Staking is one of the most popular ways of making passive income in todays market. It is easily accessible, offers attractive rewards, and requires little to no effort from its participants.

ALGO, the native token of the Algorand blockchain, is one of the best staking assets and popular among crypto users with its intriguingly high-interest rate.

In this article, we’ll take you through how to stake Algorand and the best platforms to do so, accessing their features, benefits, and limitations.

Best Exchanges & Wallets to Stake ALGO

These are our picks for the best places to stake Algorand (ALGO):

1. MyAlgo Wallet – Best for self-custody staking + highest APY2. Binance – Best way to stake Algorand as a beginner [EDITORS PICK]

3. Crypto.com – Best place to stake Algorand for CRO holder

4. Coinbase – Best for minimum ALGO staking amounts

Can You Stake Algorand?

Algorand employs a Pure Proof-of-Stake (PPoS) consensus mechanism, a variant of the Proof-of-Stake meaning you can stake its native token, ALGO.

In blockchain, staking refers to the process of locking up your assets on a blockchain in order to verify transactions and maintain network security.

When you stake tokens, you are rewarded with interest on those tokens depending on individual networks and the length of the staking period.

Stakers are granted voting rights to participate in a protocol’s governance by voting for or against any network development proposal.

Some examples of other popular assets to stake include Avalanche, Cronos, Polygon, and Shiba Inu.

Staking ALGO via Wallet

Like many other PoS cryptocurrencies, you can stake Algorand using non-custodial crypto wallets or via crypto exchanges.

To stake Algorand using a non-custodial wallet, you will first need to understand Algorand’s Governance Period Timeline.

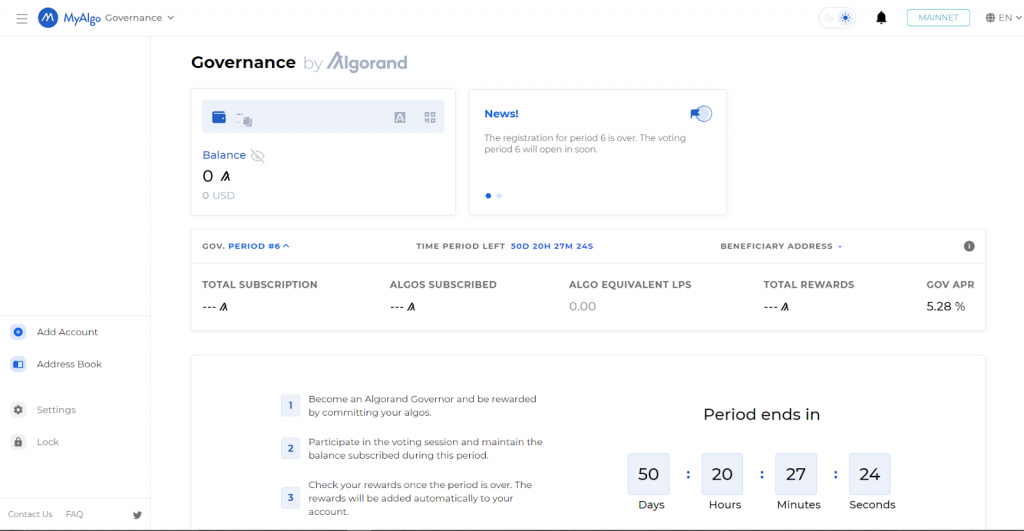

On Algorand, governance occurs in cycles. Each cycle lasts for three months and comprises three stages – the sign-up stage, the voting stage, and the rewards stage.

To participate in a governance cycle, you have to stake your ALGO tokens during the sign-up stage, which lasts for 15 days.

Failure to stake your tokens during the signup phase means waiting until the next governance cycle.

After completing the sign-up phase, you become a “governor,” and the voting stage begins. During this period, governors are required to vote on all proposals from the Algorand Foundation.

It is important to note that the number of votes accredited to each governor depends on the amount of ALGO tokens they staked during the initial sign-up stage. The voting phase lasts for the rest of the governance cycle and is followed immediately by the reward stage.

Within seven days after the end of each cycle, governors are rewarded with interest corresponding to the size of the ALGO stake and their governance performance.

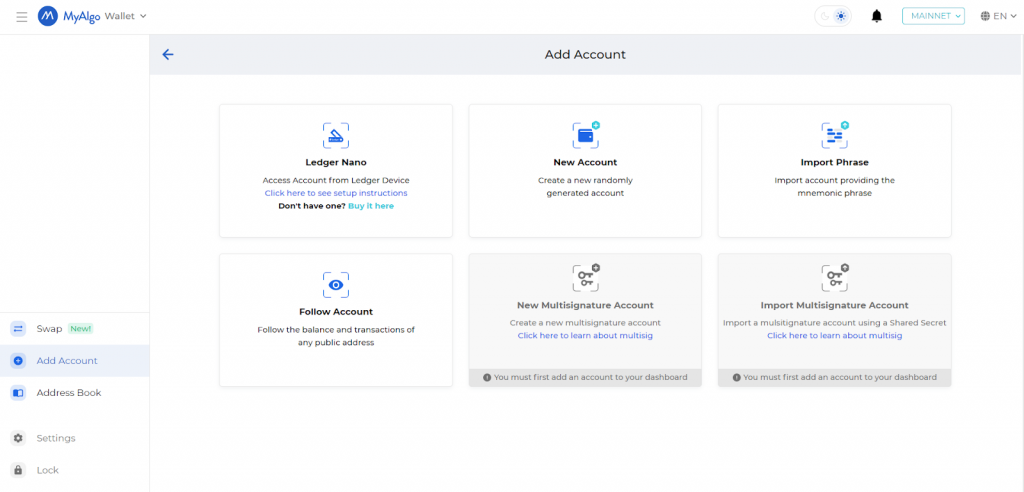

Examples of crypto wallets for staking Algorand include My Algo Wallet, Trust Wallet, and Atomic Wallet.

Staking ALGO on Exchanges

ALGO can also be staked via centralized crypto exchanges like Binance, Coinbase, and Crypto.com. This staking method is suited to beginners and requires little to no knowledge of the Algorand Governance Period Timeline.

These exchanges offer staking packages or plans with fixed or flexible terms of operation. Each plan has an interest rate as well as a minimum subscription amount.

Staking through exchanges is stress-free and requires no active participation in the Algorance network to earn staking rewards.

How To Stake Algorand?

For beginners and veterans alike, staking via exchanges is the most convenient method. The following is a step-by-step guide on how to stake ALGO on Binance.

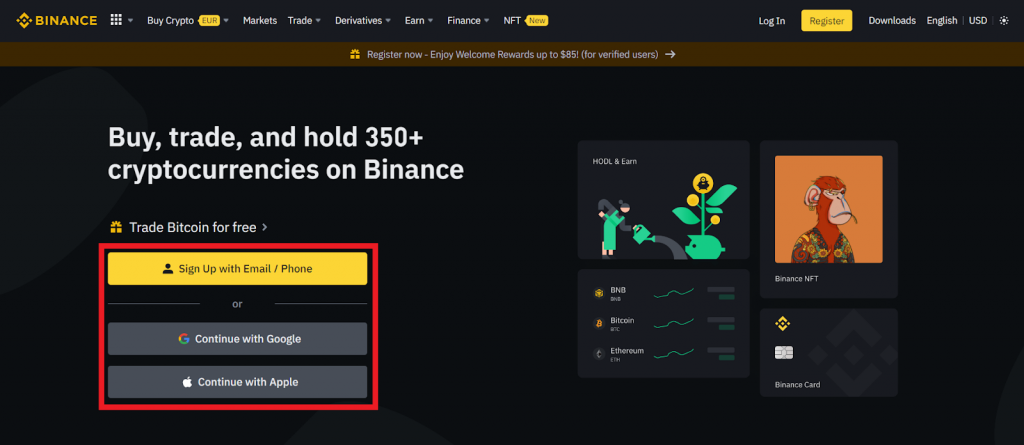

- Register an account on Binance and ensure to complete the identity verification process.

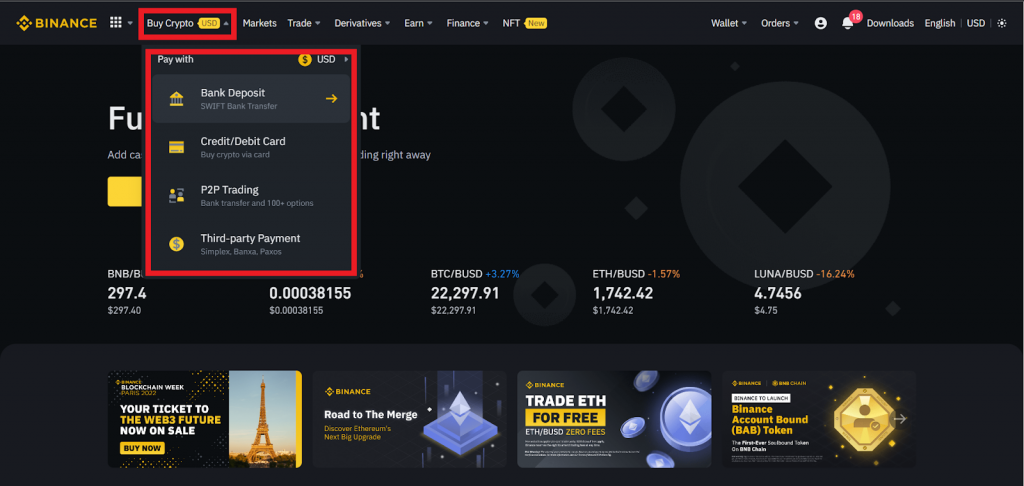

- Deposit ALGO tokens in your wallet using the Buy Crypto feature on the Binance dashboard. Alternatively, you can transfer ALGO from an already existing wallet.

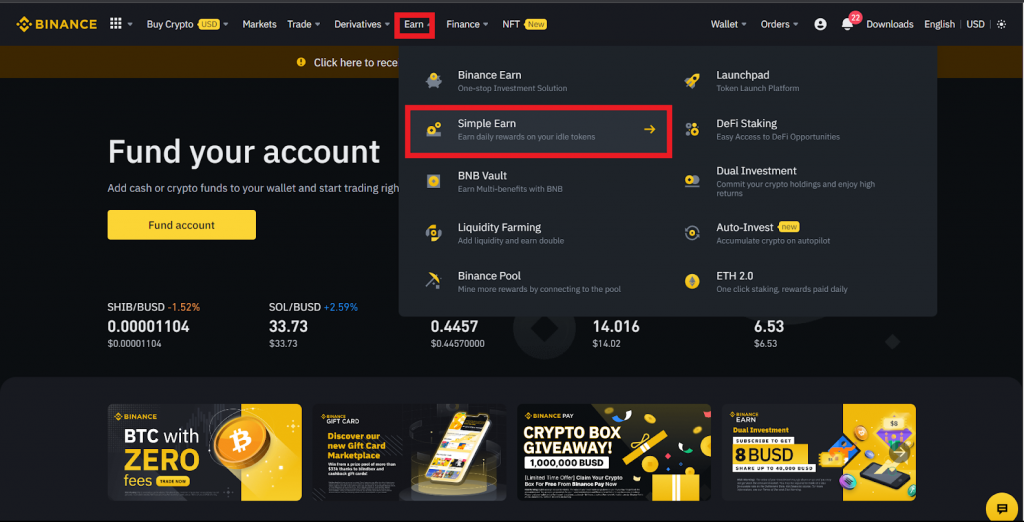

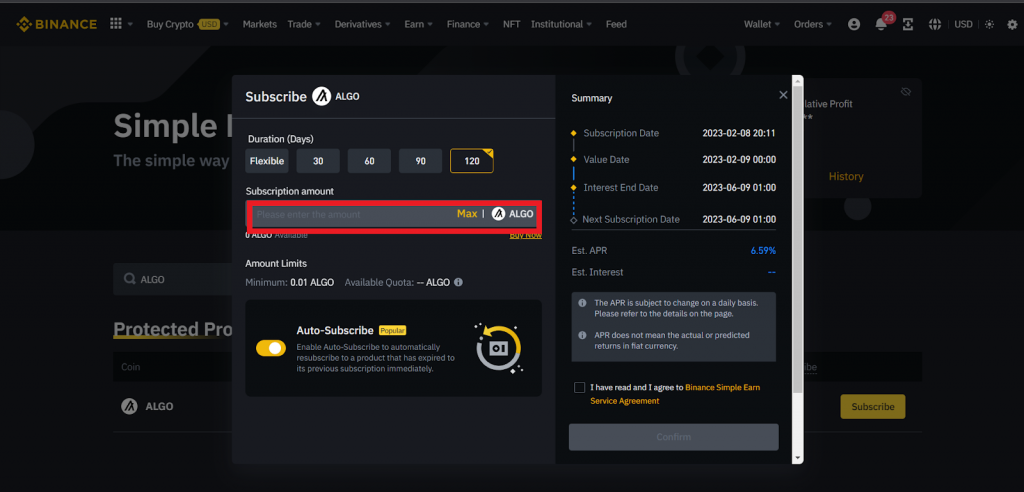

- To begin staking ALGO, click on the Earn feature on the Binance dashboard, then select the Simple Earn feature.

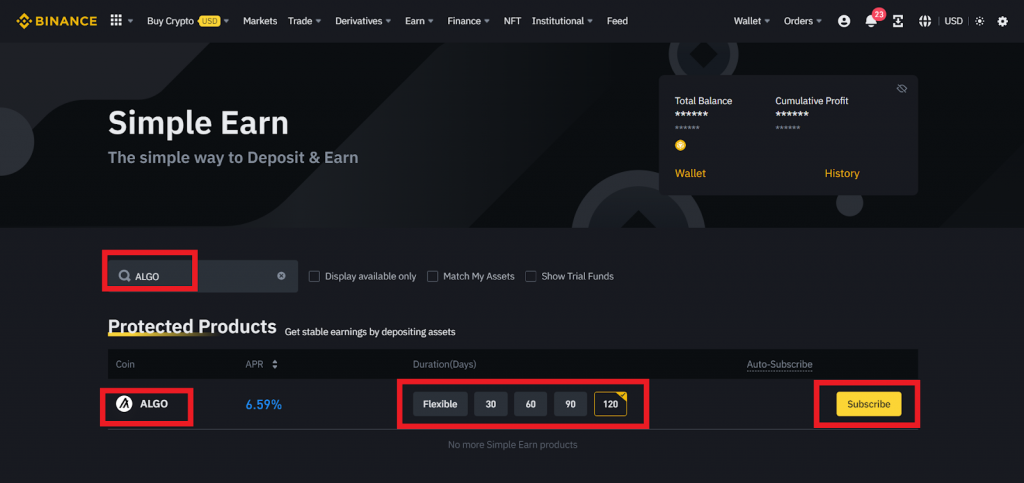

- On the next page, search for ALGO, choose your preferred ALGO staking plan, and click on “Subscribe.”

- Input the amount of ALGO you want to stake in the Subscription amount box.

- Agree to Binance Simple Earn Service Agreement and click on Confirm.

What Are The Best Places To Stake ALGO?

1. MyAlgo Wallet

Best for self-custody ALGO staking + highest APY

MyAlgo Wallet is the official Algorand wallet. It operates as a non-custodial wallet, allowing you to store your assets safely while retaining total ownership of your private keys.

MyAlgo is designed to allow a direct and secure interaction with the Algorand network and supports multiple external wallets (like Ledger) as well as ALGO and all Algorand Standard Assets (ASA).

Because of its direct connection with the Algorand blockchain, you can sign up to become governors and actively participate in the network’s governance.

Staking Rewards

The minimum staking amount required to become a governor of Algorand is 1 ALGO. However, it is worth noting that the rewards calculated are based on your stake weight in addition to the level of your performance. Thus, you are advised to stake as many tokens as possible.

Algorand requires all governors to maintain their stake weight during the governance cycle. If the number of ALGO initially staked is reduced, you automatically lose the right to any reward earned.

On MyAlgo, you can earn staking “governance” rewards between an APY of 10.02% to 14.05%.

Pros

- Non-custodial wallet

- Low minimum staking requirement of just 1 ALGO

- Offers Highest interest on staking ALGO

- Compatible with hardware wallets

Cons

- Staking occurs only in the sign-up phase of each governance cycle. If missed, you need to wait till the next cycle

- Staking rewards are not paid out till the end of a governance cycle which usually lasts for three months

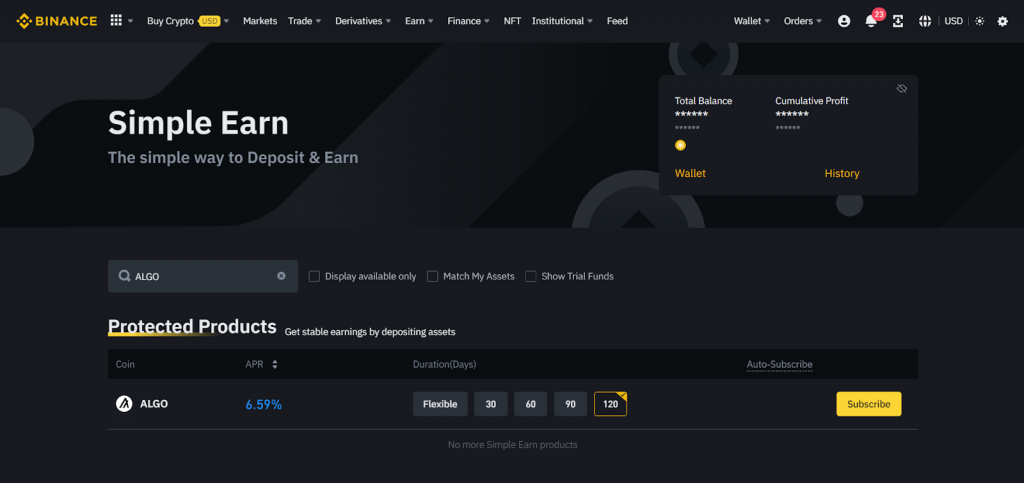

2. Binance

Best way to stake Algorand as a beginner

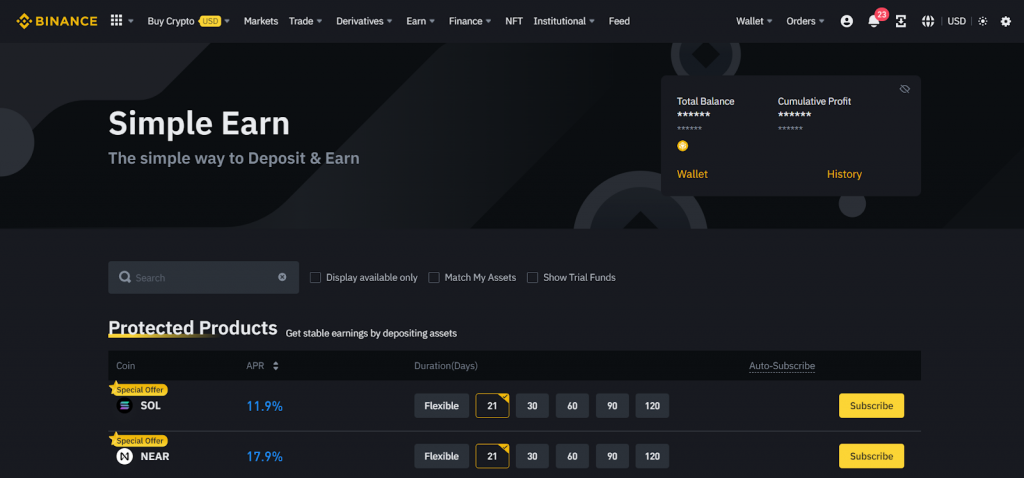

Binance is the world’s biggest and most prominent cryptocurrency exchange, boasting of over 120 million customers, for which it provides various crypto services like trading, lending, and staking.

Via the Binance Earn feature, you can stake several assets, including ALGO, and earn some juicy staking rewards.

Staking on Binance is easy and is recommended for beginners that want a hassle-free option.

Staking Rewards

Binance, like all exchanges, allows you to stake Algorand even when the sign-up phase of the current Algorand governance cycle is over.

Binance offers ALGO investors one flexible staking plan and four locked staking plans.

| Staking Product | Annual Percentage Rate (APR) | Minimum Subscription Amount |

| Flexible | 3% | 1 ALGO |

| 30 days | 3.29% | 1 ALGO |

| 60 days | 3.98% | 10 ALGO |

| 90 days | 4.9% | 1 ALGO |

| 120 days | 6.59% | 0.01 ALGO |

As the name implies, the flexible plan allows you to stake ALGO without commitment, meaning you can withdraw your tokens at any time. In turn, the flexible staking plan offers the lowest interest rate.

The locked staking plans require you to give up your tokens for a period of time. Thus, they offer higher interest rates. The longer the staking duration, the higher the interest rate, as seen in the table above.

On Binance Earn, there are no staking fees, and interest is paid out daily. However, Binance employs a custodial arrangement meaning the exchange has full ownership of all staked ALGO on its platform.

Pros

- Offers a maximum interest rate of 6.59%

- Best platform for beginners

- Offers a flexible staking plan

- Simple staking process

- Daily interest payout

Cons

- Locked staking plans require you to give up access to your tokens for a certain period

- Risk of asset loss if Binance is attacked or goes insolvent

3. Crypto.com

Best place to stake Algorand for CRO holders

Crypto.com is another popular cryptocurrency exchange based in Singapore and serves over 50 million customers worldwide. Asides from crypto trading, Crypto.com offers other intriguing services, including NFT trading, lending and saving, crypto debit cards, and staking.

On the Crypto.com exchange, you can stake 28 different assets, including ETH, ADA, MATIC, and ALGO.

Crypto.com offers a flexible staking, and two locked staking options.

On Crypto.com, the interest on your staked tokens varies depending on your CRO stake.

The CRO token is the native cryptocurrency of the Crypto.com platform and part of its utility is boosting the interest earned on other tokens staked on Crypto.com.

So, the higher the amount of your CRO stake, the higher the interest you earn by staking ALGO.

The table below provides information on the interest rates on ALGO in relation to CRO stake.

Staking Rewards

| Staking Plan | Less than $4000 CRO Stake | $4000 to $40,000 CRO Stake | More than $40,000 CRO Stake |

| Flexible | 0.10% | 0.25% | 0.25% |

| 1 Month | 0.80% | 1.60% | 3.60% |

| 3 Months | 1.60% | 2.40% | 4.40% |

The minimum staking amount of ALGO on Crypto.com is 150 tokens and interest is paid out weekly.

Pros

- Offers a flexible staking plan

- Simple process

- Weekly interest payout

- CRO tokens boost

Cons

- Low-interest rate compared to other platforms

- Risk of asset loss if Crypto.com is attacked or goes insolvent

4. Coinbase

Best for minimum ALGO staking amounts

Coinbase is one of the best cryptocurrency exchanges in the market allowing its users to buy and sell over 172 assets.

Coinbase operates as an easy-to-use staking platform, providing support for just major tokens, including SOL, ADA, XTZ, and of course… ALGO.

Staking Rewards

For ALGO staking, Coinbase offers an APY of 5.75%. However, they charge a hefty 25% commission fee and interest is paid out quarterly in line with the Algorand Governance Period Timeline.

To stake Algorand on Coinbase, you need minimum holding of 0.01 ALGO.

Note that Coinbase staking is not available for all users. So depending on your country of residence, you may or may not be able to stake Algorand on Coinbase.

Pros

- An interest rate of 5.75% per annum

- Minimum staking amount of 0.01 ALGO

- Beginner-friendly platform

Cons

- 25% commission fee

- Rewards are paid quarterly

- Risk of asset loss if Coinbase is attacked or goes insolvent

What is Algorand?

Algorand (ALGO) is a public and decentralized blockchain network that employs a two-layered infrastructure in combating the blockchain trilemma of scalability, speed, and security. It was launched in June 2019 by Italian computer scientist and professor Silvio Micali.

The two-layered architecture of Algorand is its most attractive feature as it allows the network to process transactions rapidly at a rate of 1000 per second as well as support the development and scaling requirements of various decentralized applications (dApps).

The first layer, known as the base network, provides support for basic smart contracts, asset creation, and atomic transfer. Meanwhile, the second layer allows for the deployment of the complex processes involved in smart contract and dApp development.

Algorand is based on the Pure Proof-of-Stake (PPoS) consensus algorithm, which allows anyone and everyone to be a validator, as the only essential requirement is being an ALGO holder.

ALGO, which is the governance token of Algorand, also serves as the primary payment medium on the network.

As at the time of writing, ALGO is valued at $0.287 per unit. It has a maximum supply of 10 billion tokens, of which 7.2 billion are in circulation.

Frequently Asked Questions on Algorand Staking

What is the best staking wallet for ALGO?

The best wallet for staking ALGO is the MyAlgo Wallet, which serves as the official wallet of Algorand and offers the most secure method of interacting with the Algorand network.

Where can I buy ALGO?

ALGO is listed on various cryptocurrency exchanges, including Binance, Coinbase, Kraken, Bitfinex, Crypto.com, ByBit, etc.

Who can participate in the Algorand community governance?

All Algorand holders can participate in the Algorand governance cycle, provided they own at least 1 ALGO token. In addition, ensure you register during the sign-up phase of each governance cycle.

Is there a minimum/maximum number of Governors on Algorand?

On Algorand, there is no maximum or minimum number of governors. Anyone willing to stake their ALGO tokens can become a governor. That said, there are currently over 33,000 governors on the Algorand network.

Wrap-Up

If you are an investor looking to earn staking rewards, Algorand is definitely one blockchain you should consider. It requires a low minimum staking amount and offers highly lucrative interest rates across several platforms.

We recommend you do your own research and consider the features of each platform to find the one most suitable for you.