What is an NFT floor price?

Simply put, a floor price is the lowest price for any NFT in a particular collection.

For example, as of this writing, the highly sought-after Bored Ape Yacht Club (BAYC) collection has a floor price of 78.6 ETH on OpenSea. This means that you will need to pay at least 78.6 ETH to go home with the cheapest Ape in the collection.

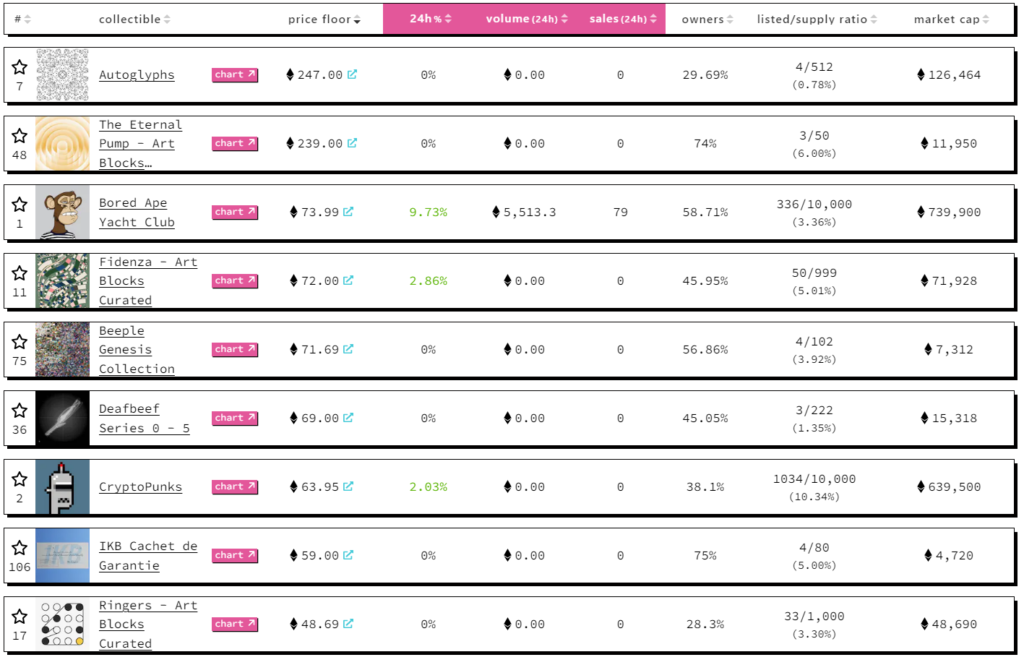

According to data from NFT Price Floor, the Autoglyphs collection has the highest floor price at 247 ETH. It is followed by the Eternal Pump and Fidenza collections in second and third place, respectively. Other notable collections on this list include Beeple’s Genesis collection, Yuga Labs’ Mutant Ape Yacht Club, and the well-known CryptoPunk collection.

Using floor price as a metric

NFT floor price is one of the most commonly-used metrics by NFT collectors and investors to evaluate a project. It gives the collector enough information about the value of a collection without delving too deeply into the analysis of in-collection factors like rarity and traits. In essence, NFT floor prices are calculated to provide a quick insight into the value of a given NFT collection.

The floor price can be utilized in assessing the popularity of an NFT collection and its perceived value over time. A continuous increase in a collection’s floor price largely reflects its popularity and growth over time. On the other hand, a fall in a collection’s floor price might indicate that the NFT project is beginning to lose traction.

It is worth noting that the floor price of an NFT collection can vary slightly from one marketplace to another. For example, the aforementioned BAYC collection, which boasts a floor price of 78.6 ETH on OpenSea, has a floor price of 73.3 ETH on Rarible – another top NFT marketplace.

How is an NFT’s floor price calculated?

The floor price of an NFT collection is determined by the NFT with the cheapest listing price in that collection. If no NFTs in a collection are listed for sale, then the price of the last sale will determine what the floor price is.

For instance, if the lowest cost to purchase an individual NFT in a random collection is 0.02 ETH, then 0.02 ETH will be the de facto floor price. In a case whereby the 0.02 ETH NFT is sold, the price of the next lowest-listed NFT will be the new floor price. So, if the next lowest-priced NFT is valued at 0.06 ETH, the collection’s floor price will increase to 0.06 ETH.

It is possible for someone to list an NFT below the collection’s floor price. In a situation like this, the collection’s floor price will decrease to the newly-listed NFT’s price.

NFT floor price tracker tools

Keeping up with multiple NFT projects can be a hectic task. But dealing with different floor prices of these NFTs can be far more challenging. Fortunately, certain tracker tools help ease the process of finding floor prices of NFT collections across multiple marketplaces.

Let’s dive into a few.

NFT Price Floor

NFT Price Floor is a data aggregator that tracks floor prices of NFTs. The platform includes metrics for volume, sales, listed ratios, top owners, and more. Each listed collection has a chart that shows the daily floor price and volume since the collection was released. You can also view individual floor prices for different traits in a single collection – which is great for finding NFTs with rare traits at a discounted price.

CryptoSlam

Cryptoslam is one of the most popular NFT analytics tools among investors. It features a page that displays minting activity and sales data for every NFT collection. On CryptoSlam, you can track all necessary information on various NFT collections, including the floor price, sales volume, rarity level, total number of owners, etc.

Nansen

Nansen is an analytics tool that provides an overview of the NFT market, including the sales volume, floor prices, trading activity, and trending projects. Besides its data tracking capabilities, this platform also features a ‘wash trading’ filter, which scans individual trades and helps detect suspicious trading activities on various NFT collections.

OpenSea

Widely regarded as the biggest marketplace for trading NFTs, OpenSea is also a platform for tracking data on different NFT collections. It offers real-time analysis of various NFTs across 8 blockchains. To view an NFT collection’s floor price, activity, and ranking, go to the ‘Stats’ page on the OpenSea website.

Flip Finance

Flip Finance is one of the best tools for finding market stats, ranking, and data on different NFT collections. This platform covers the floor prices, sales volume, and delistings of various NFT projects. Flip Finance boasts an easy-to-navigate interface, which eases the process of floor tracking.

WGMI

WGMI, recently acquired by Floor, is another excellent platform for tracking floor prices of various NFT collections. You can find other metrics with this tool, such as floor volume and sales volume. The best part is WGMI provides real-time analysis and data on different NFTs over a period of time.

Is floor price a reliable metric?

Indeed, the floor price is often a good means of evaluating the popularity and perceived value of an NFT collection. But, is it a reliable metric for choosing the most promising project to invest in?

The most candid answer is that a floor price doesn’t always reflect the true value of an NFT collection. While it may provide insight into the entry point into a collection, the floor price can be easily manipulated to benefit the holders of the NFT. One of the ways floor prices can be manipulated is by ‘sweeping the floor’.

‘Sweeping the floor’, in the NFT space, is a phenomenon when someone purchases all available NFTs at the floor price, causing it to raise suddenly. While not always intentional, this is a common way of manipulating the floor price and tricking buyers into investing in low-potential projects.

Another way of NFT floor price manipulation is wash trading, which involves a group of NFT owners selling their assets for exorbitant prices. In wash trading, an individual with enough NFTs or a group of NFT owners can artificially inflate the floor price by listing their NFTs on a marketplace for outrageous prices and then purchasing the assets amongst themselves.

These methods are used to intentionally mislead prospective NFT investors into believing that the new floor price represents the true market value of an NFT collection. When in fact, this new price is not due to natural demand.

Wrap Up

The NFT floor price is an important metric that can be used to determine the potential of an NFT project. However, it is not a surefire way of deducing the fair value of a particular NFT collection. Hence, it is essential you do your due diligence and conduct proper research before investing in any NFT project.