears of the market as it has brought a 40% decline in the price graph. Ethereum builds up its bearish phase when the crypto market’s sentiment has been quite bullish, with speculation that the merge would bring considerable returns.

According to CoinMarketCap, ETH is trading near $1,370. The technical analysis of the Ethereum price chart indicates a 25% correction downside soon. Ethereum may drop below $1,250 and then make a reversal to $1,500. The Fibonacci retracement indicates a solid pullback for Ethereum at $1,250, making fundamental support at $1,000.

What is next for Ethereum?

The primary reasons behind the bearish momentum of Ethereum are the overall selling pressure due to the panic during the merge and the FOMC meeting scheduled for tomorrow. In addition, the 21-MA (Moving Average) indicates a bearish bloodbath for Ethereum.

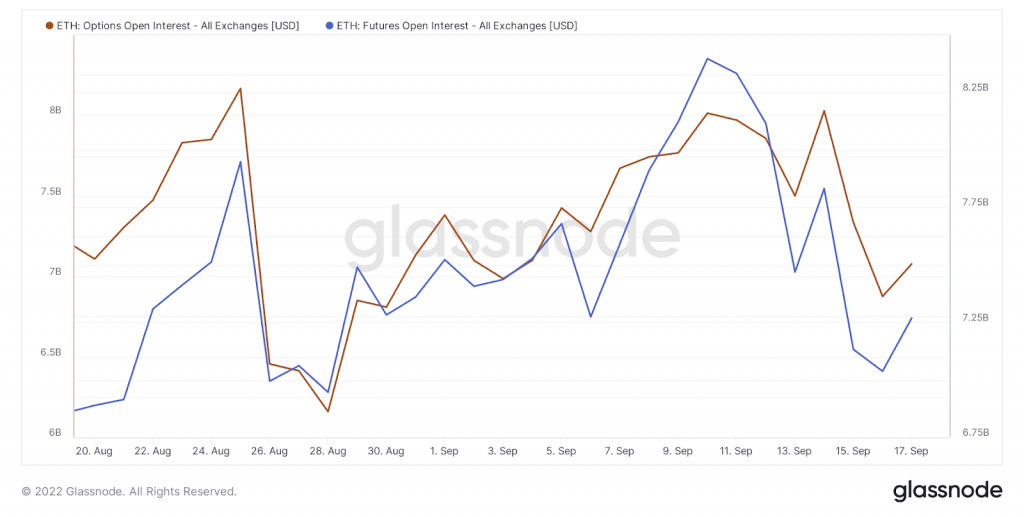

According to crypto analysts, Ethereum may trigger a bullish trend after reaching the $1,250 price level. The open interest data for Ethereum shows an increased demand in call and put options, which may drive the price upward. As a result, it is expected that the bulls will be back on track, and Ethereum may see a bull run by the end of this year.