Ribbon Finance, the second biggest options protocol by TVL according to DefiLlama, has recently launched a new major product category called “Ribbon Earn”.

The goal of this product category is to attract more users to use the protocol’s vaults by offering principal protection and not exposing users’ funds to unnecessary risks.

Ribbon Finance

Ribbon Finance is a protocol that helps users access DeFi structured products. Structured products are essentially financial instrumentals that utilize derivatives to generate yield with a relatively low risk-reward ratio.

The most popular Ribbon product is Theta Vault. Theta vaults are yield-focused strategies that earn yield on their deposits by running an automated options selling strategy every week.

Ribbon Earn

While Theta Vaults can generate high APYs for depositors when the market isn’t too volatile, depositors may also lose money if the options that Ribbon is selling are exercised.

Ribbon Earn solves this problem by lending the deposited funds on external protocols and using a part of the yield generated to buy exotic options.

The first vault of this kind allows only USDC deposits.

The first Ribbon Earn strategy lets depositors get exposure to short-term volatility of $ETH.

In the worst-case scenario where all the exotic options purchased by the vault expire worthless, the depositors will still have their initial deposit and 4% APR rewards generated through lending.

The Strategy Efficiency

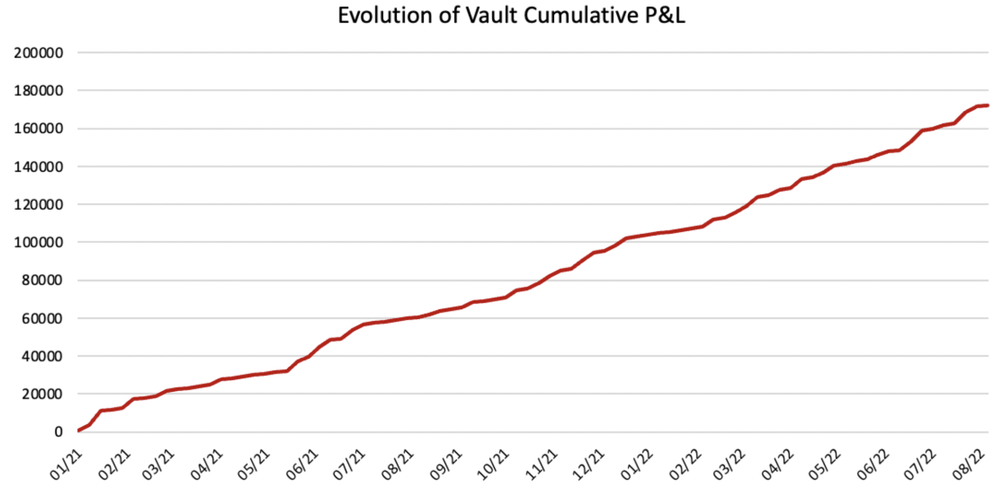

The team at Ribbon Finance stated that they’ve run a backtest of how the vault would have performed since January 2021. The results show that depositors would have earned nearly 10.3% APY rewards, corresponding to a 17% total yield.

As Ribbon Earn generates rewards through lending, the main risk to which depositors are exposed is the smart contract risk.

The vault was launched a few days ago and has quickly reached its $2.5M capacity. Other similar vaults that will allow users to deposit $BTC and $ETH as collateral are expected to launch in the upcoming months.