Fantom (FTM) is one of the most popular coins for staking. Compared to most staking assets, it offers an attractive interest rate and is accessible on several platforms. Moreover, the Fantom token is one with massive potential for price growth due to the intriguing nature of its blockchain. In this article, we will guide interested investors on the best places to stake Fantom, discussing the benefits and risks associated with each platform.

Best Exchanges & Wallets to Stake FTM

Can You Stake Fantom?

Fantom is a Proof-of-Stake blockchain; thus, it supports staking.

To simplify, Fantom staking refers to investors locking up their FTM tokens on the Fantom network to enable transaction validation and strengthen the network’s security. In return, they are rewarded with interest in FTM tokens as well as voting rights, which allows them to participate in the governance of the Fantom network.

Where Can You Stake Fantom?

Generally, you can stake FTM via a crypto wallet or a centralized exchange. Staking Fantom via a wallet means delegating your tokens to a network validator, which validates transactions on your behalf in return for a commission fee on your staking rewards.

However, as Fantom is a permissionless network, everyone is allowed to run a validator. But it is worth noting that the minimum staking amount to set up a network validator is 500,000 FTM.

Due to this high requirement, it is always recommended that investors delegate their tokens to existing validators to start earning interest. Moreover, delegation is quite beneficial, as it allows you to stake your tokens without the concerns of maintaining an active validator node. Staking via delegation also enables investors to retain full custody of their staked tokens.

That said, investors can also choose to stake their FTM tokens using centralized exchanges. When staking with exchanges, there is no need to delegate tokens to a validator. You need only subscribe to an FTM staking product available on the exchange.

While staking via exchanges is more comfortable and accessible, it is worth noting that this usually requires investors to commit custody of their tokens to the exchange for the staking duration. This can be risky as investors lose their assets if the exchange is attacked or becomes insolvent.

How Much Can You Earn by Staking Fantom?

You can earn as high as a 14% annual percentage yield (APY) by staking FTM via a crypto wallet. If you prefer to stake via exchanges, Binance offers investors a maximum annual percentage rate (APR) of 13.9%.

What Are the Best Places to Stake Fantom?

When choosing a staking platform, there are factors to consider, including interest rates, security, performance, etc. The following exchanges and wallets satisfy all these criteria and are placed as the best places to stake Fantom.

1. fWallet

Offers the highest APY on locked-up FTM

Overview

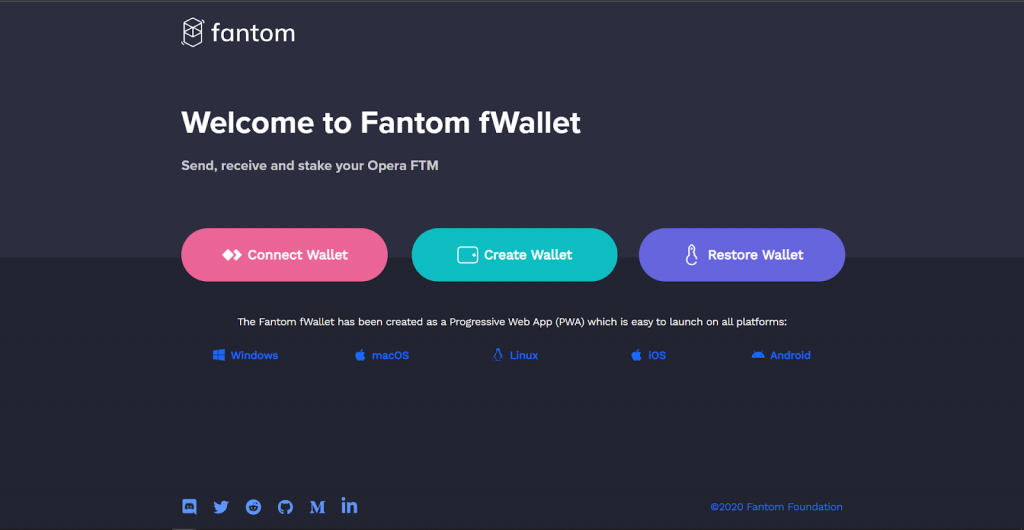

fWallet is the official wallet of the Fantom network created for storing and receiving FTM tokens. fWallet can also store other Fantom-based tokens such as fUSDT and USDC. fWallet is the recommended platform for staking Fantom. It is highly secure and easy to use.

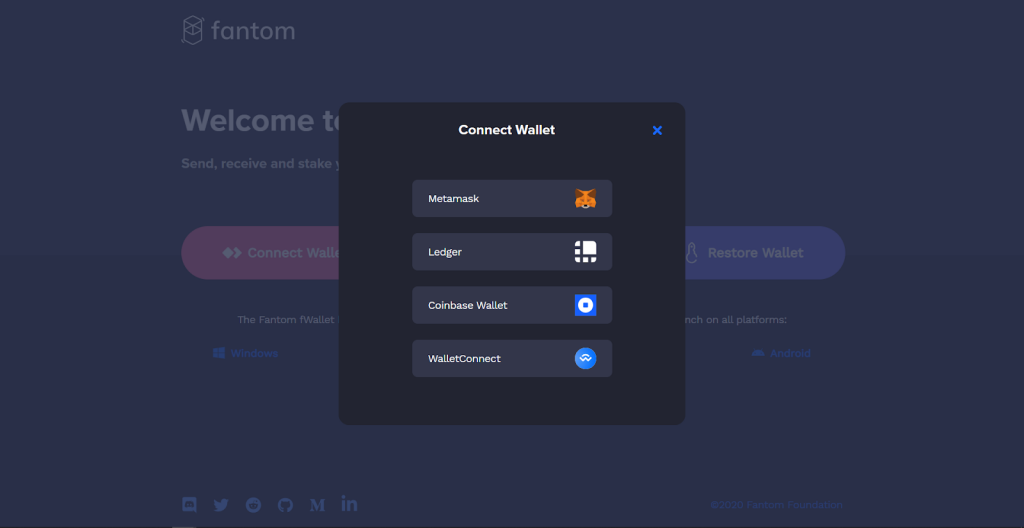

To stake FTM on fWallet, you will need first to create a wallet and deposit FTM tokens into it. Alternatively, you can connect with an existing wallet containing your FTM tokens. The fWallet is currently compatible with only four crypto wallets, i.e., Coinbase wallet, MetaMask, WalletConnect, and the Ledger Nano X.

When staking with fWallet, investors delegate their FTM tokens to a network validator. There are numerous validators on the Fantom network. In choosing one, investors are advised to consider the validator’s uptime as well as performance record. This is quite important as tokens can be lost if a chosen validator displays any behavior the Fantom network recognizes as malicious.

Staking Rewards

On Fantom, the minimum staking amount via delegation is 1 FTM. Investors earn a basic APY of 4% by staking FTM with no lock-up period. This allows investors to stake their tokens with the freedom to unstake them anytime.

However, if you decide to lock up your FTM tokens for a fixed period of time, Fantom offers higher interest rates depending on the lock-up period. Currently, the maximum lock-up period for Fantom is 365 days, in which investors will earn a 14% APY on their staked FTM tokens.

To wrap up, it is worth noting that all validators on Fantom charge a 15% commission fee on delegators’ rewards. If you want to avoid this fee, you can always set up a personal validator, provided you are staking a minimum amount of 500,000 FTM.

Pros

- Offers an interest rate as high as 14% APY

- Allows investors to earn a 4% APY with no lock-up period required (liquid staking)

- Compatible with other wallets

- Easy to use

- Low minimum delegation amount of 1 FTM

Cons

- High requirement to set up a validator node.

- Higher interest rates require investors to lock up their tokens for a fixed time

- 15% commission fee paid to validators

- Loss of tokens if chosen validator shows malicious behavior

2. Binance

Easiest way to stake FTM

Overview

With a daily trading volume of $76 billion, Binance ranks as the world’s leading cryptocurrency exchange. Binance offers its 90 million customers access to 350+ cryptocurrencies alongside other services such as margin trading, lending, and staking.

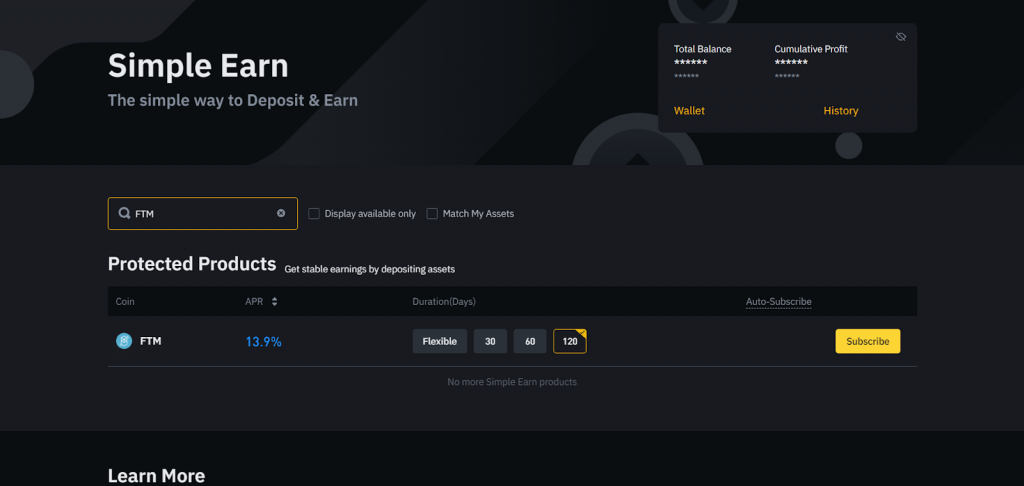

Currently, investors can stake over 50 cryptocurrencies, including FTM, on Binance. Staking FTM on Binance requires investors to subscribe to one of its four FTM staking products. The table below will provide information on each staking product, its respective APR, and minimum subscription amount.

Staking Rewards

| Staking Product | Annual Percentage Rate (APR) | Minimum Subscription Amount |

|---|---|---|

| Flexible | 1% | 0.1 FTM |

| 30 days | 4.3% | 0.1 FTM |

| 60 days | 6.5% | 0.1 FTM |

| 120 days | 13.9% | 0.1 FTM |

The flexible staking product allows users to stake FTM with the freedom to withdraw their tokens anytime. While this can be quite beneficial to active traders, it offers the lowest interest rate.

To earn a higher interest, FTM investors will have to subscribe to the other staking products with a fixed staking period. These products require investors to lock up their tokens for the stated period of time, i.e. 30, 60 or 120 days. During this time, the staked FTM tokens and any interest earned cannot be accessed or withdrawn.

On Binance, interests are distributed daily, starting from the next day after subscription. In addition, as Binance is an exchange, you should note that the platform is solely responsible for the security of your FTM tokens during staking.

Pros

- A maximum APR of 13.9%

- Offers a flexible staking product

- No need for delegation

- Low minimum staking amount

- You earn interest daily

- Beginner friendly

Cons

- Some staking products come with a fixed lock-up time

- Risk of any asset loss if Binance suffers an attack

3. KuCoin

Best for daily interest on flexible staking

Overview

KuCoin is one of the most prominent cryptocurrency exchanges. It is based in Seychelles and serves over 10 million customers worldwide. KuCoin offers over 200 cryptocurrencies on its platform alongside other crypto-based services, including staking.

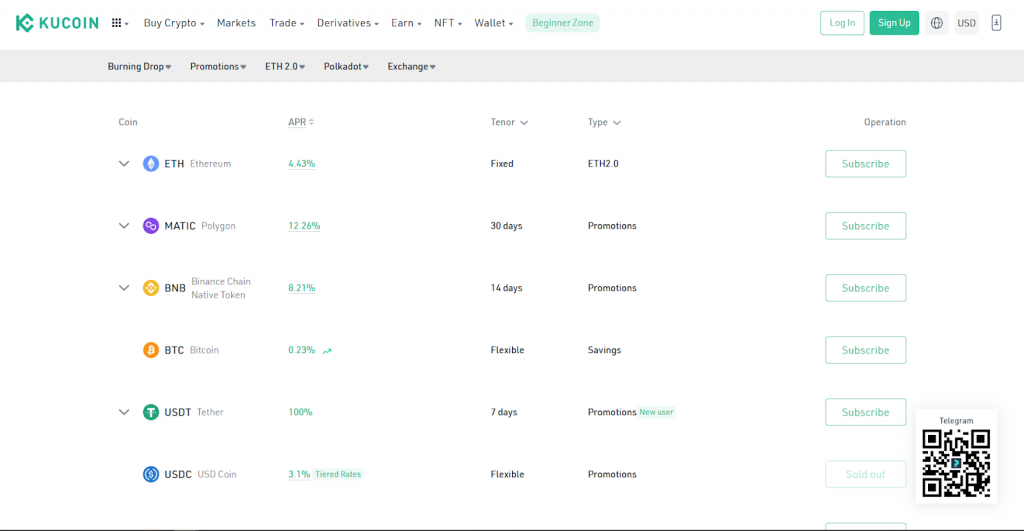

For FTM investors, KuCoin offers a flexible staking product and two fixed staking products. The table below will cover each FTM staking product, its individual APR, and minimum subscription amount.

Staking Rewards

| Staking Product | Annual Percentage Rate (APR) | Minimum Subscription Amount |

|---|---|---|

| Flexible | 2.1% | 50 FTM |

| 7 days | 6.15% | 50 FTM |

| 14 days | 8.21% | 50 FTM |

Similar to Binance, the flexible staking product is designed for investors who may want to withdraw their staked FTM tokens at any time. Also, the fixed-term products require you to lock up your FTM tokens for the stipulated period, i.e. 7 or 14 days.

On KuCoin, interests are also distributed daily. In addition, you get to earn POL credits alongside your staking rewards.

Pros

- Offers a flexible staking plan

- High-interest rates

- No need for delegation too

- Investors earn staking rewards + POL credits

- Interests are earned daily

Cons

- High minimum staking amount

- Some staking products come with a fixed lock-up time

- Risk of asset loss by any attack on KuCoin

How to Stake Fantom

In this section, we’ll provide a quick guide on how to stake Fantom using the Binance Exchange.

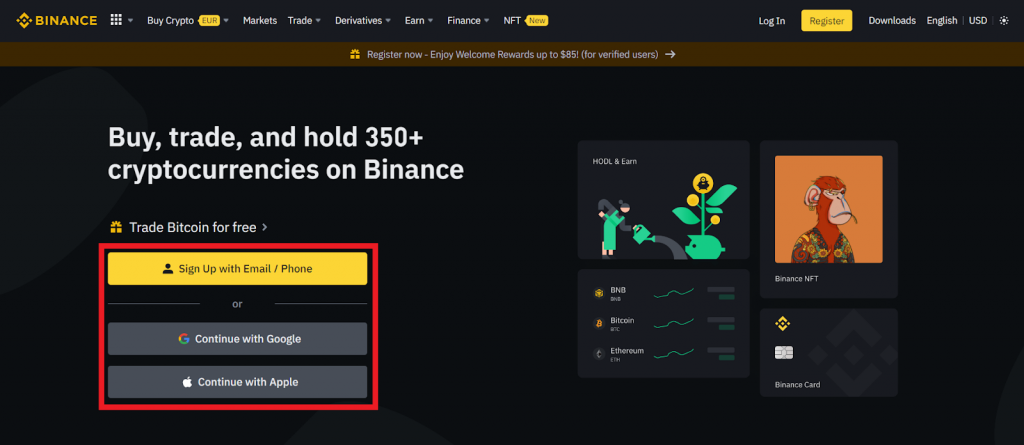

First, register an account on Binance and complete the verification process.

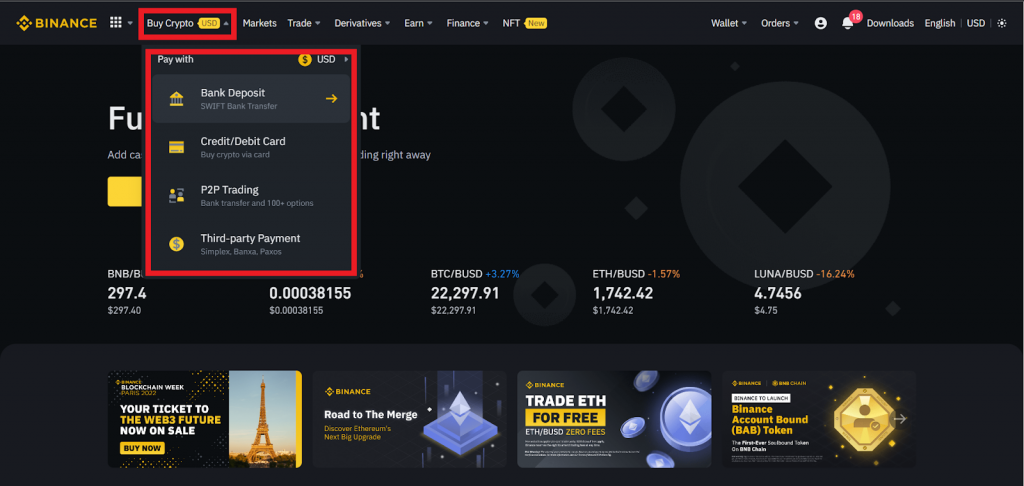

Next up is funding your Binance account with FTM tokens. You can transfer FTM from another crypto wallet or buy FTM directly from the Binance exchange.

To buy FTM from Binance, click on Buy Crypto on the Binance dashboard and choose a payment medium – credit/debit card, bank deposit, P2P trading, and third-party system.

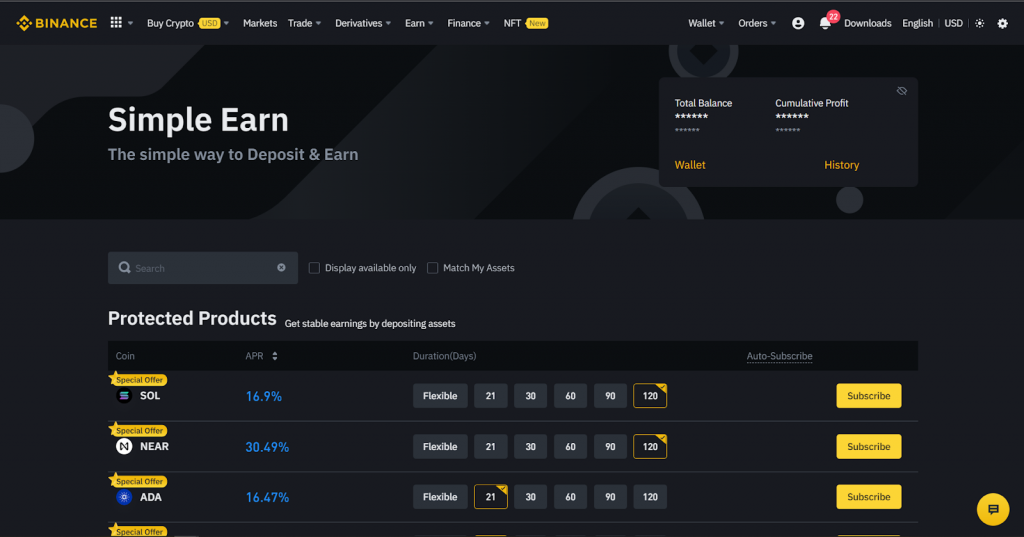

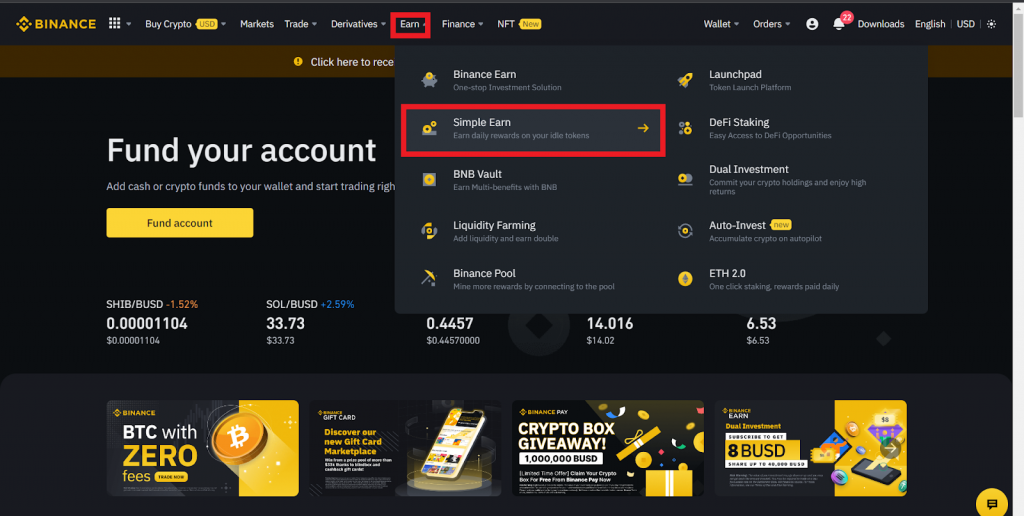

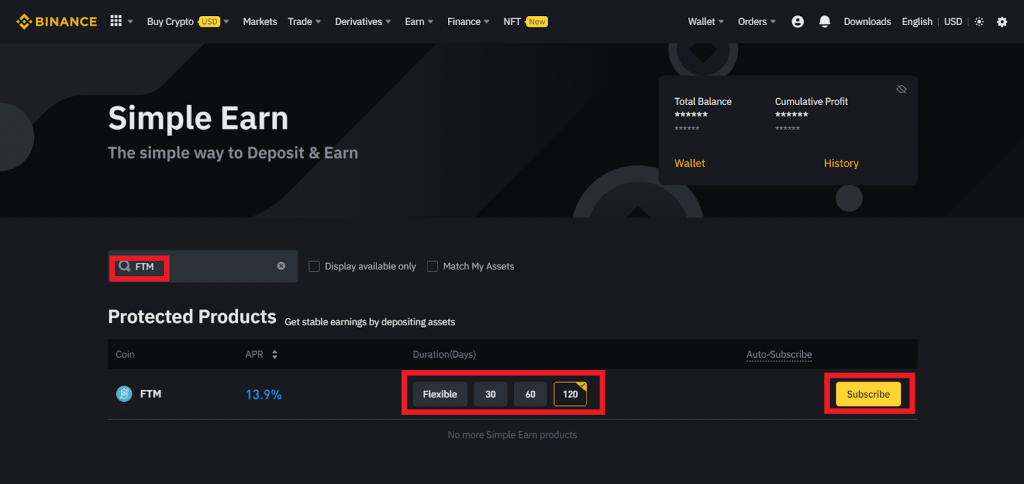

After completing this step, you can now begin staking. Return to the Binance dashboard, select Earn, and click on Simple Earn.

Search for FTM, select your preferred FTM staking product, and click on Subscribe.

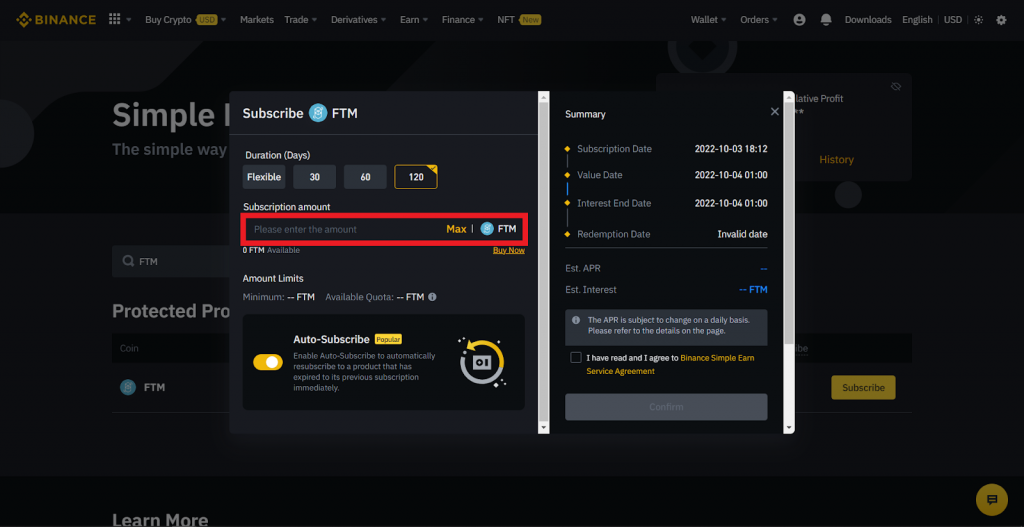

Enter the amount of FTM you wish to stake in the “Subscription amount” box.

Agree to Binance Simple Earn Service Agreement and click on Confirm.

What is Fantom (FTM)?

Fantom is a decentralized and open-source smart contract platform. It is a high-performance, scalable and secure network built for the seamless operations of smart contracts and decentralized applications (dApps). Fantom is also an EVM-compatible blockchain, capable of providing support for Ethereum-based dApps.

Launched in 2019, Fantom’s Mainnet – known as Fantom Opera – is built on Lachesis, a leaderless proof-of-stake protocol that enables Fantom to effectively tackle the blockchain trilemma of security, scalability, and decentralization.

Lachesis is an Asynchronous Byzantine Fault Tolerant (aBFT) algorithm that allows several nodes globally to process network data at different times in a permissionless, open environment, providing a high level of decentralization and scalability.

Furthermore, this aBFT mechanism guarantees strong security on the Fantom Opera by ensuring that the network remains safe and functional even if up to one-third of the validator nodes are faulty or malicious.

That said, Fantom Opera is powered by its native FTM token, which serves as the primary medium of transactions as well as the governance token of the network.

FAQs

Is staking on Fantom safe?

Yes, staking on Fantom is safe and secure. However, investors should take note of all risks that come with validators and exchanges.

What wallets can I use to stake Fantom?

You can only stake Fantom via the fWallet. However, the fWallet can be linked to other crypto wallets, including Coinbase wallet, MetaMask, WalletConnect, and Ledger Nano X.

Can I delegate FTM to multiple validators?

You can only delegate FTM to multiple validators using multiple wallets. The Fantom network is designed to enable one delegation per wallet.

Wrap Up

In this article, we have provided information on where to stake Fantom, alongside the various offers of each staking platform. Regardless of which exchange or wallet you choose, staking Fantom remains a brilliant way of earning passive income. However, investors are reminded to approach staking just as any form of investment, maintaining all necessary caution.