A Twitter thread by a user @CirrusNFT has pointed out the fact that there is an imminent chance of a liquidation spiral on NFT lending protocol BendDAO.

BendDAO claims to be the first decentralized peer-to-pool based NFT liquidity protocol. Where users can deposit NFTs as collateral to borrow ETH.

Most NFTs on the protocol are collateralized at 30-40% of their floor value with an interest rate of 15-25% on the loan.

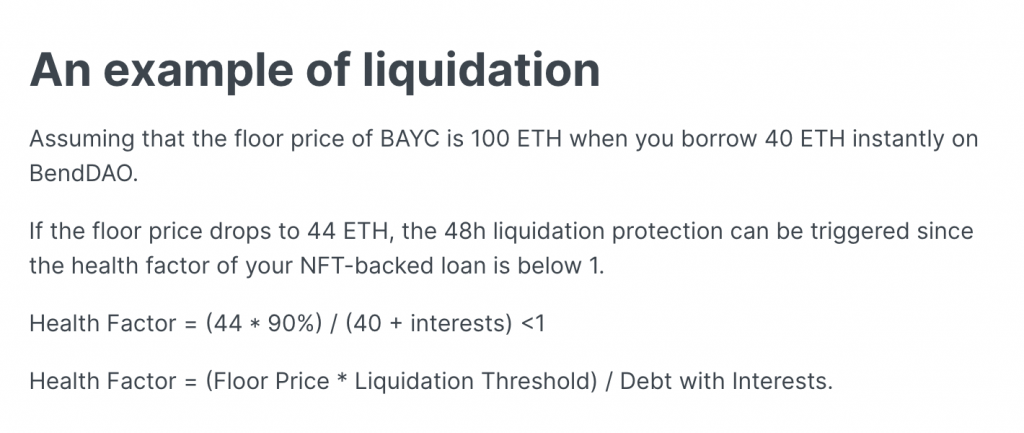

However, since NFTs are known to be volatile assets, if the floor price drops below a certain level (health factor) it triggers a liquidation process which gives the owner 48 hours to either repay the loan or the NFT gets sold to the highest bidder.

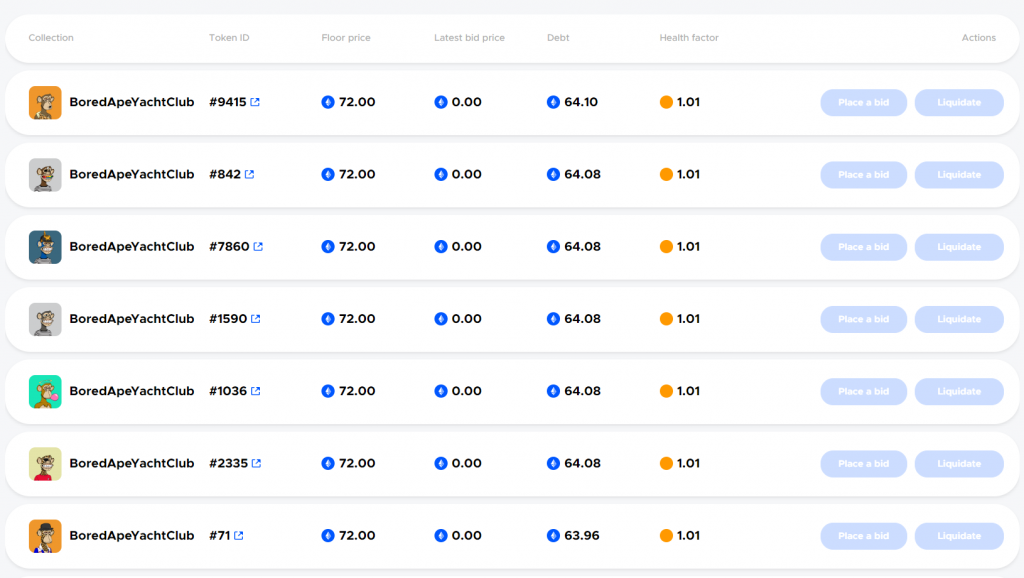

There are currently 120 Bored Apes being collateralized on BendDAO. 56 of them with a health factor below 1.2, which is up from 45 yesterday.

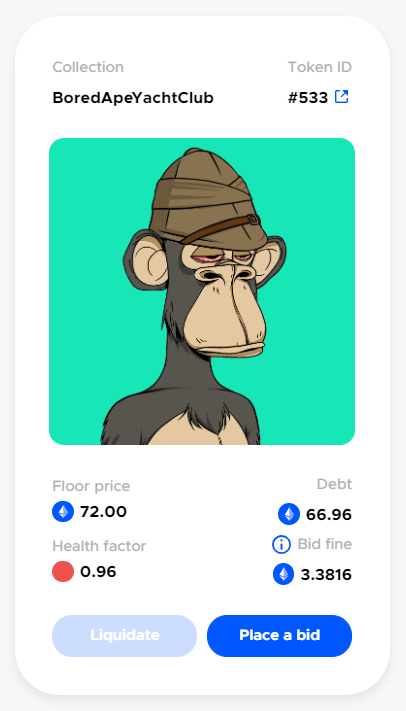

We’ve also seen the first of the liquidations take place with #533 going up for sale a few hours ago.

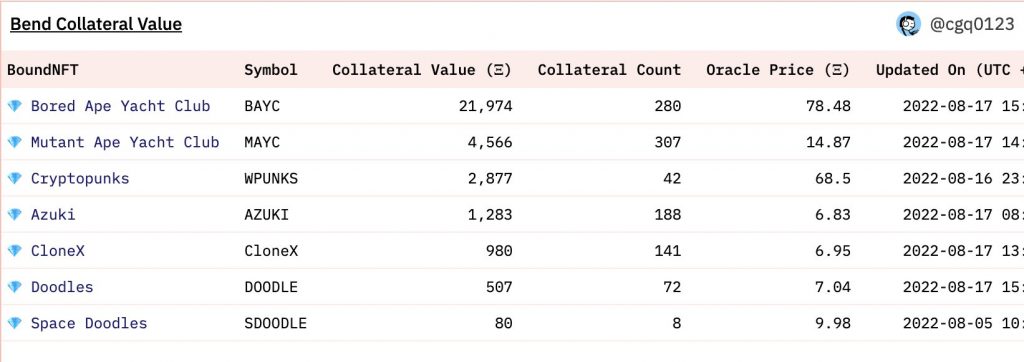

BAYC isn’t the only NFT collection at risk of mass liquidation. MAYC, Cryptopunks, Azuki, CloneX and Doodles are all among the list of collateralized NFTs on BendDAO.

We could soon be witnessing a domino effect of mass sell-off as protocols liquidate assets to save what is left of the loans.