Ripple (XRP) is the 6th largest cryptocurrency in the world. It is one of few cryptocurrencies with a high level of real-world application, making it a favourable asset for long-term investment. As an investor, several platforms offer means by which you can earn a passive income with your XRP tokens. In this piece, we shall guide you on the best places to stake XRP while assessing the benefits and risks of each platform.

Best Exchanges & Platforms to Stake XRP

Can You Stake Ripple (XRP)?

XRP runs on the XRP Ledger, which is not a proof-of-stake blockchain. Instead, the XRP Ledger relies on a consensus protocol to verify transactions and create new blocks. Therefore, you cannot stake XRP to earn rewards.

That said, you can earn interest on your XRP tokens by lending them to third parties such as crypto exchanges which usually require crypto liquidity for their operations.

For exchanges like Binance, you loan out your XRP tokens by subscribing to a savings product/plan with a fixed interest rate. Other exchanges like Nexo pay you interest for simply depositing your tokens in their crypto wallet, which is set up as a savings account.

Crypto lending can boost the value of your portfolio while you anticipate a rise in the prices of your asset. However, you should know that by lending your cryptocurrency to an exchange, they gain full custody of these coins and are solely responsible for their security.

How Much Can You Earn by ‘Staking’ Ripple?

Depending on which exchange you choose as a lending platform, you can earn as high as an 8% annual percentage yield (APY) on your XRP tokens.

What Are the Best Places to ‘Stake’ Ripple?

Several exchanges offer crypto lending services to their users. However, investors must commit their assets to credible and secure platforms that offer a good interest rate. The following are the best places to lend Ripple.

1. Binance

Best for flexible staking (no lock-up)

Overview

The Binance exchange is the world’s most popular cryptocurrency exchange. Binance offers its users access to over 350 cryptocurrencies as well as several crypto-based services and products. To lend Ripple on Binance, you have to subscribe to its XRP savings product.

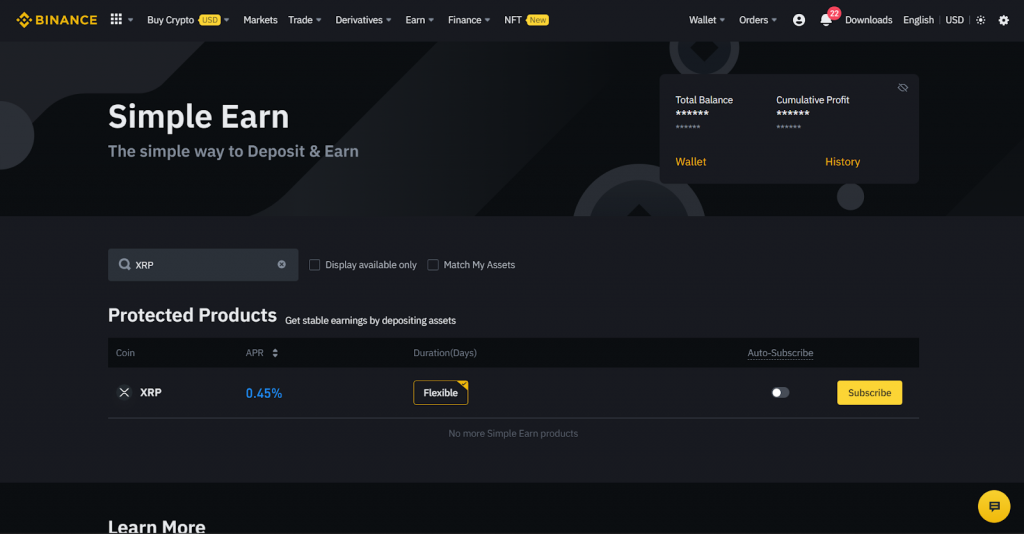

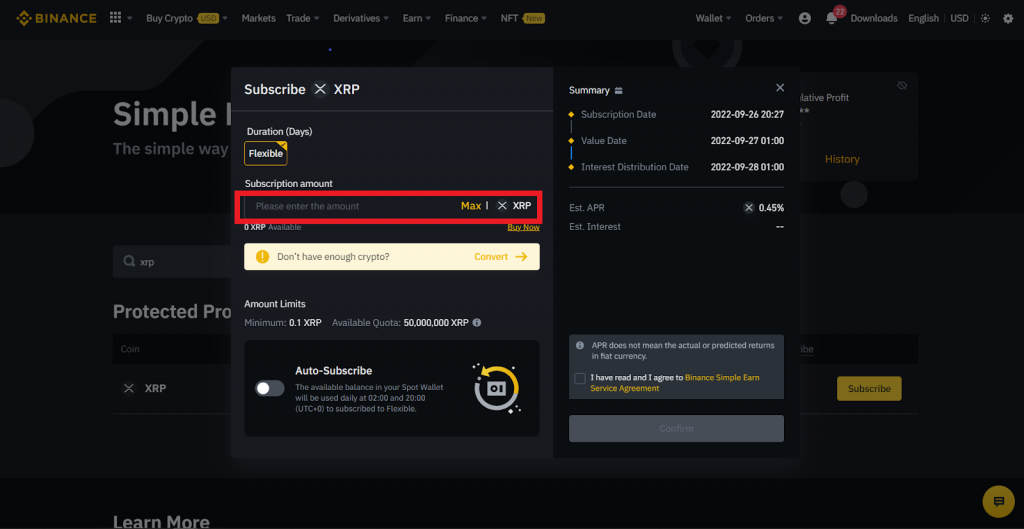

This is a flexible savings plan which allows you to withdraw your tokens anytime you wish. The Binance XRP savings product offers an annual percentage rate (APR) of 0.45%, and all investors must deposit a minimum subscription amount of 0.1 XRP to start earning returns.

Although lending Ripple on Binance offers a low-interest rate compared to other platforms, it is a comfortable savings plan for investors who might desire constant access to their tokens. Moreover, investors are paid their earned interest daily.

However, like all exchanges, Binance retains custody of your XRP tokens for the period your subscription is active. Therefore, you can lose your assets if the Binance exchange undergoes an attack or closes down.

Pros

- Flexible savings plan

- Low minimum subscription requirement

- Your interest is paid daily

Cons

- Low-interest rate compared to other exchanges

- Risk of asset loss by any attack on Binance

2. AAX

Best for flexible saving plans

Overview

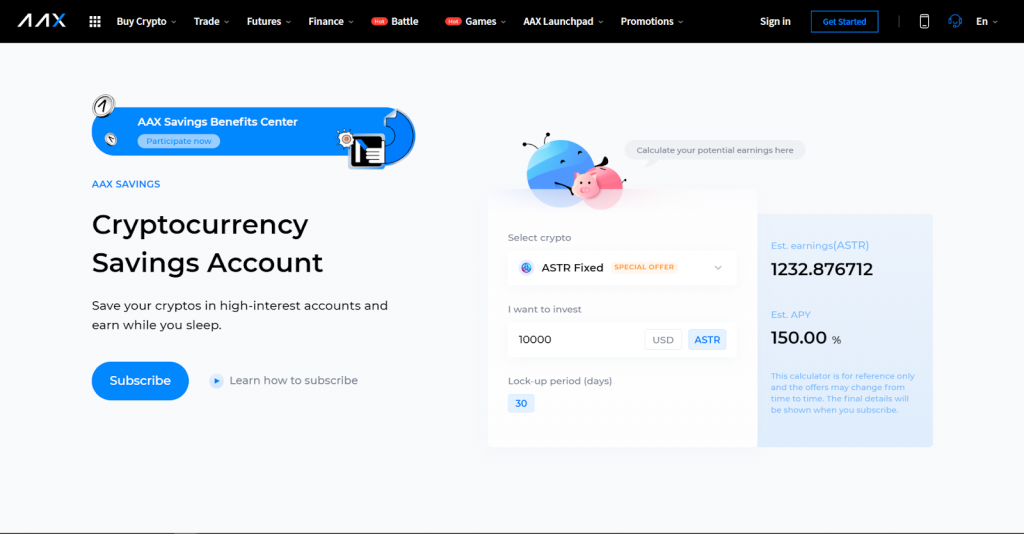

AAX is a renowned cryptocurrency exchange based in Hong Kong. It serves over 2 million users worldwide, providing them access to over 40 cryptocurrencies. To lend Ripple on AAX, you will need to subscribe to one of its four XRP savings plans.

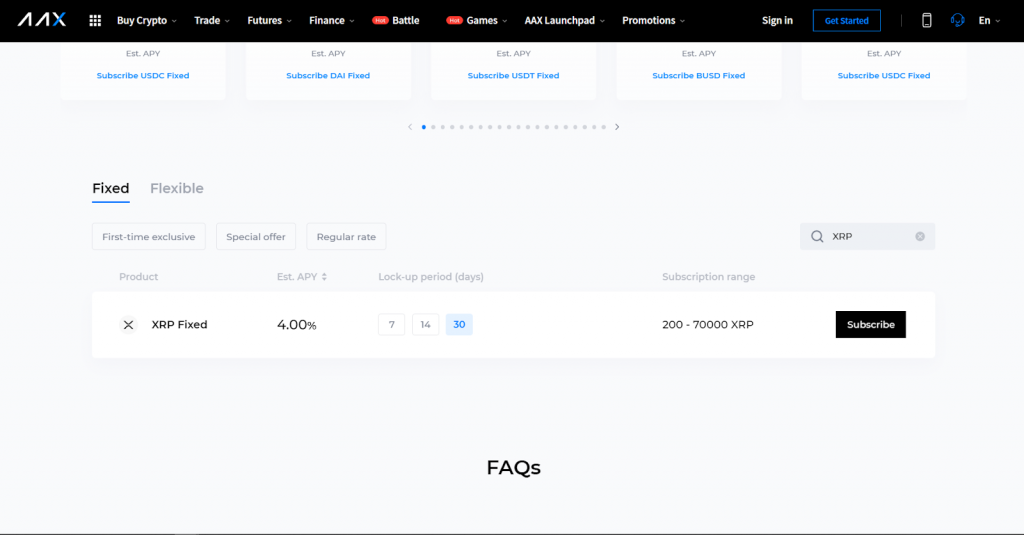

AAX offers one flexible plan and three fixed plans for XRP holders. The table below covers each XRP saving plan, their respective APY, and their subscription range.

| AAX Savings Plan | Est. Annual Percentage Yield (APY) | Subscription range |

|---|---|---|

| Flexible | 2.50% | 20-60000 XRP |

| 7 days | 3.00% | 200-70000 XRP |

| 14 days | 3.50% | 200-70000 XRP |

| 30 days | 4.00% | 200-70000 XRP |

Similar to Binance, the flexible saving plan gives you the freedom to transfer out your XRP token at any time. However, this plan offers the lowest interest rate.

On the other hand, the fixed plans require you to lock up your XRP tokens for the stipulated period of time, i.e. 7 days, 14 days or 30 days, depending on which plan you choose. In return, you are rewarded with a higher interest rate compared to the flexible plan.

On AAX, interest is usually paid out daily. However, for fixed plans, investors will have to wait until the number of days on their plan is complete before they can access their tokens.

Pros

- Higher interest rate than Binance

- Availability of a flexible savings plan

- Interest is distributed daily

Cons

- The fixed-term plans require investors to lock up their XRP tokens.

- The fixed-term plans have a high minimum deposit of 200 XRP

- Risk of asset loss by any attack on AAX

3. Nexo

Offers the highest XRP interest rate

Overview

Founded in 2018, Nexo is a cryptocurrency exchange that allows users to trade assets, earn interests and borrow assets. Nexo boasts of over 4 million users while managing $15 billion worth of assets. Also, Nexo features a native cryptocurrency known as the NEXO token.

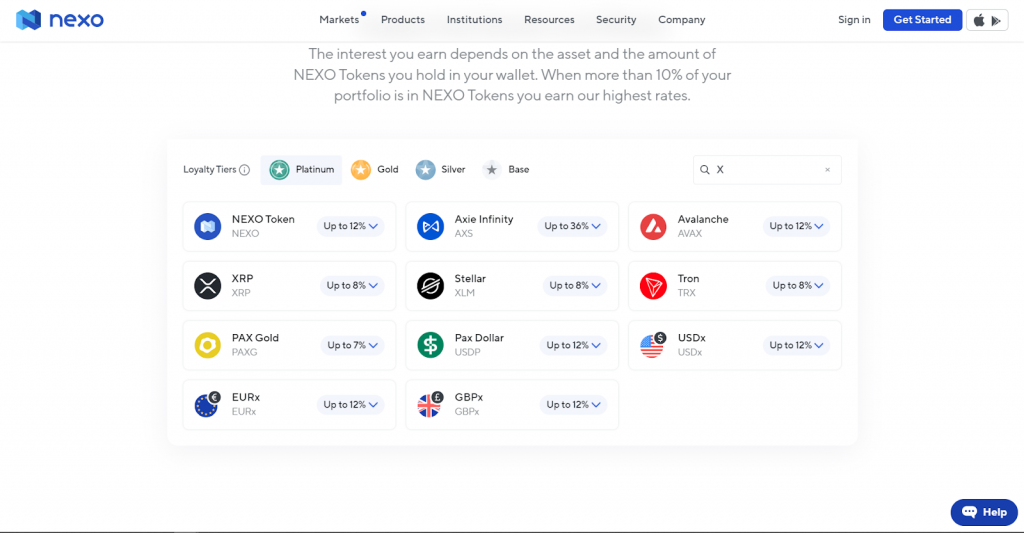

Lending Ripple on Nexo is a simple and straightforward process. Unlike Binance and AAX, there are no savings plans on Nexo. Investors are simply required to transfer their XRP tokens to their Nexo account and automatically start earning Interest. This is because the Nexo wallet usually functions as a savings account.

Nexo offers investors a basic 5% APY on Ripple, which is paid out daily. However, there are ways in which you can earn additional interest. For example, if 10% of the holdings in your Nexo wallet are NEXO tokens, you receive an extra 1% interest, leading to a total of 6% interest.

Furthermore, if you choose to receive your returns in NEXO tokens rather than XRP, you get an additional 2% yield. Therefore, you can earn a total APY of 8% by loaning out XRP on Nexo. On Nexo, there is no minimum amount required to start earning interest, making it a suitable platform for investors with a small amount of XRP. In addition, you have constant access to your XRP tokens and can withdraw them at will.

Pros

- Highest interest rate on lending Ripple

- No lock-up required

- No minimum lending amount required

- Interest is paid out daily

Cons

- Risk of asset loss by any attack on Nexo

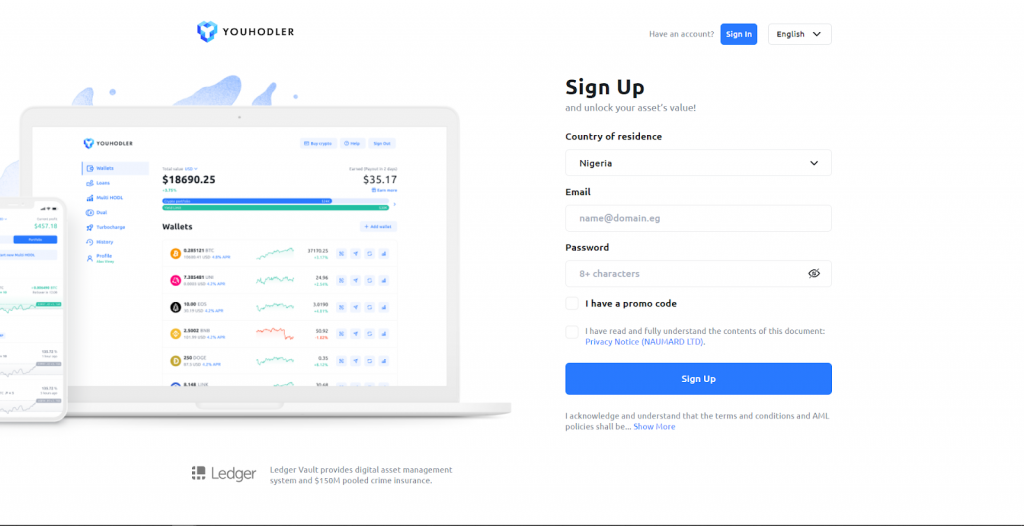

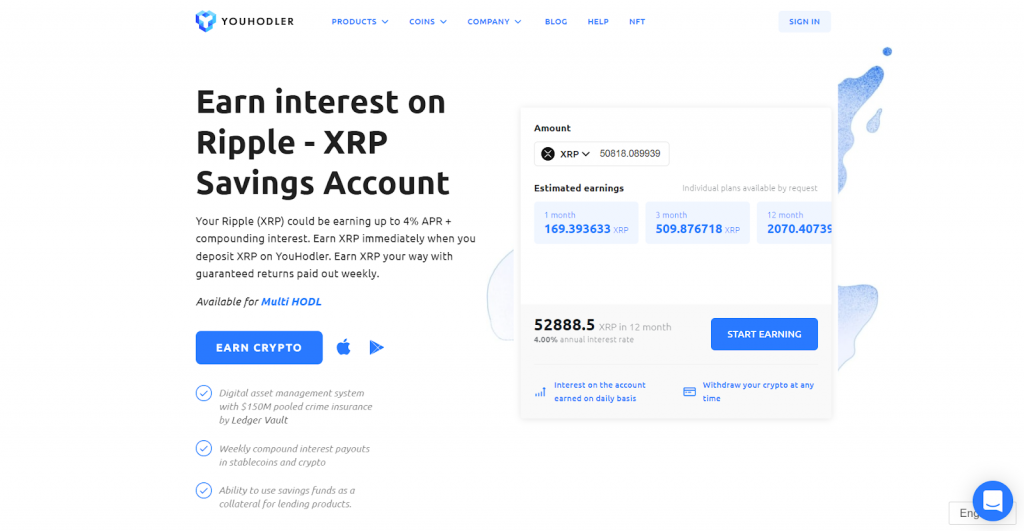

4. YouHodler

Best for weekly XRP interest pay-outs

YouHodler is a cryptocurrency exchange that focuses on crypto lending and high-interest savings. It was founded in 2017 and is based in Switzerland and Cyprus.

Like Nexo, you lend XRP tokens on YouHodler by depositing XRP tokens in your YouHodler wallet. However, you are required to deposit a minimum amount of $100 worth of XRP to start earning interest.

On YouHodler, investors are offered an APY of 4.08% on their XRP tokens. They are also granted full access to their tokens and can trade them anytime. In addition, earned interests are paid out weekly.

Pros

- APY of 4.08%

- No savings plan required

- No lock-up required

- Interest is paid out weekly

Cons

- $100 minimum deposit of XRP to start earning interest

- Risk of asset loss by any attack on YouHodler

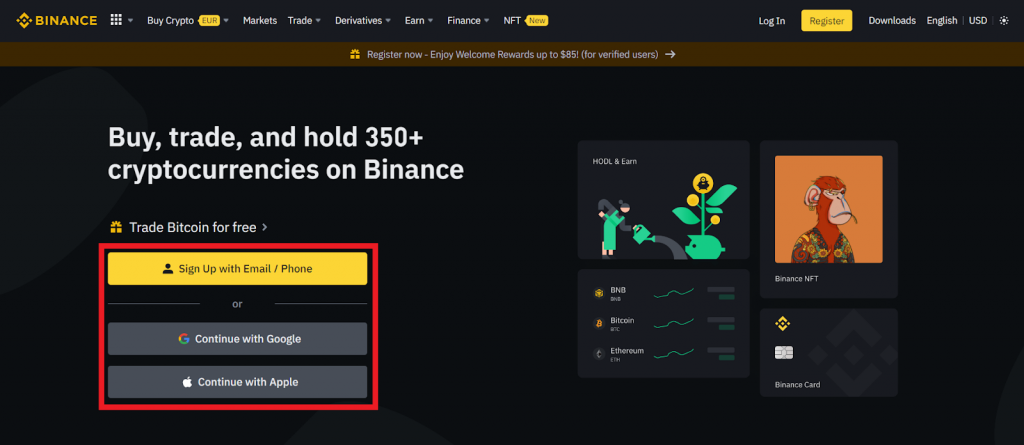

How to ‘Stake’ XRP?

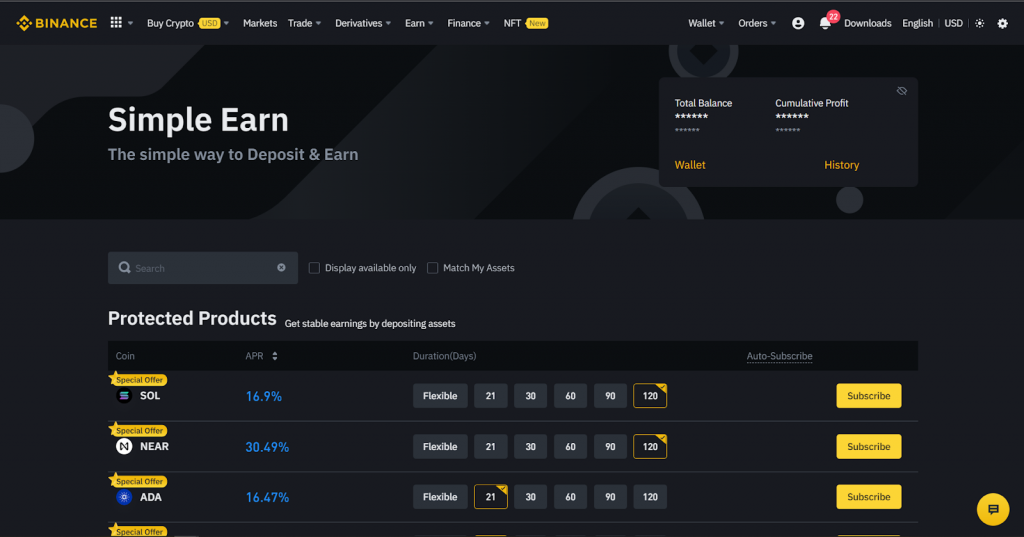

Using the Binance exchange, we shall illustrate how to lend XRP in six simple steps.

Register an account on Binance and complete the verification process.

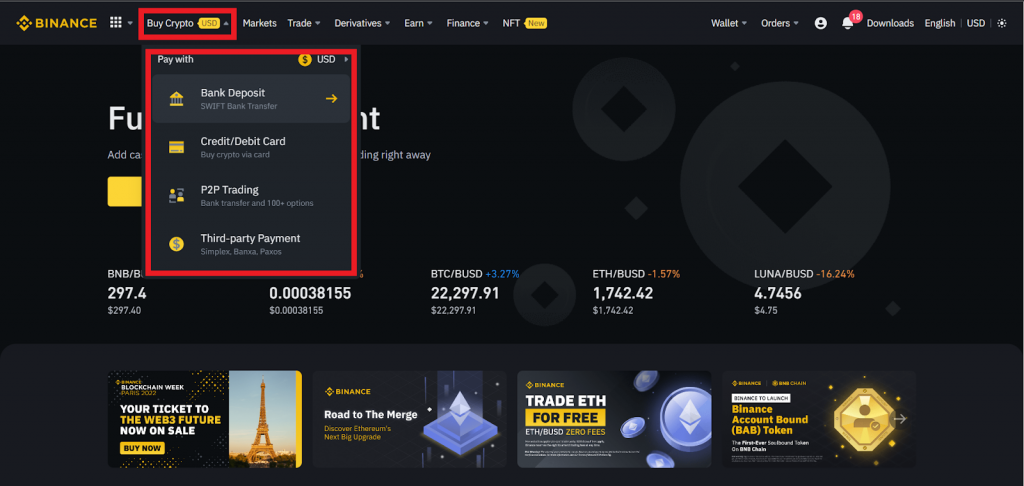

Deposit XRP tokens into your Binance account. You can either transfer XRP from another wallet or buy XRP directly on the Binance exchange.

To buy XRP on Binance, select Buy crypto on the Binance dashboard and choose your preferred means of payment – credit/debit card, bank deposit, P2P trading, and third-party system.

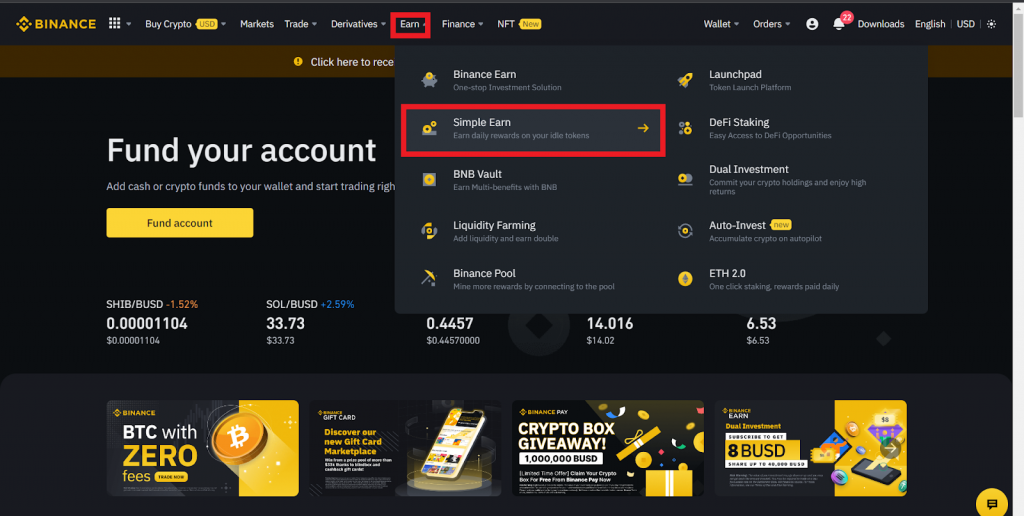

After acquiring some XRP, you can now begin the lending process. On the Binance dashboard, select Earn and click on Simple Earn.

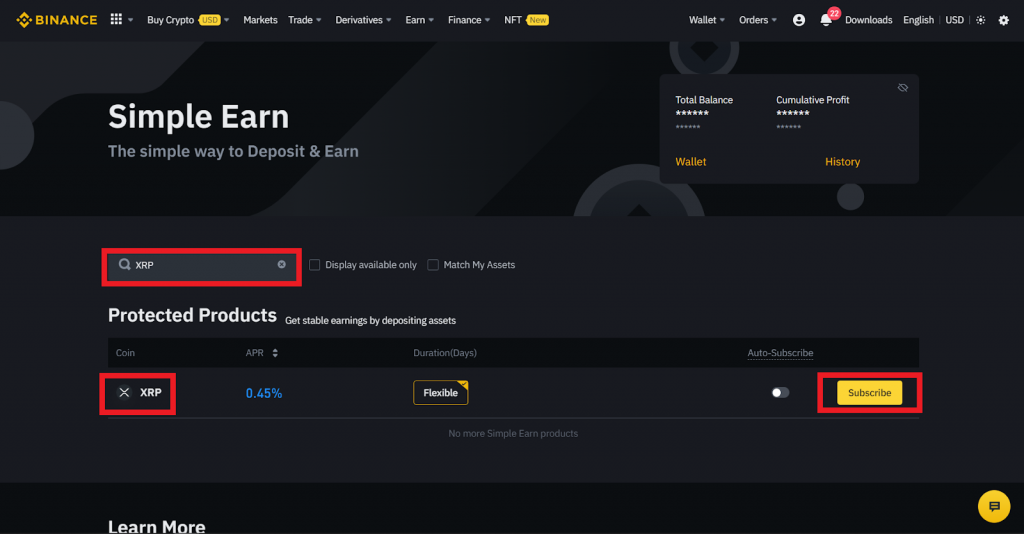

Search for XRP and click on Subscribe.

Enter the amount of XRP you want to subscribe to the savings plan.

Agree to Binance Simple Earn Service Agreement and click on Confirm.

What is Ripple (XRP)?

Ripple is a blockchain-based payment system built to facilitate financial transactions across the globe. It was launched in 2012 by co-founders Jed McCaleb and Chris Larsen.

Similar to the SWIFT payment system, Ripple is designed to connect banks, businesses, payment solutions, and digital exchanges, thus functioning as a real-time gross settlement (RTGS) system for money transfers, asset exchange, and remittance services around the world.

The Ripple network is built on the XRP Ledger (XRPL), a blockchain with a native cryptocurrency called ‘ripples’ or ‘XRP’. The XRP tokens are primarily designed to serve as a temporary settlement layer on the Ripple network, allowing financial institutions to execute cross-border transactions at high speed and low cost.

Currently, over 300 financial institutions in over 45 countries are part of the Ripple Network. Due to this massive customer base, the XRP token is one of the most popular cryptocurrencies, with a market cap value of $24 billion.

Like other digital coins, XRP can be bought for trading and investment purposes. On most platforms, it is also employed as a means of generating income for investors.

FAQs

What is XRP?

XRP is a digital asset that runs on the XRP ledger. It is commonly used within the Ripple payment system as an intermediate medium of exchange to facilitate cross-border transactions across the globe.

Is XRP a proof-of-stake coin?

No, XRP is not a proof-of-stake coin. It operates on the XRP ledger, a blockchain that utilises consensus protocol to verify transactions.

Can you stake XRP?

Technically no. Since XRP is not a proof-of-stake token, it cannot be staked. However, you can earn interest similar to how you would staking by lending your XRP to third parties.

Where can you buy XRP?

You can purchase XRP on over 60 cryptocurrency exchanges worldwide, including Binance, Coinbase, AAX, Nexo, and YouHolder.

Wrap Up

Lending XRP is an excellent way of earning passive income. With this guide, you have gained information on the most secure platforms that offer the best interest rates on your XRP tokens. However, before investing with any platform, ensure to consider its advantages alongside all risks involved.