In recent years, the concept of staking has gained much ground among investors as a way to earn an extra income stream on the side.

Associated with Proof-of-Stake (PoS) networks, staking occurs when you lock up your assets on a blockchain to becoming a validator – verifying transactions and protecting the network integrity.

Similar to that of a fixed deposit account, you are rewarded with interest on those assets. However, unlike these traditional deposit or savings accounts, staking typically offers higher interest rates.

Take Polkadot (DOT) for instance. One of the most popular PoS assets that offers a return as high as 19% APY. With such a high interest rate, this token is widely recognized as one of the most profitable staking assets.

Aside from that, Polkadot is one cryptocurrency investors like to accumulate as it shows good signs for mainstream adoption as well as significant price growth in the coming years.

Just note, that with staking comes risk. So it’s important you understand what you’re doing to put yourself in the best position possible. You can read our guide on the risks of staking to learn more.

Alright, lets take a dive into how you can stake Polkadot and best places to do to so!

In this guide:

Can you stake Polkadot (DOT)?

Polkadot uses a Nominated Proof of Stake (NPoS) consensus protocol to validate transactions and maintain the network integrity. Therefore, the blockchain requires its users to stake it’s native DOT tokens to keep the network operational.

You can stake DOT natively on Polkadot or via third-party platforms e.g., non-custodial wallets, centralized exchanges, and liquid staking platforms.

There are two ways to stake DOT natively; as a nominator or validator.

Staking DOT as a validator

To be a validator, you need to run a node on the Polkadot network and actively participate in the transaction validation process. Based on performance, validators are rewarded with newly minted DOT tokens, transaction fees, and additional benefits.

Staking DOT as a nominator

As a nominator, you participate in staking by opening a nomination pool or joining an existing one. Each nomination pool has a validator or a set of chosen validators it backs. Alternatively, you can choose to nominate independently.

The Polkadot network automatically distributes your stake to their respective validators and ensures all nominators receive a portion of the staking rewards.

On Polkadot, nomination is quite important as only the validators with the most nominations can approve transactions and earn staking rewards. Every 24 hours, the network re-selects its active set of validators based only on this criteria.

Staking via a third-party

If you are considering staking DOT through a third-party platform (or just a beginner), it is often recommended to go with centralized exchanges as they’re are easily accessible and user-friendly.

These exchanges offer plans that are designed with a fixed or flexible lock-up term, giving you the freedom to choose how you’d like to stake.

How much can you earn by staking Polkadot (DOT)?

If you choose to staking DOT directly via the Polkadot network, you earn an annual percentage yield (APY) of 15%. Exchanges like Kraken reward DOT stakers with an APY of 19%, while Binance offers an APR of 16.7%.

How To Stake Polkadot (DOT)?

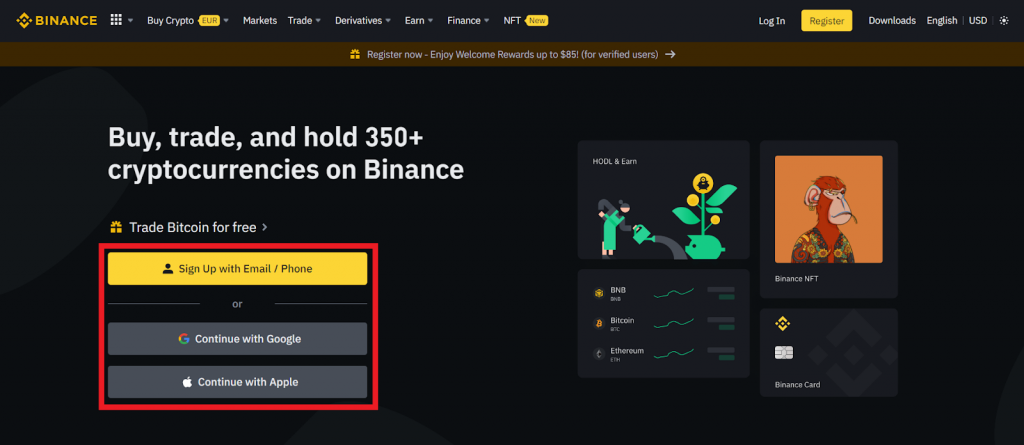

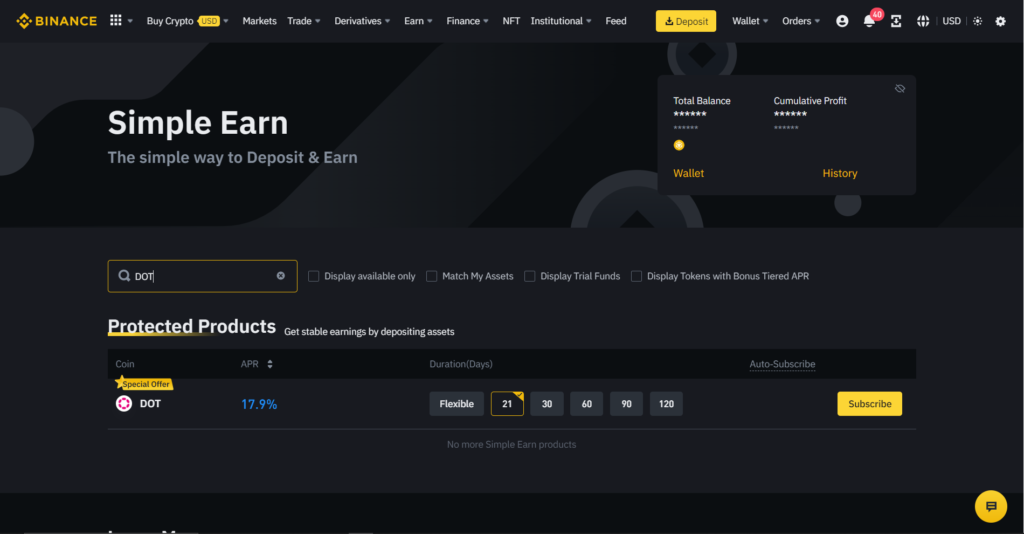

The following is a step-by-step guide on how to stake Polkadot (DOT) on Binance – the suggest platform for begginers.

- Register an account on Binance and complete the identity verification process.

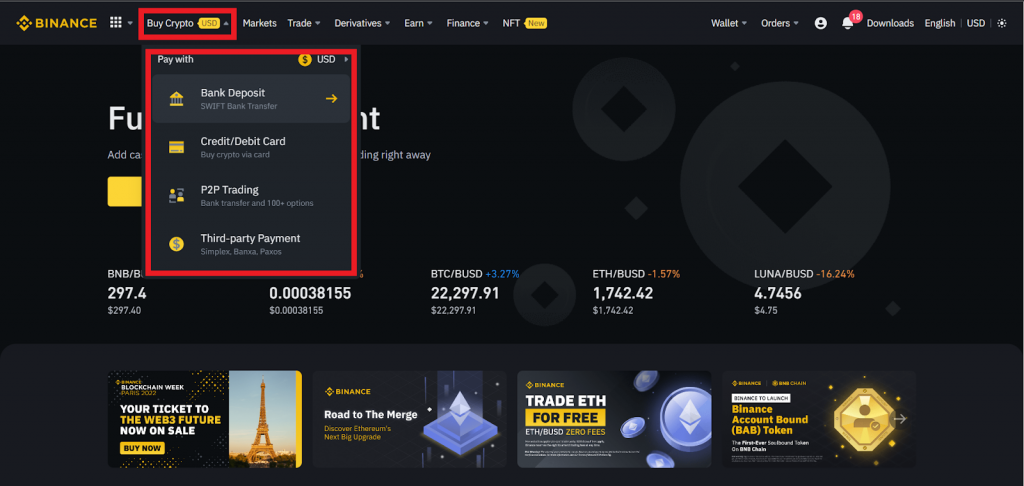

- Purchase DOT tokens via the Buy Crypto feature on the Binance dashboard. Or if you already have DOT tokens, you can transfer them into your Binance wallet.

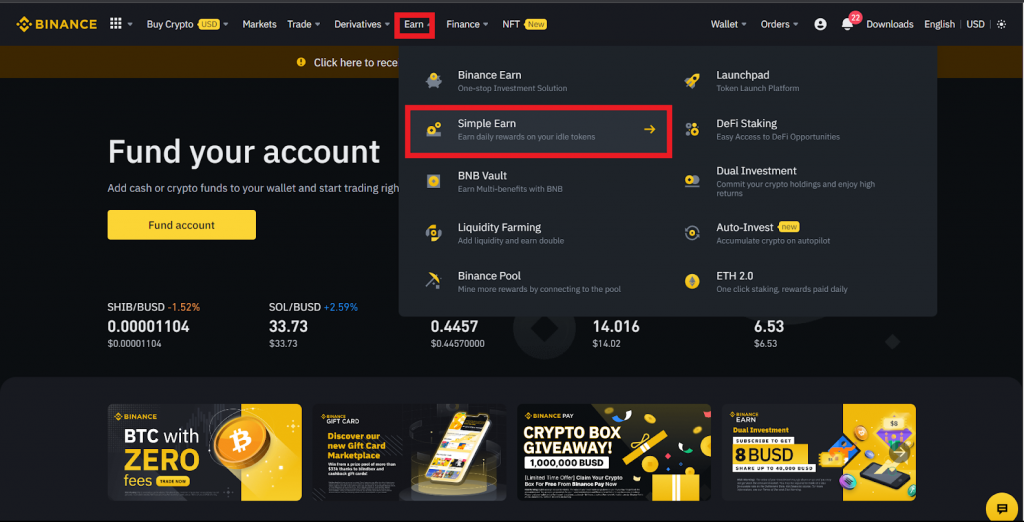

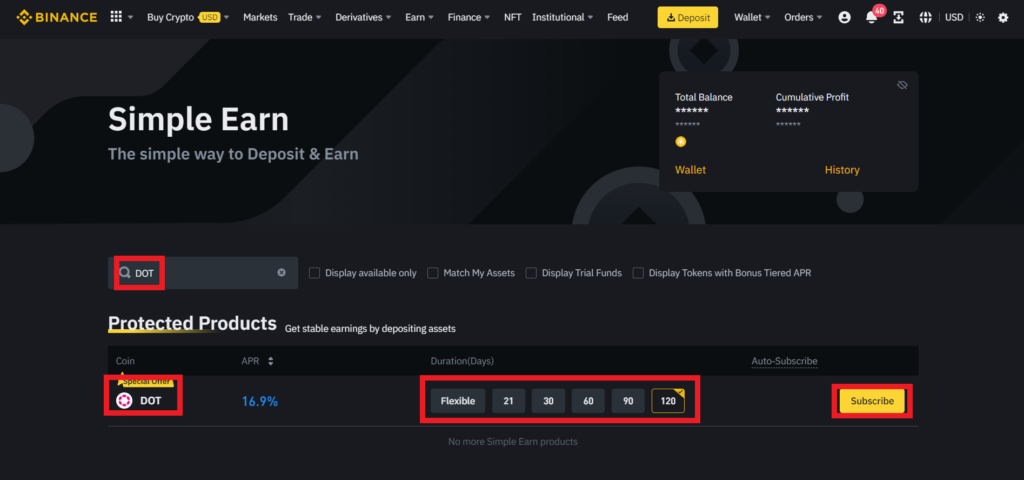

- Select the Earn Feature on the Binance Dashboard, then click on the Simple Earn feature.

- On the following page, search for DOT, select a DOT staking plan and click on Subscribe.

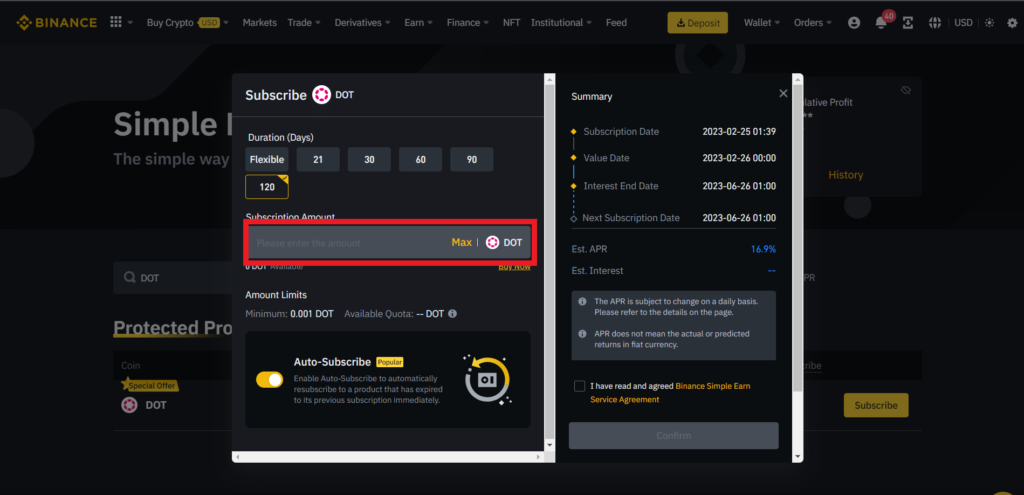

- Enter the amount of DOT you want to stake in the Subscription Amount Box.

- Agree to Binance Earn Service Agreement and click on Confirm.

What are the best places to stake Polkadot (DOT)?

Due to its popularity, there are numerous platforms that allow users to stake Polkadot. However, a few of these platforms are considered outstanding to be the “best” due to their high interest rates and user security. They include:

- Polkadot Staking Dashboard

- Binance

- Kraken

- KuCoin

- ByBit

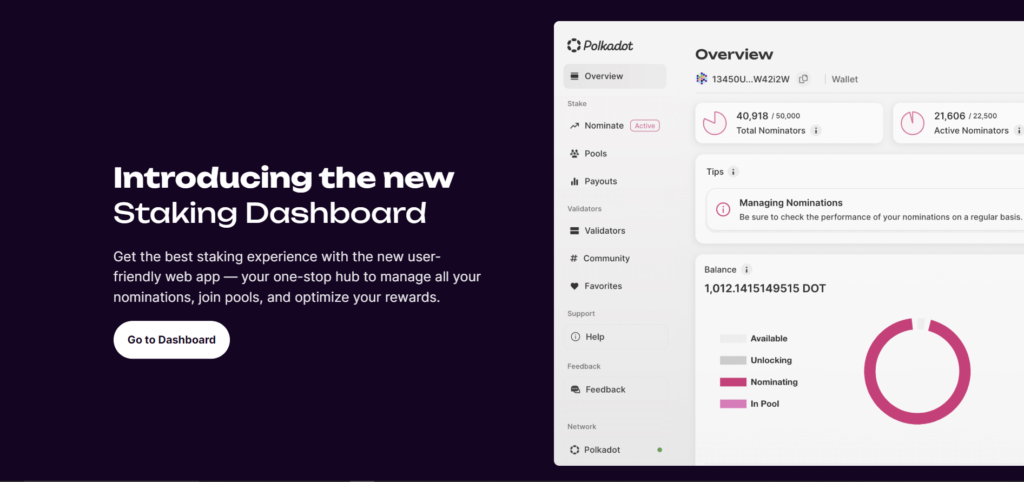

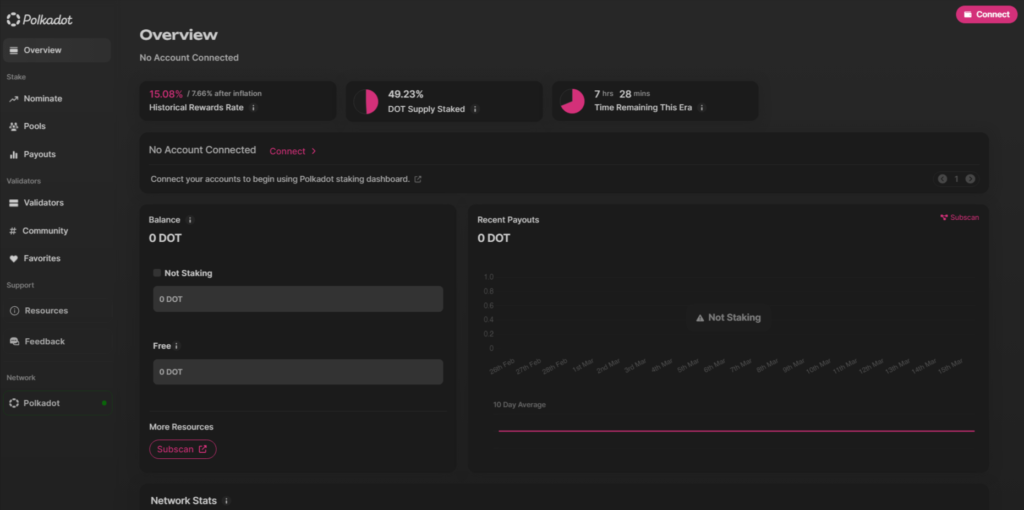

1. Polkadot Staking Dashboard

The Polkadot Staking Dashboard is the official staking platform of the Polkadot blockchain. It is the safest method of staking DOT, allowing investors to stake natively on the Polkadot network.

To interact with the platform, you are first required to connect a wallet containing DOT tokens. Common wallets supported by the Polkadot Staking Dashboard include SubWallet, Talisman, Polkadot.js, and Nova Wallet.

Alternatively, you can connect with hardware wallets such as the Ledger Nano X, which allows you to keep your assets offline, giving you the least amount of risk of losing your DOT.

As we mentioned earlier, you can stake Polkadot as either a nominator or a validator. However, regardless of each role you choose, you get to keep full custody of your staked tokens as well as your voting rights to approve governance proposals.

If you decided to partake in being a validator, you will need to do proper due diligence to avoid facing a slashing penalty. Slashing occurs when a validator loses a portion (or all) of its stake as a penalty for displaying any malicious network behavior.

If you decided you’d rather be a Nominator, then try your best to stay clear of validators with a history of slashing.

The minimum required staking amount is 1 DOT and rewards earned are paid out every 24 hours.

Pros

- Offers an 15.08% APY (7.66% after inflation)

- Low minimum staking amount to get started

- Investors retain control of their assets

- Rewards are paid out daily

- Most secure method of staking DOT

Cons

- Can be complex for begginers

- Risks of slashing (if you’re a validator)

2. Binance

Binance is the world’s leading decentralized exchange serving around 120 million users worldwide. It provides support for trading 360+ cryptocurrencies and digital assets. Binance also doubles as an excellent staking platform for begginers supporting over 60 PoS assets.

Binance offers a variety of DOT staking plans, comprising one flexible plan and four fixed plans with lock-up duration ranging from 30-120 days.

Check out the table below for each of the plans.

| Staking Product | Annual Percentage Rate (APR) | Minimum Subscription Amount |

|---|---|---|

| Flexible | 2.8% | 0.1 DOT |

| 30 days | 10.9% | 1 DOT |

| 60 days | 11.9% | 1 DOT |

| 90 days | 13.9% | 1 DOT |

| 120 days | 16.9% | 0.001 DOT |

The flexible staking plan is recommended for daily traders as it allows investors to stake and withdraw their DOT tokens anytime. Although, it does offers the lowest interest rate so that’s something to keep in mind.

The fixed staking plans offer the highest interest rates – with the longer you lock-up your tokens, the higher the reward. Once you opt into a fixed staking plan you cannot withdraw your tokens, so these are only recommended if you plan to hold Polkadot for the long-term.

Binance is one one of the best way to get started with staking for beginners, and removes the hassle of having to be a validator or a nominator. However, since Binance is centralized exchange, it will have full control and custody of your staked DOT tokens.

Staking rewards on Binance are paid out daily.

Pros

- Maximum APY of 16.9%

- Offers a flexible staking plan

- Best platform for beginners

- Low staking requirement

Cons

- Lock-in periods for fixed staking plans

- Investors do not retain custody of staked assets

- Risk of asset loss if Binance is attacked or goes insolvent

3. KuCoin

Based in Seychelles, KuCoin is a crypto exchange with a daily trading volume of over $900 million. KuCoin offers a range of services, including spot trading, margin trading, fiat trading, futures trading, lending, and staking.

KuCoin is easily one of the best platforms for staking Polkadot as it’s easily accessible and simple to navigate.

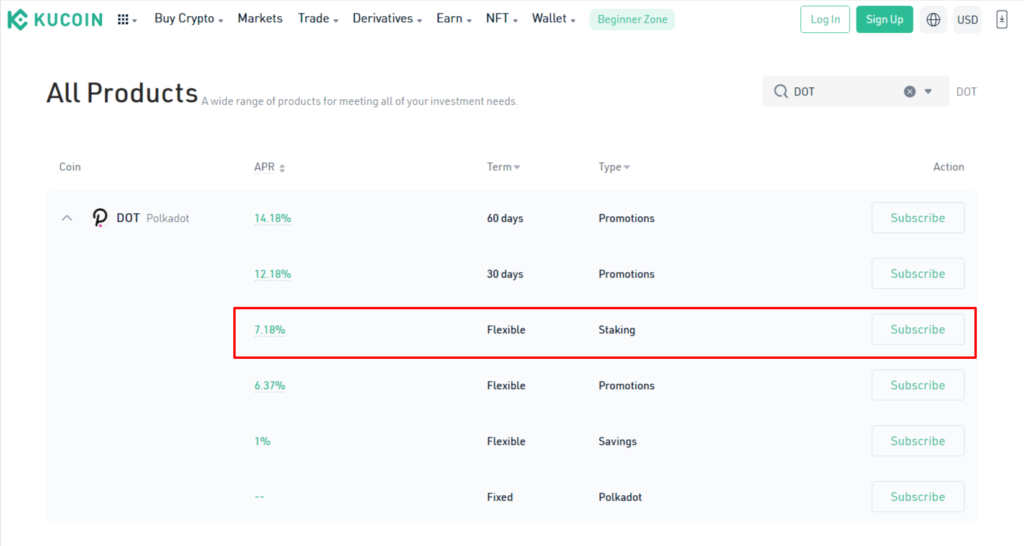

On KuCoin, you stake DOT through their Earn program. In addition to the normal interest earned staking DOT, KuCoin also rewards you with POL mining rewards which are paid out daily.

KuCoin offers a flexible staking plan for DOT with an APY of 7.2%, which requires minimum staking amount of 0.2 DOT.

Pros

- Flexible staking (unlock at any time)

- APY of 7.2%

- POL mining rewards

- Low minimum staking requirement of 0.2 DOT

Cons

- No custody of staked assets

- Risk of asset loss if KuCoin is attacked or goes insolvent

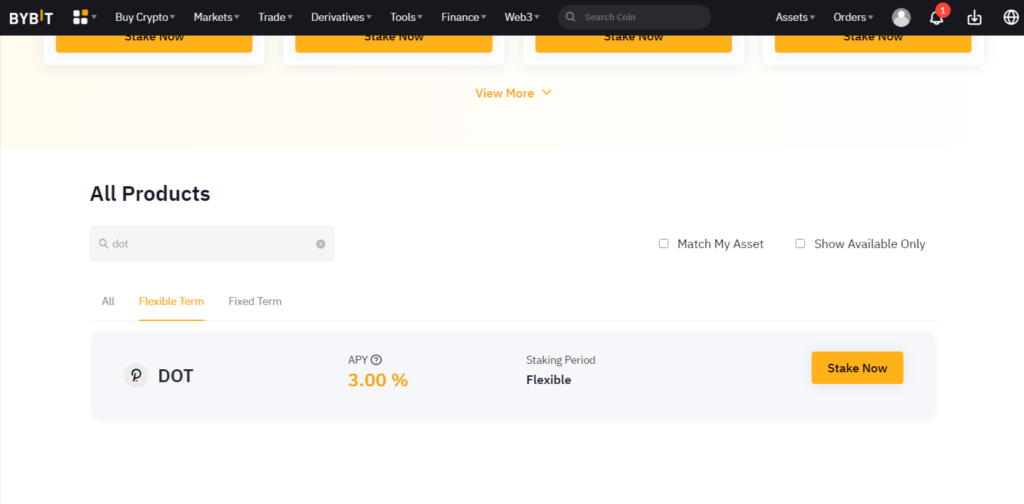

4. ByBit

ByBit is a Dubai-based cryptocurrency exchange boasting over 10 million registered customers worldwide. It is another top, secure platform that offers flexible and fixed staking plans for several PoS assets.

ByBit currently offers one flexible staking plan for DOT at an APY of 3%. While the APY is not the best, staking on ByBit is a seamless experience, so it’s a great option if you’re just starting out.

ByBit is also currently running a special bonus program where you can earn an extra $10 in BTC when you deposit a minimum of $100 in your account.

Pros

- Offers a flexible staking plan

- No KYC required (Lvl 1 KYC is required for staking)

- Free $10 BTC when you deposit at least $100

Cons

- Low-interest rate at 3%

- Risk of asset loss if ByBit is attacked or closes down

- No custody of staked assets

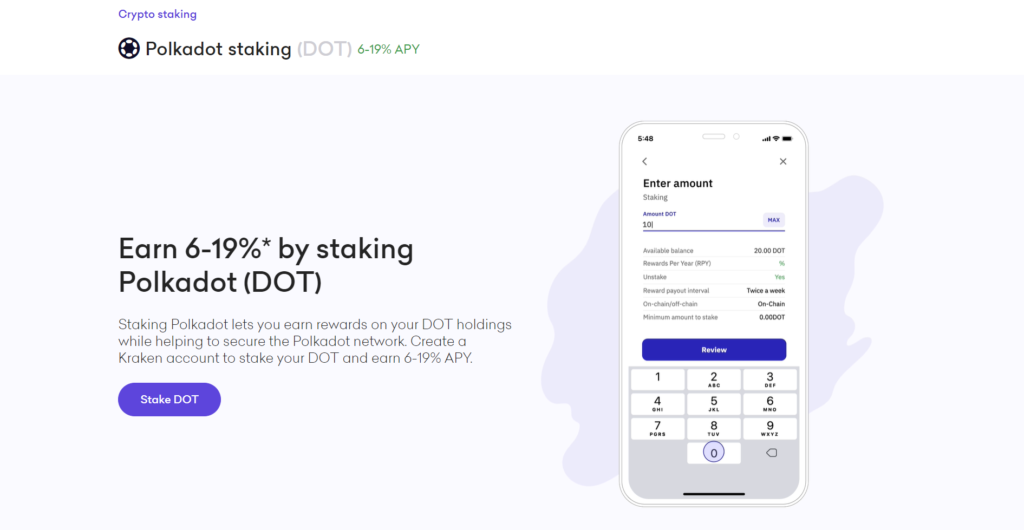

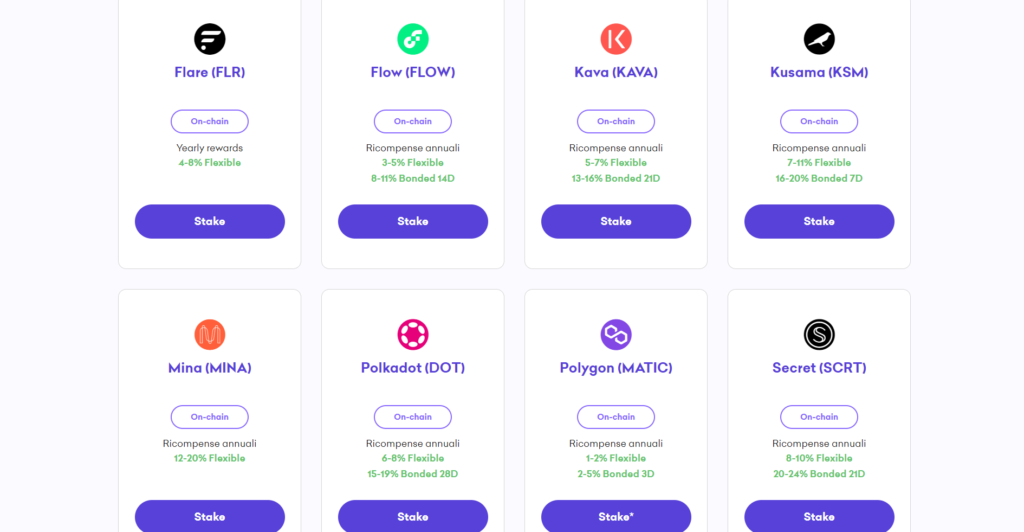

5. Kraken

Kraken is a cryptocurrency exchange that offers secure and safe staking services to crypto users. Kraken supports the trading of 185+ cryptocurrencies and supports 14+ assets (including Polkadot) for staking.

Staking DOT on Kraken is a simple and straightforward process and has no minimum staking amount. Meaning you can stake as little as possible – amazing!

Kraken offers a flexible staking plan for DOT where you can earn an APY of 6-8%. Alternatively, you can invest in a 28-fixed staking plan which offers an APY of 15-19%. Staking rewards are paid out weekly by Kraken.

Pros

- Offers highest APR on DOT (19%)

- Offers flexible/fixed staking plans

- No minimum staking amount

- Weekly pay-out

Cons

- Exchange holds custody over your assets

- Potential loss of tokens if Kraken is attacked or goes insolvent

- Less alternative staking options for PoS tokens

What is Polkadot (DOT)?

Polkadot is a decentralized protocol designed to allow different blockchain networks to interact seamlessly with one another, enabling cross-chain transfers of any form of data or asset, thus, creating a heterogeneous multi-chain ecosystem.

Polkadot was launched in May 2020 by Ethereum co-founder Gavin Wood. However, the project’s white paper was published as far back as 2016. Simply put, Polkadot aims to eliminate the current limitations of blockchains in terms of security, scalability, and interoperability.

To that end, it utilizes a unique network infrastructure centered around a main blockchain called the “relay chain” connected with several independent chains known as “parachains.” The relay chain is responsible for maintaining the cross-chain interoperability and high-security level of the Polkadot ecosystem.

Polkadot is powered by the DOT token, which also functions as its governance token. DOT tokens are mainly used for network fee payment as well as facilitating data transfer among the various chains in the Polkadot network.

Polkadot is based on a unique Proof-of-Stake variant – the Nominated Proof-of-Stake (NPoS) consensus algorithm, which allows investors to nominate a set of validators to verify transactions by backing them up with their stake.

Frequently asked questions

How much DOT do I need to stake?

The minimum amount of DOT required to stake directly on the Polkadot network is 1 DOT. However, the staking requirements for third parties platforms tend to differ. For example, Kraken has no minimum staking amount, while KuCoin has a minimum staking requirement of 0.2 DOT.

Is staking DOT worth it?

Considering its high-interest rate, staking DOT is an investment worth exploring. Although, like other Proof-of-Stake assets, there are always risks involved when staking that should be taken into account.

What is the Polkadot Staking Dashboard?

Polkadot Staking Dashboard is the official staking platform of the Polkadot network. It allows investors to interact directly with the Polkadot blockchain, to stake DOT natively as a nominator or validator.

What risks do I have when staking DOT?

Risks involved when staking DOT include complete or partial loss of your tokens if your chosen validator behaves maliciously. For investors staking through third parties like a centralized exchange, asset loss can occur if the platform is compromised or goes insolvent.

Wrap-up

Clearly, Polkadot is one of the best staking assets with its security and attractive interest rates. It is only expected that more platforms will roll out staking support for this altcoin in the coming years to match its increasing demand.

The platforms we covered above are currently the best places to stake Polkadot. If you’re looking to stake please take into consideration the features and associated risks of each platform.