While the TVL of the most popular chains took a massive hit recently because of the recent macro events, there’s one chain that stands out. I’m speaking about Optimism, which saw a 70% TVL increase in the last 30 days.

In this article, I’ll analyze the recipe for success used by Optimism to continue growing in popularity and the top protocols native to Optimism.

What is Optimism?

Optimism is an Ethereum Layer 2 scaling solution and is among the most popular of its kind. Optimism puts transactions in batches and posts them on the Ethereum mainnet after compressing them in order to reduce the gas fees.

The reason behind the Optimism TVL spike

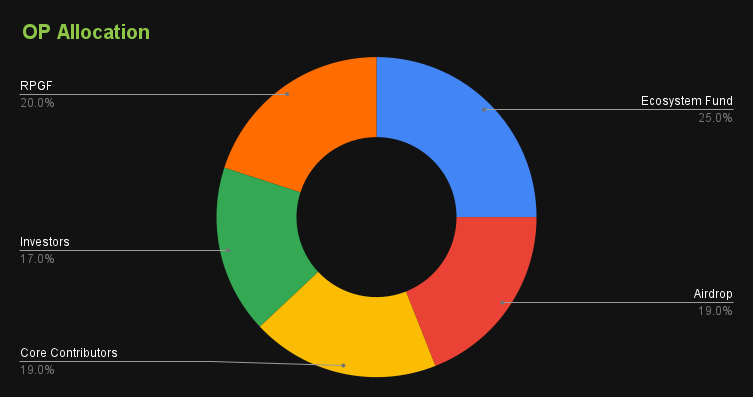

On 31 May, the project team announced the launch of $OP token. 5% of its supply was airdropped to the users of the Optimism chain, and 25% of $OP supply was allocated for Ecosystem Funding.

After popular applications built on top of Optimism including Velodrome, the biggest DEX on Optimism, started to distribute the grants received in form of $OP tokens for building on Optimism to the users of their platform, the Optimism TVL increased to $555M from a $274M low in July.

But the real spike in TVL was seen after 4 August, when AAVE incentivizes started to be distributed to the lenders and the borrowers that use AAVE on Optimism. In just a week from the moment when $OP rewards to AAVE users started to be distributed, the chain’s TVL hit an all-time high of $1.16b.

Top protocols built on Optimism

1. Velodrome

Velodrome is the biggest DEX on Optimism right now. It is a relatively new AMM based on Solidly, a revolutionary AMM that was launched by a notorious developer called Andre Conje at the beginning of this year. It allows $VELO token holders to vote on the pools where they allocate emissions.

In exchange for their votes, $VELO stakers get the fees generated from the pools they voted for. In this way, Velodrome is incentivizing volume rather than fees in contrast to Curve Finance.

2. Lyra

Lyra is a decentralized options protocol native to Optimism. It has a user-friendly interface and uses Black Scholes model to automatically establish the price of options.

3. Kwenta

Kwenta is a decentralized derivatives trading platform. It allows trades with 0 slippage and instant confirmation with a variety of digital and traditional assets.

An optimistic future

Even if the number of Optimism-native applications is relatively low right now, the ecosystem fund composed of 25% of the $OP token supply started to attract a lot of new projects recently.

It should be interesting to see what the future holds for Optimism.