Staking is one of the most common ways of earning passive income in the crypto that involves locking up your tokens on a network to validate transactions and contribute to network security. In return for staking, you are rewarded with interest.

Staking is only possible with Proof-of-Stake (PoS) assets such as Ethereum (ETH), Cardano (ADA), and Fantom (FTM). The Cronos (CRO) token – native token of Crypto.com – is another PoS asset which is gaining attention among investors due to its high utility level and attractive interest rates.

In this article, we’ll go over how to stake CRO on various platforms whilst accessing their pros and cons.

Best Exchanges & Wallets to Stake CRO

These are our picks for the best places to stake CRO:

1. Crypto.com Exchange – Best way to stake CRO as a beginner

2. Crypto.com App – Best way to stake CRO with added benefits [EDITORS PICK]

3. Crypto.com DeFi Wallet – Highest APY for CRO staking

Can you stake CRO?

The CRO token operates as the main currency of the Crypto.org network, a public PoS blockchain that uses delegated proof-of-stake (DPoS) consensus protocol. Therefore, you can stake CRO tokens to earn interest and generate some passive income.

Before diving into how CRO staking works, you should note that there are two types of CRO tokens: the native CRO on the Crypto.org chain and the ERC20 CRO on the Ethereum blockchain.

The ERC20 CRO is used for token swaps on the Ethereum network, while the native CRO serves as the native token of the Crypto.org chain and is used for staking.

Staking CRO as a delegator or validator

Using the Crypto.com DeFi wallet, you can gain direct access to the Crypto.org blockchain and participate in staking by delegating CRO tokens to a validator on the network. Each validator offers a fixed interest rate alongside a commission fee that it deducts from the delegators’ rewards.

On the Crypto.org network, you can stake or unstake CRO tokens anytime. However, there is a 28-day unbonding period involved when unstaking your CRO tokens. During this time, the tokens being unbounded will not earn any interest or be accessible for withdrawal.

Staking CRO via exchange

Another way to stake CRO is via the Crypto.com exchange or the Crypto.com app. Using either of these platforms, you do not need to choose a validator and instead subscribe to a staking plan. Each plan comes with a fixed interest rate and fixed duration, during which the staked CRO tokens cannot be accessed.

How much can you earn by staking CRO?

Similar to most PoS chains, CRO stakers are rewarded with interest paid in CRO tokens. However, the annual percentage rate (APR) depends on the platform.

Using the Crypto.com DeFi wallet, you can earn as high as 20% returns on your CRO tokens.

If you are stalking CRO via the Crypto.com exchange or Crypto.com app, your expected return ranges between 4% to 8% per annum.

How to Stake CRO?

The following are guidelines on how to stake CRO on its three compatible platforms.

How to stake CRO on the Crypto.com exchange

- Log in to the Crypto.com Exchange.

- Deposit some CRO tokens into your wallet depending on how much CRO you want to stake. You can purchase CRO directly from the exchange through a credit/debit card or a bank transfer. Alternatively, you can transfer CRO tokens from an external wallet.

- Select the “Stake and Earn” Feature from the menu tab.

- On the next page, click “Stake CRO” and enter the CRO amount you want to stake.

- Click on “Review” to view staking details such as the amount you want to stake, APR, staking period, and the date your tokens can be withdrawn.

- Click on “Confirm” to complete the staking period and start earning your interest.

How to stake CRO on the Crypto.com app

- Install the Crypto.com app from the Google Play Store or Apple App Store.

- Register an account and log in to the app.

- Deposit some CRO tokens into your wallet using the same means as the Crypto.com exchange.

- After acquiring some CRO tokens, tap on the “Card” icon at the bottom right corner of the page.

- Choose your desired Crypto.com premium Visa card.

- Tap on the “Stake CRO” feature and review all staking details.

- Tap on “Confirm” to complete the staking process.

How to stake CRO on the Crypto.com DeFi Wallet

- Install the Crypto.com DeFi wallet from the Google Play Store or Apple App Store and complete the setup process.

- On the DeFi Wallet interface, Tap on the “Earn” feature located in the bottom navigation bar.

- Tap on “Start Earning” or “Earn More.” Then select CRO from the list of supported assets.

- Enter the amount of CRO you want to stake to see your projected annual returns based on the present estimated annual reward as of that time.

- Proceed to choose a validator by tapping on the “To Validator” feature and choosing from the whitelisted validator list compiled by Crypto.org. To select a validator outside the Whitelist, you will need to access the blockchain via other wallet interfaces, which are the Crypto.org Chain Desktop Wallet (Beta) and the Crypto.org Wallet Client (chain-maind)

- Review the staking details and confirm the transaction by tapping “Confirm Stake.”

- Enter your passcode and 2FA pin to authorize the transaction, and wait for on-chain confirmation of the staking process. Upon confirmation, you can view your staked CRO tokens in the DeFi Earn tab.

What are the best places to stake CRO?

The Crypto.com exchange offers three platforms on where you can stake CRO and earn staking rewards.

- Crypto.com Exchange

- Crypto.com App

- Crypto.com DeFi Wallet

1. Crypto.com Exchange

Based in Hong Kong, Crypto.com is one of the world’s biggest cryptocurrency exchanges, boasting over 70 million customers and a daily trading volume of over $370 million.

This platform allows customers to trade over 250 cryptocurrencies, including major coins like Bitcoin and Ethereum. It also provides access to NFT markets, crypto loans and staking support for various PoS assets.

Staking CRO on the Crypto.com exchange is simple and offers a variety of benefits. Asides from an annual percentage rate (APR) of up to 8%, this staking method also offers rebates on transaction fees, referral program bonuses, access to the Syndicate, and exclusive pay benefits on Crypto.com.

The Crypto.com exchange offers various CRO staking plans, which are measured in tiers. Each tier has its respective benefits, and the higher the tier, the more benefits it offers. The table below shows each tier and the benefits it provides.

| CRO Staked | Maker Fee Benefit | Taker Fee Benefit | Interest APR | Syndicate | Pay Benefits |

|---|---|---|---|---|---|

| ≥ 1,000 | 3% off | 3% off | 0% | ❌ | ❌ |

| ≥ 5,000 | 5% off | 5% off | 0% | ✔️ | ❌ |

| ≥ 10,000 | 8% off | 8% off | 0% | ✔️ | ✔️ |

| ≥ 50,000 | Zero | 12% off | 4% | ✔️ | ✔️ |

| ≥ 100,000 | 0.01 bps Rebate | 15% off | 4% | ✔️ | ✔️ |

| ≥ 500,000 | 0.02 bps Rebate | 20% off | 8% | ✔️ | ✔️ |

| ≥ 1,000,000 | 0.05 bps Rebate | 25% off | 8% | ✔️ | ✔️ |

| ≥ 5,000,000 | 0.10 bps Rebate | 30% off | 8% | ✔️ | ✔️ |

On the Crypto.com exchange, the minimum staking amount is 1000 CRO. However, you do not start earning interest until you stake more than 50,000 CRO. The staking period for all tiers is 180 days and interest earned is paid daily.

The Crypto.com exchange is a great option for staking CRO with lucrative interest rates and rewards. However, be mindful that the exchange gains full custody of your tokens during the staking period. This means if the exchange suffers an attack, it could lead to the loss of your investment.

Pros

- APR of up to 8%

- CRO rebate

- Access to the Syndicate

- Crypto.com pay benefits

- Interest is paid daily

- Eliminates the task of picking a validator

- Minimum staking amount of 1000 CRO tokens

Cons

- Locked staking period of 180 days during which you cannot access your tokens.

- Risk of asset loss if the exchange is attacked or goes insolvent

2. Crypto.com App

The Crypto.com app is the official mobile app of the Crypto.com exchange. It is a well-designed app with innovative features and a user-friendly interface that enables it to serve as the most convenient platform to stake CRO.

The Crypto.com App has five different tiers of CRO staking, each representing a Crypto.com Visa card. They are the Jade Green, Royal Indigo, Frosted Rose Gold, Icy White and Obsidian tiers. Each tier has its respective staking amount, and the APR varies between 4% and 8% depending on the tier.

| Staking Tier | CRO Stake (USD) | Annual Percentage Rate (APR) |

|---|---|---|

| Royal Indigo | $4,000 | 4% |

| Jade Green | $4,000 | 4% |

| Frosted Rose Gold | $40,000 | 8% |

| Icy White | $40,000 | 8% |

| Obsidian | $400,000 | 8% |

In addition to the interest generated, staking CRO on the Crypto.com app also provides you with other benefits such as purchase rebates and extra card cashbacks, a higher APR via the Crypto Credit and Crypto Earn features, and the premium metal Crypto.com Visa card of their selected tier, which is usually packaged and shipped immediately after you subscribe to a tier.

Using the Crypto.com app, the staking period remains at 180 days and interest is paid out weekly. The app is compatible with all Android and iOS devices and is easy to setup. Note that CRO staking on the Crypto.com app shares the risk of the exchange since the staked tokens are in custody of the Crypto.com exchange.

Pros

- APR of up to 8%

- Purchase rebates of up to 5%

- One of Crypto.com’s premium metal cards

- Higher APR via the Crypto Credit and Credit Earn

- Eliminates the task of picking a validator

Cons

- Minimum staking amount of $4000 worth of CRO

- Interest is paid weekly

- Locked staking period of 180 days

- Risk of asset loss if the Crypto.com exchange is attacked or goes insolvent

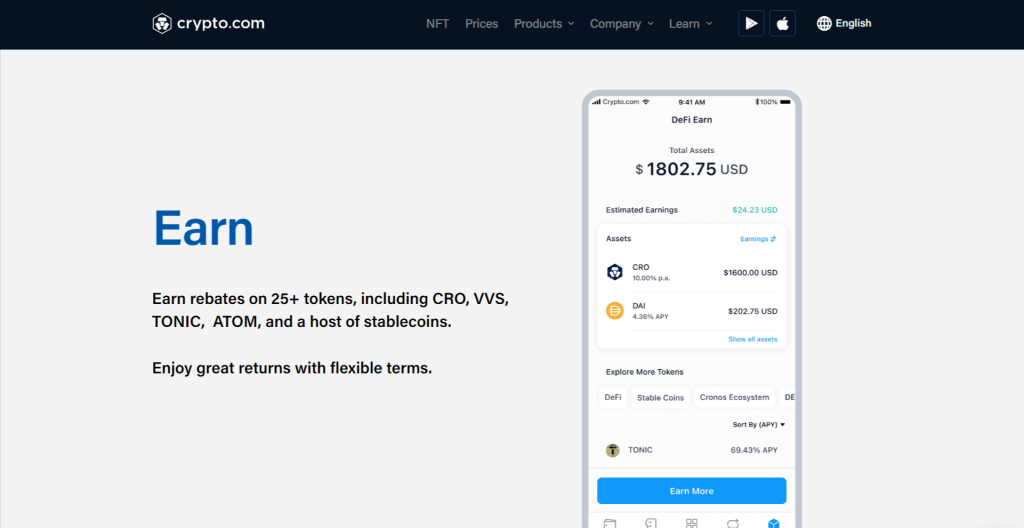

3. Crypto.com DeFi Wallet

The Crypto.com DeFi wallet is a non-custodial wallet created by the Crypto.com exchange. It provides support for 31 blockchains and over 700 tokens, including Bitcoin, Tron, Cronos and Ethereum. This crypto wallet functions mainly as a Web3 browser connecting to various dApps and DeFi protocols.

To stake CRO on the Crypto.com DeFi Wallet, you will first need to select a validator. Remember to evaluate factors such as interest rates, commission fees, voting power and the performance history of the validators before choosing.

There is no minimum staking amount required and depending on your selected validator, you can earn as high as 20% annually.

Due to its non-custodial design, the Crypto.com DeFi wallet offers the safest means of staking CRO as it allows you to retain sole control over your tokens even during the staking period. Meaning your assets are safe even if the chosen validator is attacked.

Staking through the DeFi wallet also allows you to unstake CRO tokens at will. Although, remember there is a mandatory 28-day unbonding period that must occur before you can access your tokens.

Pros

- Earn an APR up to 20%

- Access to various dApps on multiple chains

- Non Custodial wallet

- Best staking medium for advanced traders

- No minimum staking amount

- No fixed lock-up period

Cons

- Mandatory 28-day unbonding period after unstaking.

- Complex mode of staking for beginners

- Risk of asset loss if your chosen validator shows a behaviour considered malicious by the Crypto.org chain

Frequently asked questions

What is the best way to stake CRO?

For beginners, the best way of staking CRO is via the Crypto.com app or the Crypto.com exchange. That said, the Crypto.com DeFi wallet is more suited to veteran investors with blockchain experience.

What are the risks of staking CRO?

The risks associated with staking CRO include slashing if your chosen validator behaves maliciously. For investors staking CRO on the Crypto.com exchange or app, they should be aware of potential asset loss if the Crypto.com exchange goes insolvent.

What are the benefits of staking CRO on the crypto.com exchange?

The benefits of staking CRO on the crypto.com exchange include an interest rate of 8% p.a, rebates on transaction fees, permission to participate in the syndicate and Crypto.com exclusive pay benefits.

Can you stake CRO on Binance?

No, you cannot stake CRO on Binance as the exchanges offer no staking product for the asset. That said, Binance remains a top staking platform with staking support for over 60 cryptocurrencies.

Can I increase my staked CRO amount on the Crypto.com exchange?

Yes, you can increase your staked CRO amount at any time. However, note that every time you increase your staked CRO, the 180-day staking period undergoes a reset.

When can I withdraw my staked CRO?

You can withdraw your staked CRO after your 180 staking period expires.

CRO Staking Wrap-Up

The CRO token is one of the best staking assets for investors looking to earn some income and actively grow their portfolio without needing to be an active trader.

CRO staking is not a risk-free investment. All investors are advised to do their due diligence and always stay updated on the current state of the crypto market.