Cardano (ADA) is one of the biggest cryptocurrencies in the world that allows investors to earn passive income via staking. Cardano staking is quite popular in the cryptocurrency community for its easy accessibility and high-interest rates. This piece is curated to guide interested investors on where to stake Cardano, evaluating the merits and risks of each staking platform and how to stake Cardano.

Best Exchanges & Wallets to Stake Cardano

Can You Stake Cardano (ADA)?

The Cardano blockchain employs a proof-of-stake consensus mechanism; thus, investors can stake ADA to receive rewards.

In cryptocurrency, staking simply refers to locking up your token on a network to facilitate transaction validation and strengthen network security. In return, you are rewarded with interests and voting rights to partake in network governance.

Staking Cardano as a Validator or Delegator

Like other PoS assets, you stake Cardano using crypto wallets or exchanges. Staking through wallets allows you to delegate your tokens to an existing staking pool, which acts as a network validator on your behalf. The more assets delegated to a pool, the greater its chances of being picked by the network to act as a validator.

Each staking pool functions as a single validator, and any reward won is shared among all pool members. However, you should know that staking pools usually charge their members certain fees – commissions – for their services.

Staking Cardano on Exchanges

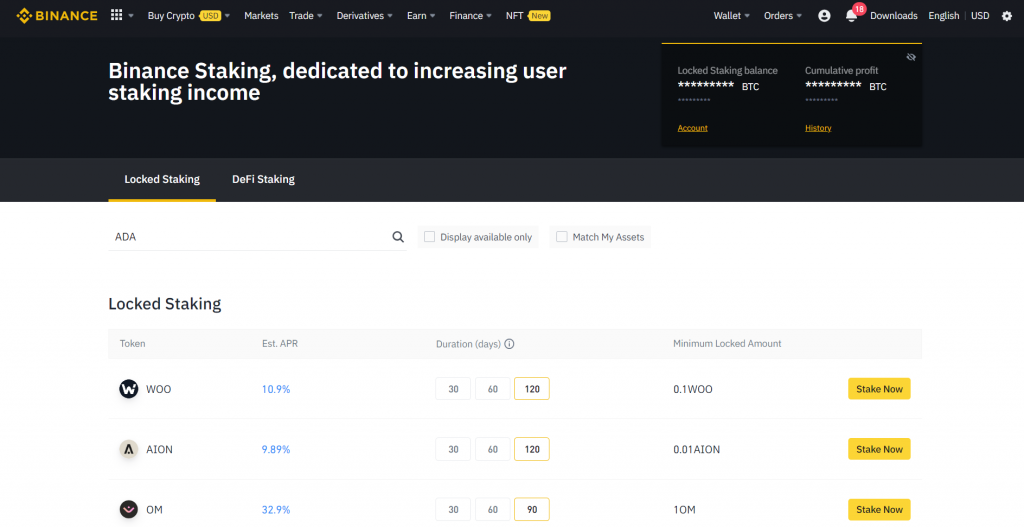

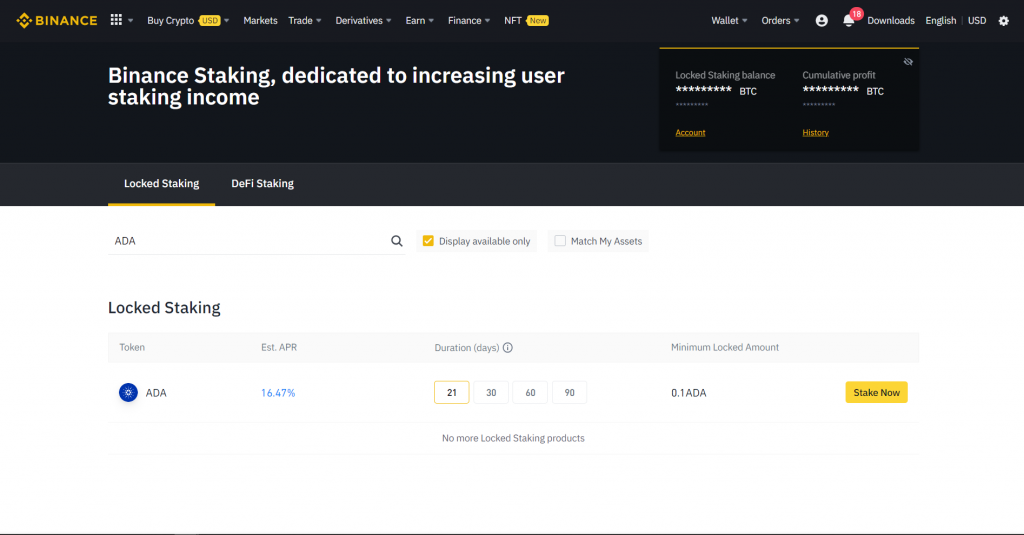

Alternatively, you can also stake ADA via centralized exchanges, which provide staking services. Some exchanges like Binance require investors to lock in their ADA tokens for a certain time ranging from 21-90 days, to earn staking rewards. On the other hand, exchanges such as Kraken allow investors to stake and unstake ADA at will.

How Much Can You Earn by Staking Cardano?

As an investor, you can earn an annual percentage yield(APY) of 4-5% by staking ADA, depending on your wallet or staking pool. Kraken offers investors an APY of 4-6%, while Binance offers an annual percentage rate(APR) as high as 16.47%.

How to Stake Cardano

For crypto beginners, staking via an exchange is the easiest and simple method. This section will illustrate how to stake ADA using the Binance Exchange.

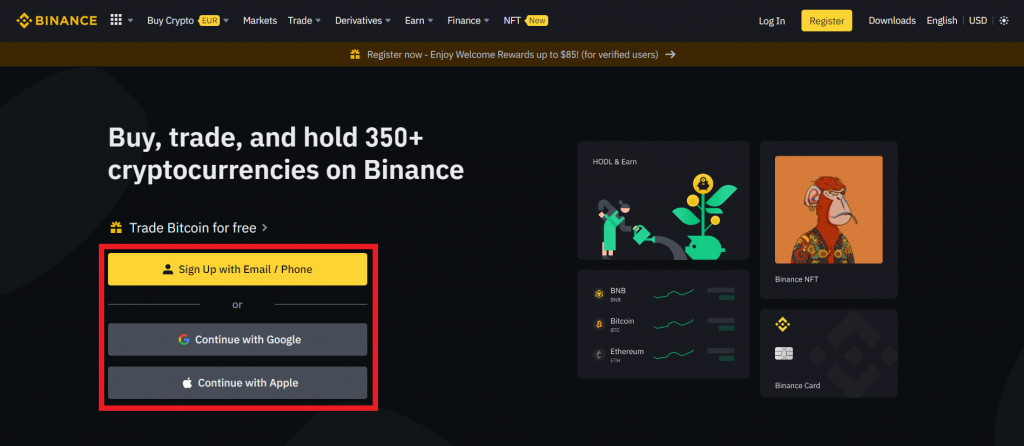

Register an account on Binance and complete the verification process.

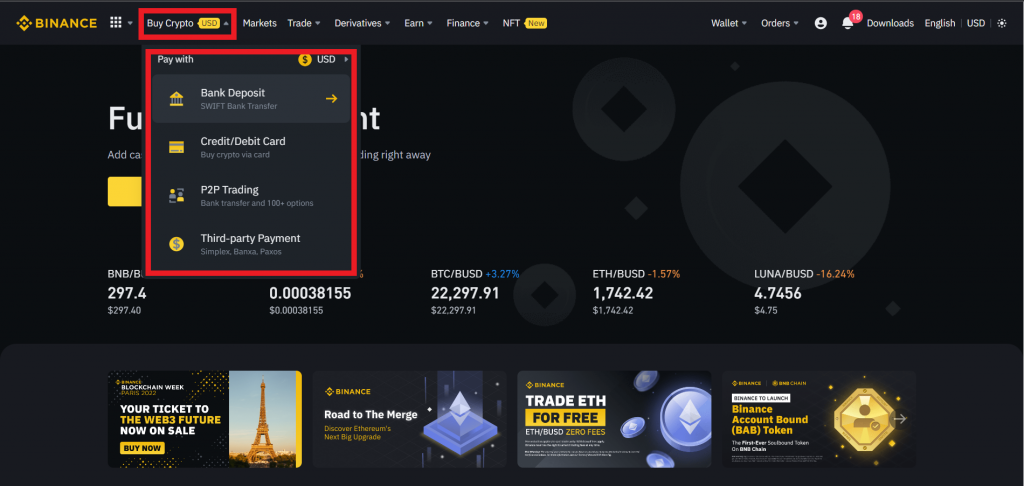

Fund your Binance account with ADA.

On the Binance dashboard, you can Buy Crypto on Binance via bank deposit, credit/debit card, P2P trading, and third-party payment.

After acquiring some ADA, you can now begin the staking process.

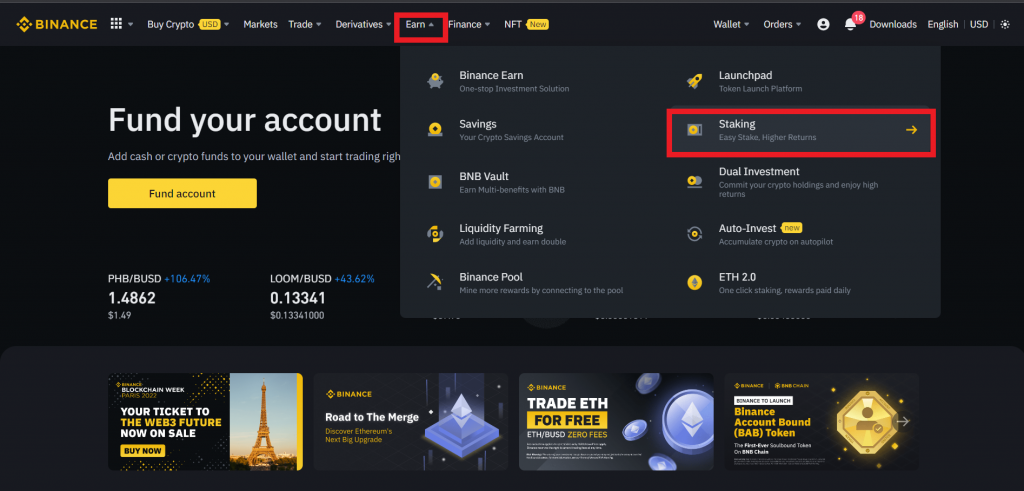

Return to the Binance dashboard, click on Earn and select Staking.

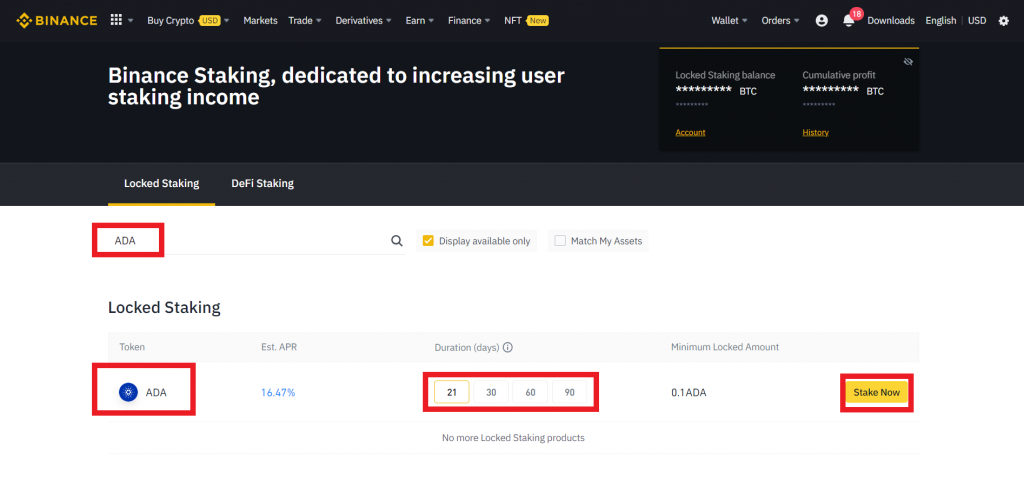

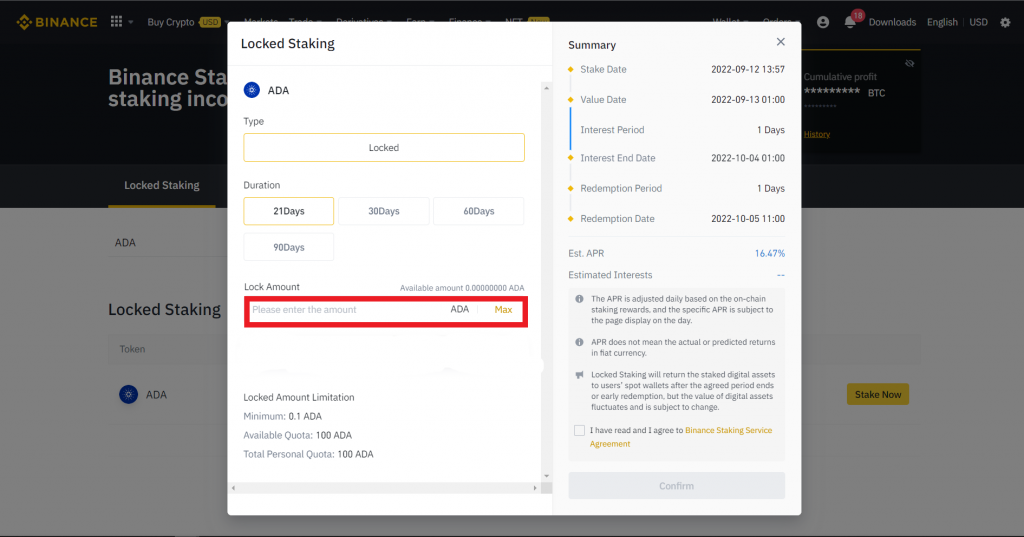

Under Locked Staking, Search for ADA. Select your staking duration (21,30, 60 or 90 days), then click on Stake Now.

Enter the amount of ADA you want to stake.

Agree to Binance Staking Service Agreement and click “Confirm” to stake ADA.

What Are the Best Places to Stake Cardano?

Staking is just as important as any form of investment. Hence, it is best to stake your ADA tokens via exchanges or wallets that provide security alongside reasonable interest rates. The following are the best places to stake Cardano.

1. Daedalus

Safest place to stake Cardano (most secure)

Overview

Daedalus is the most suitable and secure wallet for staking Cardano. It is designed by IOHK- Cardano’s developer team and can be installed on computers only. The Daedalus wallet is also compatible with hardware wallets, allowing investors to participate in staking while storing their assets offline.

Daedalus is a full-node wallet, granting users direct access to the Cardano blockchain. This is quite beneficial as it helps investors to avoid third-party network issues associated with using other wallets.

While using the Daedalus wallet, you will be required to select a staking pool. There are usually many options available, and investors are advised to spread their ADA tokens across several pools.

Nevertheless, in choosing any pool, ensure to consider factors such as saturation, pool pledge, server uptime, margin, performance(produced blocks) and fees.

Investors who stake ADA via the Daedalus wallet are rewarded with 5% APY. Furthermore, they retain full custody of their assets and can trade or transfer them at will.

However, you should note that setting up the Daedalus wallet requires a huge amount of time and storage space. This is because the wallet needs to download the entire transaction history of the Cardano network to be operational.

Pros

- Offers an APY of 5%

- Investors keep control of their staked ADA – no lock-in period required

- Compatible with hardware wallets

- No third-party network issues

- Safest medium of staking ADA

Cons

- Non-compatible with mobile devices

- Requires a lot of storage space

- Installation process is long

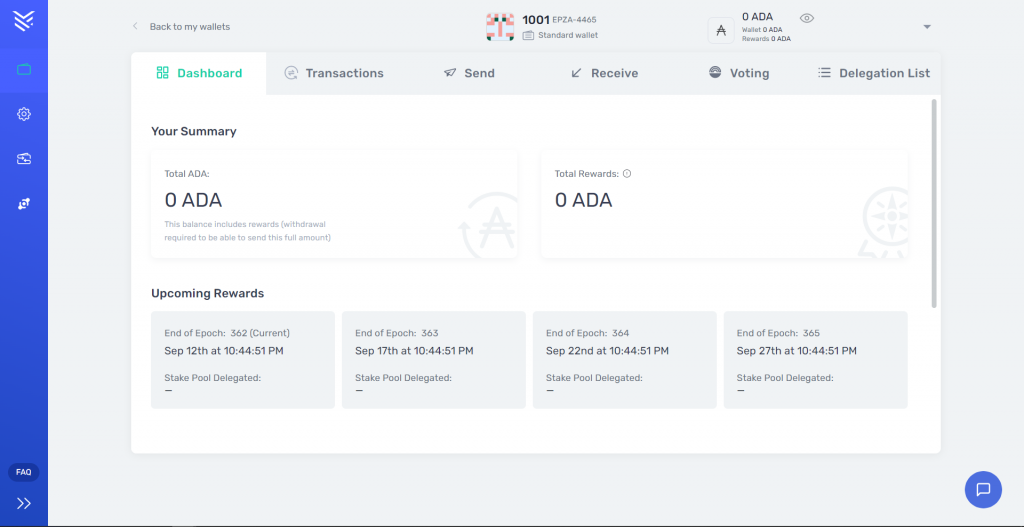

2. Yoroi

Best Cardano staking wallet mobile users

Overview

Yoroi is a secure software wallet for staking Cardano. Compared to Daedalus, it has a lightweight design and does not need to download the Cardano blockchain to operate. Instead, the Yoroi wallet connects to a full Cardano server hosted by a third party known as Emurgo.

The Yoroi wallet is easy to use and highly recommended to beginners looking to delegate their coins to staking pools. Furthermore, it can be installed as an app on mobile devices or a browser extension on your computer.

Yoroi offers you a high-security level by ensuring your private keys are stored safely on your devices, not third-party servers. Like Daedalus, it can also be used with hardware wallets if you desire to store your assets offline.

On Yoroi, investors earn an APY ranging from 4.84% to 5.12%, depending on the staking pool. Staking rewards are usually paid every five days. However, to be eligible to earn rewards, all investors must wait 15-20 days after they begin staking.

Pros

- Can be instantly setup because it’s a lightweight wallet

- Mobile and desktop compatibility

- Can be connected to hardware wallets

- Investors keep control of their staked ADA – no lock-in period required

Cons

- You cannot start earning rewards till 15-20 days after you start staking

3. Binance

Offers the highest APR when staking Cardano (lock-up)

Overview

Binance is the largest cryptocurrency exchange in the world with several products, features and services. It is a credible place to purchase digital assets as well as one of the best staking platforms. When it comes to staking Cardano, Binance offers the highest returns to investors.

Binance eliminates the task of picking a staking pool. You simply have to select a staking package and begin earning your rewards. Cardano staking on Binance offers packages with a fixed duration of 21,30,60, or 90 days. When your staking duration is over, all interest earned is paid immediately.

The table below covers each Cardano staking duration on Binance, their APR, and the minimum staking amount.

| Staking Duration | Annual Percentage Rate(APR) | Minimum Amount |

|---|---|---|

| 21 days | 16.47% | 0.1 ADA |

| 30 days | 4.31% | 1 ADA |

| 60 days | 4.65% | 1 ADA |

| 90 days | 11.29% | 0.001 ADA |

Staking ADA through Binance is quite straightforward. However, it also presents its own downsides. For example, you cannot stake your assets across different staking pools like in wallets.

Furthermore, you are required to lock-in your assets on the exchange for the length of your staking duration. This means you cannot withdraw or transfer your ADA tokens until your package matures and pays off.

Pros

- Highest staking returns on Cardano

- Easy to use

- No need to pick a staking pool

- You can easily purchase and stake ADA on the same platform.

Cons

- You cannot distribute your assets across several staking pools

- Your ADA tokens are locked for 30, 60, 90 or 120 days

- Risk of asset loss by an attack on Binance

4. Kraken

Best for flexible Cardano staking (no lock-up)

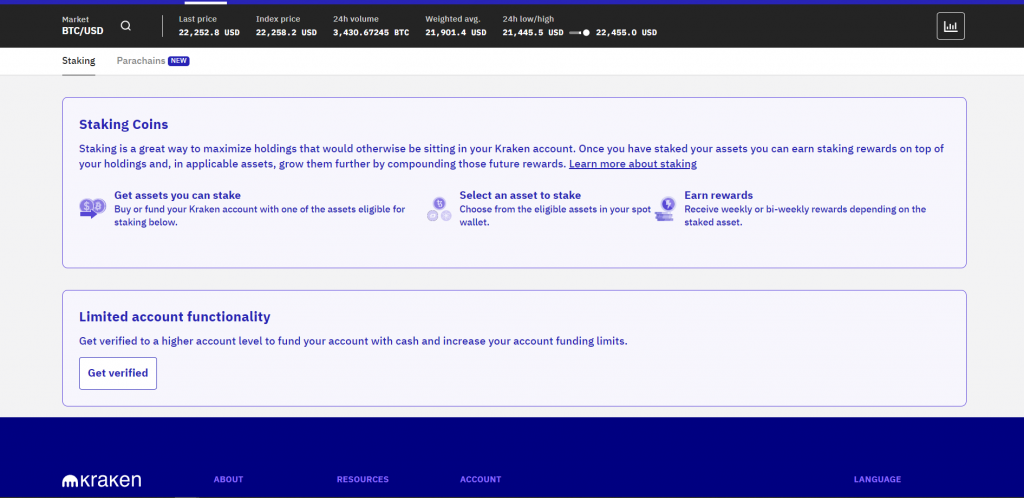

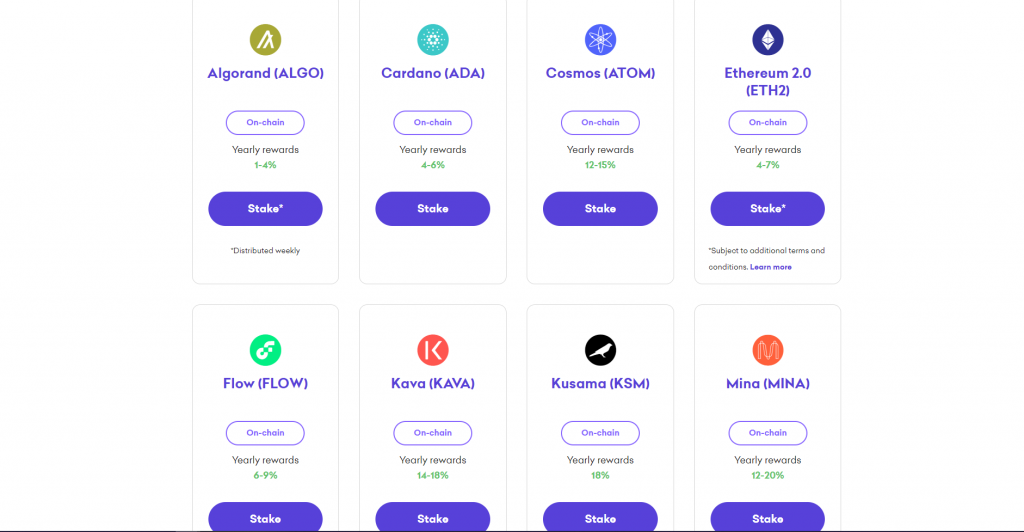

Kraken is a prominent digital asset exchange which grants investors safe and secure access to 185+ cryptocurrencies. Kraken also offers multiple services, including staking, allowing users to earn interest while holding their coins on the exchange.

Staking Cardano on Kraken is an easy and seamless process. It simply requires one to own ADA, which can be purchased on the exchange. Like Binance, investors also need not worry about picking a staking pool.

However, staking is flexible on Kraken with no fixed term or duration. Investors are allowed to stake and unstake their assets anytime they wish. It would also interest you that Kraken offers investors a yearly interest of 4-6%.

For investors who stake ADA via Kraken, rewards are paid every five days. These rewards can be withdrawn and traded for other tokens.

Pros

- Yearly interest of 4-6%

- Flexible staking

- Easy to use

- No need to pick a staking pool

Cons

- Risk of asset loss by an attack on Kraken

- You cannot distribute your assets across several staking pools

What Is Cardano (ADA)?

Cardano is a blockchain network that enables efficient and large-scale operations of smart contracts and decentralized applications (DApps). It was founded in 2017 by Ethereum co-founder Charles Hoskinson.

Based on peer-reviewed academic research, Cardano is an open and transparent network with all its development activities publicly accessible. It is also one of the most popular blockchains that utilises the consensus of the proof-of-stake (PoS) consensus algorithm.

Cardano is highly rated for its low transaction fees and high processing speed, which makes it a major competitor to Ethereum in terms of smart contracts operations. In fact, Cardano is well-known as the “Ethereum Killer”.

That said, all transactions on Cardano are made via the ADA token. Asides from functioning as a medium of payment, ADA also serves as the governance token of the Cardano network.

Frequently Asked Questions

What happens to your Cardano when you stake?

When you stake Cardano, your tokens are used to verify new transactions, thus maintaining the network’s integrity. In return, the network rewards you with interest.

Is staking ADA safe?

Staking ADA is safe. The only risks on staking ADA are those associated with exchanges and wallets.

Is staking ADA worth it?

Yes, it is worth staking ADA. Across several platforms, staking ADA allows investors to earn at least 5% interest which is higher than any bank interest rate. Moreover, the long-term prospects of ADA look good, and the coin could increase massively in value in the coming years.

Wrap Up

In this article, we have reviewed the best places to stake Cardano and start earning your rewards. Each exchange or wallet mentioned above is an excellent option for staking Cardano, having built a credible track record over the years. Nevertheless, all new and veteran investors should consider each platform’s pros and cons and select a choice most suitable to their needs.