Uniswap is the most popular decentralized exchanges (DEX) and is the go-to exchange for majority of DeFi users. It has the largest daily trading volume of $1.21 billion and the second-largest TVL (Total Value Locked) of $3.8 billion among all DEXs, according to data by DefiLlama.

With a fixed transaction fee of 0.3%, Uniswap allows investors to exchange over 800 tokens across six chains: Ethereum, Optimism, Arbitrum, Polygon, Optimism, and Celo.

Like most DEXs, Uniswap also offers means for investors to earn a passive income with features including staking, yield farming, and liquidity mining. In addition, Uniswap serves as a platform for developers to build and deploy blockchain projects.

However, while Uniswap may be the biggest name in the DEX landscape, several other DEXs rival it in functionality and performance while offering users lower fees. Some of these platforms even offer other services that are unavailable on the Uniswap DEX that you may not be aware of.

In this article, we we’ll go over the best Uniswap alternatives, their features, services, and usability.

Below is an overview of our top picks for the best Uniswap alternative:

- 1. Sushiswap

- 2. PancakeSwap

- 3. KyberSwap

- 4. Curve Finance

- 5. Trader Joe

- 6. Orca

- 7. THORSwap

- 8. QuickSwap

- 9. Osmosis

- 10. Velodrome Finance

- 11. SpookySwap

- What is a decentralized exchange?

- What is the best Uniswap alternative?

- Is SushiSwap cheaper than Uniswap?

- Is PancakeSwap better than Uniswap?

- Is Uniswap still good?

Best Uniswap Alternatives

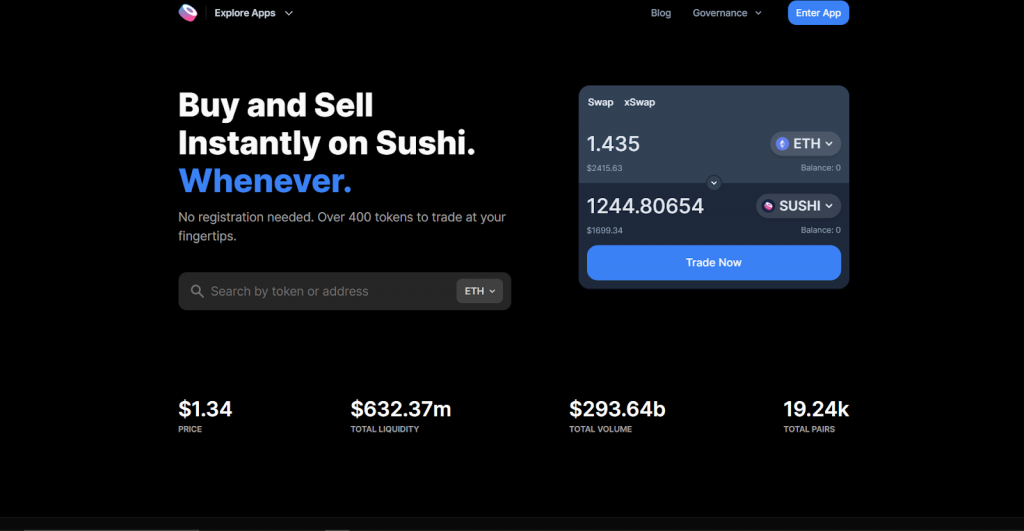

1. Sushiswap

SushiSwap was launched in September 2020 by two anonymous developers known as 0xMaki and Chef Nomi. It is a fork of Uniswap; thus, both projects share a similar appearance and architecture.

SushiSwap is one of the most popular DeFi protocols, with a TVL of $477.08 million. It operates as a multi-chain DEX, with deployment on over 16 blockchains including Ethereum, Polygon, Fantom, BNB Chain, Harmony, and Avalanche.

Like Uniswap, SushiSwap operates as an “Automated Market Maker” using a mathematical algorithm to determine the prices of the assets in its liquidity pool. That said, liquidity providers (LPs) on SushiSwap are rewarded with SUSHI, an ERC-20 token, which also serves as the governance token of the protocol.

Unlike most DEXs which offer only a token swap mechanism and a liquidity pool farming feature, SushiSwap provides users with additional services such as lending and leverage (Kashi), staking (Sushi Bar), token vault (BentoBox), and an IDO launchpad (MISO).

2. PancakeSwap

PancakeSwap is the most prominent decentralized exchange on the Binance Smart Chain. Similar to Sushiswap, it was also forked from Uniswap on September 2020. PancakeSwap currently sits as the third-largest DEX with a TVL of $2.43 billion. Asides from the BNB Chain, PancakeSwap is also deployed to Ethereum and Aptos chains.

Compared to Uniswap, PancakeSwap offers a plethora of features that make it one of the few DEXs with services that rival those offered by some centralized exchanges. Asides from the obvious token swaps, other features include yield farming, perpetual futures trading, syrup pools (staking), Initial Farm Offering (IFO), NFTs, and lotteries.

Like most DEXs, PankcakeSwap is a permissionless, meaning any token can be listed on the exchange, provided a liquidity pool is created for it. While this is beneficial as it is all-inclusive, it also allows for the operations of scam projects (which everyone should be cautious of).

PancakeSwap is governed by its native token – CAKE – that allows its holders to create and vote on proposals. PancakeSwap is known to be a highly secured exchange with no history of hacks or other forms of cyber attacks.

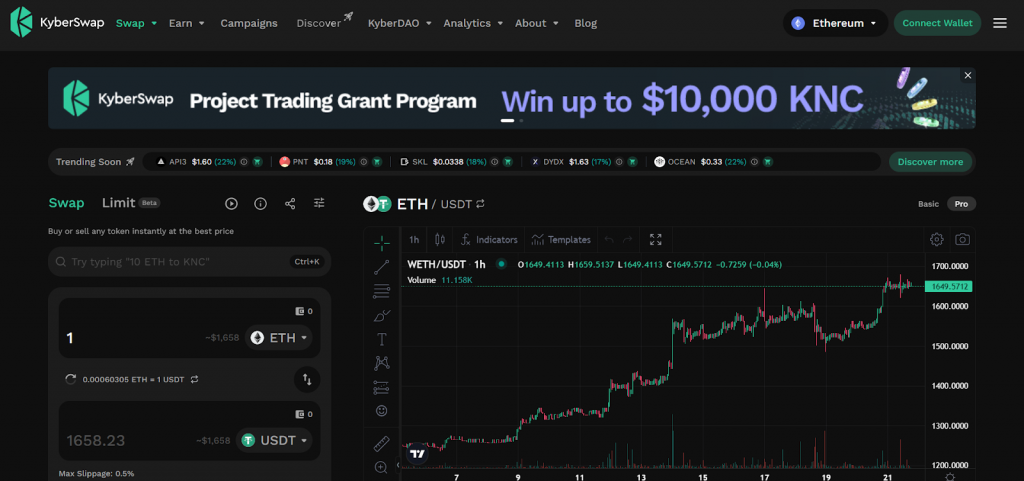

3. KyberSwap

KyberSwap is a multi-chain DEX aggregator that allows users to swap tokens and earn across its 13 supported blockchains, including Ethereum, Polygon, BNB Chain, Fantom, etc. It is the flagship product of KyberNetwork, a blockchain protocol designed with the goal of making DeFi trading efficient and more accessible.

Being a DEX aggregator, KyberSwap is able to provide users with liquidity not only from its pools but also from pools on the 70+ DEXs operating on all its supported networks. Due to this mode of operation, KyberSwap ensures users get the best available rates on their swap orders.

KyberSwap is also equipped with various features that help improve the earnings of liquidity providers on its platform. One such feature is its Classic Dynamic Market Maker protocol, a variant of the conventional AMM model that automatically modifies the LP fees based on market volatility. Therefore, liquidity providers earn more in a volatile market and less in a stable market.

Other features on KyberSwap include the KyberSwap Classic’s Amplification protocol, which allows a liquidity pool to show higher levels of liquidity without adding more tokens, and the KyberSwap Elastic protocol, a tick-based AMM that is behind the protocol’s concentrated liquidity, auto compoundability and multiple fee tiers.

KyberSwap protocol is governed by holders of its native cryptocurrency – KNC. At the time of writing, the KNC token sells for $0.84, and its circulating supply is capped at 164.89 million.

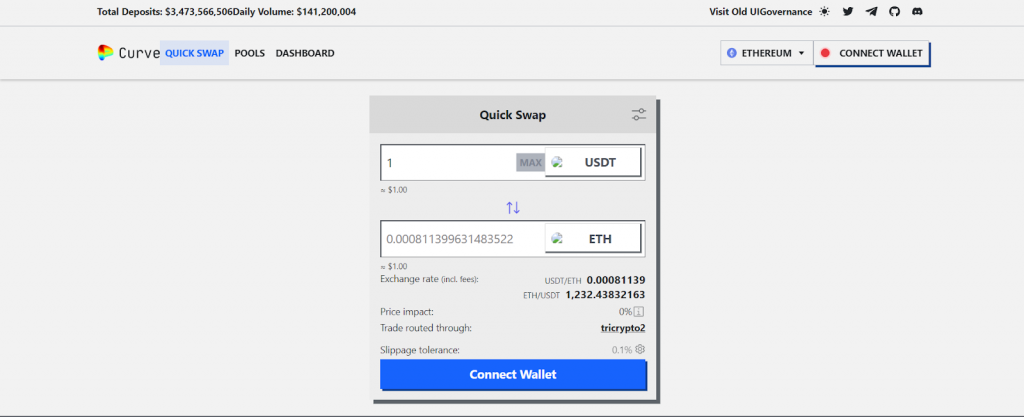

4. Curve Finance

Curve Finance was launched in 2020 and is the biggest DEX based on TVL, with the total locked assets worth $4.55 billion. Similar to Uniswap, it is an automated market maker; however, Curve Finance is unique as its operations are aimed at the seamless and efficient exchange of only stable assets.

These assets include stablecoins such as USDC, BUSD, and USDT and tokenized versions of assets like WBTC and WETH. Using a unique mathematical formula different from the standard AMM model, Curve Finance ensures that users are able to pay low fees (0.04% – 0.4%) and experience less slippage when conducting transactions with these stable assets.

Like all DEXs, liquidity providers on Curve earn a portion of the trading fees from their respective pools. However, in addition to this, certain pools on Curve allow LPs to earn more interest by deploying their capital on lending protocols such as Aave and Compound.

Adding to this, CRV, the governance token of Curve Finance, is known for its high level of liquidity; thus, it is commonly deployed as a yield-farming tool. This has led to other DeFi Projects, such as Yearn Finance incorporating the CRV token into their ecosystem.

Curve Finance is available on multiple chains, including Ethereum, Arbitrum, Polygon, Optimism, Fantom, Avalanche, and xDai.

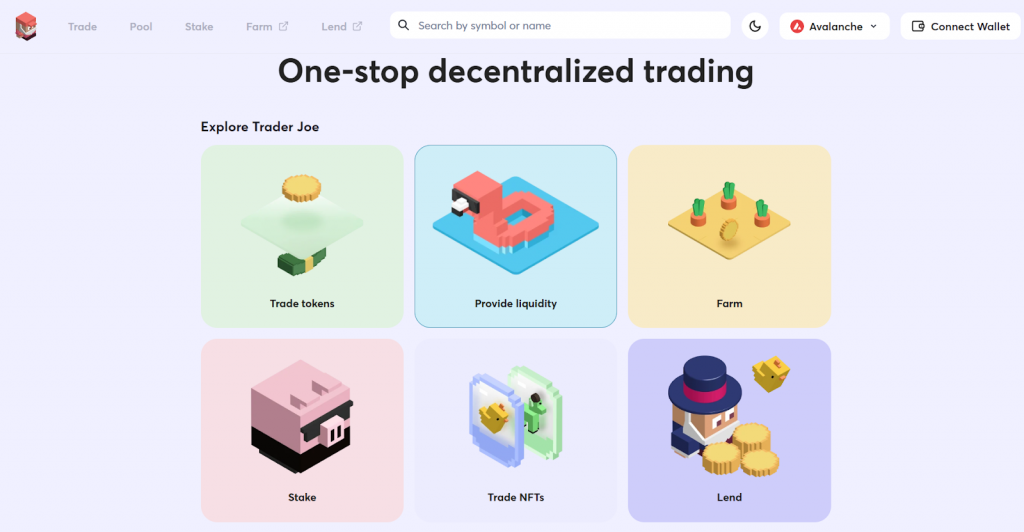

5. Trader Joe

Trader Joe is a DEX that runs on the Avalanche blockchain. It was launched in June 2021 and has grown tremendously, becoming the biggest DEX in the Avalanche ecosystem and the 9th biggest DEX across all chains with a TVL of $65.8 million.

Trader Joe was initially deployed as a platform for token exchange only. However, it has been continuously modified over time to provide the “one-stop-shop” experience for all DeFi transactions. With Trader Joe, users now access staking, farming, NFTs, and lending.

Trader JOE is popular for its friendly user interface that allows users to easily navigate its multiple features. It also offers a low trading fee of just 0.3% on all transactions across all fees.

The native cryptocurrency of Trader Joe is known as JOE which serves as the reward to the liquidity providers on the protocol. The JOE token is also used for staking, allowing traders to earn as high as 5% APY on their tokens. At the time of writing, JOE is valued at $0.19 per token.

6. Orca

Orca is a Solana-based DEX that offers users a secure and easy way of swapping tokens at high speed and low cost. Orca boasts of fees as low as $0.00001 and transaction times of less than one second.

Like Uniswap, the Orca DEX offers traders ways of earning interest on their tokens via liquidity mining and yield farming. The exchange also provides a variety of financial tools to aid traders. For example, there is an in-built price comparison mechanism with top crypto site CoinGecko.

Traders also have access to a fair price indicator that ensures the difference between the rate of a token on the exchange and its listed market rate on Coingecko isn’t more than 1%. Orca’s native token is ORCA, which has a circulating supply of over 35 million and can be staked for extra rewards. At the time of writing, ORCA is valued at $1.02 per unit.

7. THORSwap

THORSwap is the native decentralized exchange of THORchain, a cross-chain liquidity platform that enables asset swap between eight major blockchains. Those of which include Ethereum, Bitcoin, Dogecoin, CosmosHub, Litecoin, BNB Chain, Avalanche, and Bitcoin Cash.

THORSwap operates as a DEX aggregator connecting liquidity across these eight blockchains and pulling price comparisons between the several DEXs and aggregators which run on these chains to provide its users with the best possible prices for their swap orders.

In terms of trading fees, THORSwap stands out as one of the few DEXs that offer fees as low as 0%, depending on the trade. It is also known for its excellent community support, which extends to all members, including investors, liquidity providers, and traders.

THORSwap’s native token THOR token acts as the governance token of the protocol. THOR is also used to fund projects targeted at the growth of the THORSwap protocol and is largely community owned.

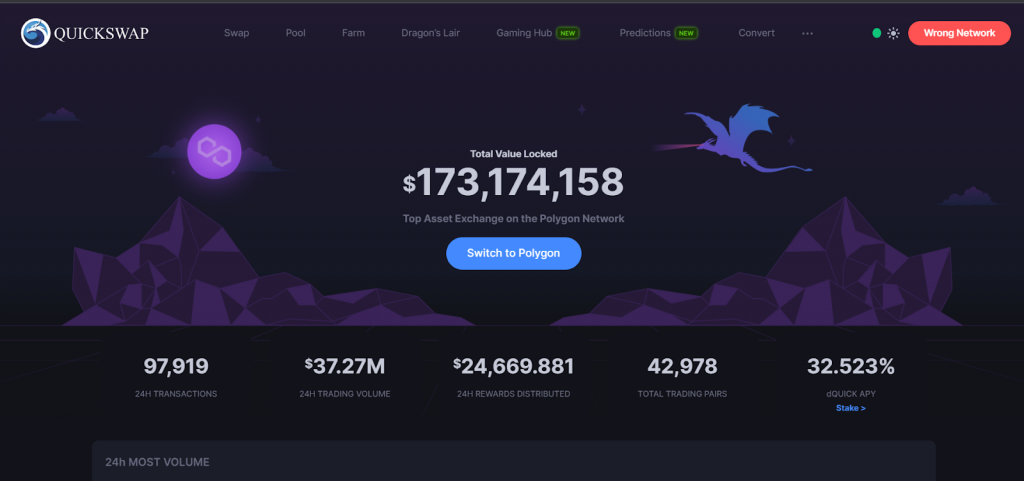

8. QuickSwap

QuickSwap is one of the many new additions to the DeFi space. It is a decentralized exchange that runs on the Polygon Network, an Ethereum-layer 2 scaling solution, making it stand out among competitors deployed directly on the Ethereum Mainnet.

Due to its underlying layer-2 platform, QuickSwap is immune to network congestion and high gas fees, thus, eliminating the excessive costs associated with DEX transactions. Using QuickSwap, traders can process thousands of transactions involving ERC-20 assets with little to no gas fees and at lightning speed.

Furthermore, QuickSwap also presents investors with highly lucrative earning opportunities. Similar to most DEXs, it utilizes a community-based governance structure that consists of only holders of its native token – QUICK.

The QUICK token can also be used for staking, as well as liquidity mining. As of the time of writing, 1 QUICK token is valued at $50.36, with the total market cap of the assets set at $25 million.

9. Osmosis

Launched in 2021, Osmosis is a multi-chain AMM DEX built using the Cosmos SDK. It also functions as a smart-contract platform that allows developers to quickly build and deploy customized AMMs with their own liquidity pools.

Osmosis is the first and biggest decentralized exchange in the Cosmos ecosystem. It leverages the power of the Inter Blockchain Communication (IBC) protocol to enable the swap of several assets in the Cosmos Network.

Other services available on the Osmosis include staking, airdrops, and liquidity mining. One unique feature of Osmosis is the ability to create customized liquidity pools with a flexible fee structure, thus allowing investors to optimize their earnings from trading fees generated.

Osmosis also provides self-governing liquidity pools that allow users to vote on changes to a specific pool’s protocol. Osmosis’s main cryptocurrency is OSMO and is used for governance, staking, liquidity mining rewards, and payment of transaction fees.

10. Velodrome Finance

Velodrome Finance is an AMM protocol that serves as the main liquidity layer of the Optimism ecosystem. It was launched in June 2022 with the aim of incentivizing liquidity for DeFi protocols.

Velodrome Finance is based on the infrastructural model of Solidly, a Fantom-based DEX with similar goals. However, Velodrome introduces several improvements in countering the issues associated with liquidity incentivization.

Some of these improvements include reduction in the costs of Pool 2 emissions and the introduction of a White-Glove support feature which provided partners and stakeholders of the project with the needed support following its launch.

Velodrome Finance is known to operate with two types of liquidity pools. Stable Pools for assets with little volatility, and Variable Pools for assets with high volatility.

The native cryptocurrency of Velodrome Finance is VELO. At the time of writing, VELO is trading at $0.038, with its market cap currently at $5.3 million.

11. SpookySwap

SpookySwap is a decentralized exchange and automated market maker that runs on the Fantom Opera Network. Its functions include essential DEX services such as token swaps, staking, and yield farming.

SpookySwap allows users to swap tokens between different blockchains and Fantom using its in-built bridge feature. Its supported chains include Avalanche, Ethereum, Polygon, and Arbitrum – to mention a few.

Leveraging the infrastructure of the Fantom network, SpookySwap allows traders to process their transactions with a 0.20% network fee (paid in FTM), which is quite attractive compared to most DEXs.

SpookSwap also allows traders to boost their earnings on the platform by minting its native NFT – Magicats.

The native token of the DEX is BOO, with its main utility being protocol governance.

Frequently Asked Questions

What is a decentralized exchange?

A decentralized exchange (DEX) is a DeFi protocol built to enable the direct exchange of tokens between investors without the need for intermediaries or middlemen. DEXs are usually designed to be safe, permissionless and non-custodial protocols.

What is the best Uniswap alternative?

The best Uniswap alternatives include PancakeSwap, SushiSwap, Curve Finance, KyberSwap, and THORSwap – to mention a few.

Is SushiSwap cheaper than Uniswap?

The fee for swapping on SushiSwap and Uniswap is the same. Both exchanges have a 0.3% fee for swapping tokens.

Is PancakeSwap better than Uniswap?

Depending on what chain you’re using, PancakeSwap may be the better choice. For token swaps on the Binance Smart Chain, PancakeSwap is the clear winner.

Is Uniswap still good?

Yes, without a doubt Uniswap is still a great decentralized exchange and remains the top choice for DeFi enthusiasts.

Conclusion

It goes without saying that Uniswap is the leading decentralized exchange in the crypto space.

However, for investors who seek additional features or better market conditions in terms of fees or speed, this article provides a list of the best alternatives to Uniswap.

With that said, investors are advised to interact with these DEXs using the necessary caution, taking into account all possible risks.