Crypto staking is extremely common on some of the most popular cryptocurrency exchanges. If you’re dipping your toe into the world of crypto or looking into how it works, it’s very likely that you’ve stumbled upon some mention of staking.

Crypto staking, in its most basic form, is a way of earning rewards for holding specific types of cryptocurrency or tokens.

Staking is possible with cryptocurrencies that use a proof-of-staking consensus mechanism.

This includes (but is not limited to):

- Ethereum 2.0 (ETH2)

- Terra (LUNA)

- Polkadot (DOT)

- Avalanche (AVAX)

- Tezos (XTZ)

- Cosmos (ATOM)

Proof-of-stake (POS) was originally created as an alternative to proof-of-work (POW), the original consensus mechanism designed to add new blocks to the blockchain, often known as mining. Proof-of-stake is seen as a lesser risk to the security of the network because of verification. It also uses much less processing power than POW.

How does Crypto Staking Work?

In most cases, when you stake some of your held crypto, you will earn a reward (often based on percentage). The most common way to stake the crypto that you hold in your wallet is in something called ‘staking pools’.

The probability of validating a new block that contributes to the blockchain is determined by the size of the stake. Stakers will receive network reward fees in relation to the stake size. Staking systems can be much more cost-effective and energy-efficient than other validation methods like mining.

What are the Cons of Crypto Staking?

Of course, no type of investment is without its own risks. Crypto staking is no exception.

Cryptocurrencies are relatively new and therefore can be volatile. It’s not uncommon for cryptocurrencies to see dips just as regularly as they see rises. Staking is, ideally, for those who plan to hold their assets as a longer-term investment (regardless of the dips and peaks).

Some currencies will have a minimum staking period in which you will not be able to withdraw your stake. Similarly, some staking pools will take time to return your stake, due to the wait for the blockchain.

Although it is slim, there is also a chance that a staking pool could get hacked, and due to the lack of governance and available insurance, any losses would be unlikely to be recouped.

Where are the Best Places to Stake Crypto?

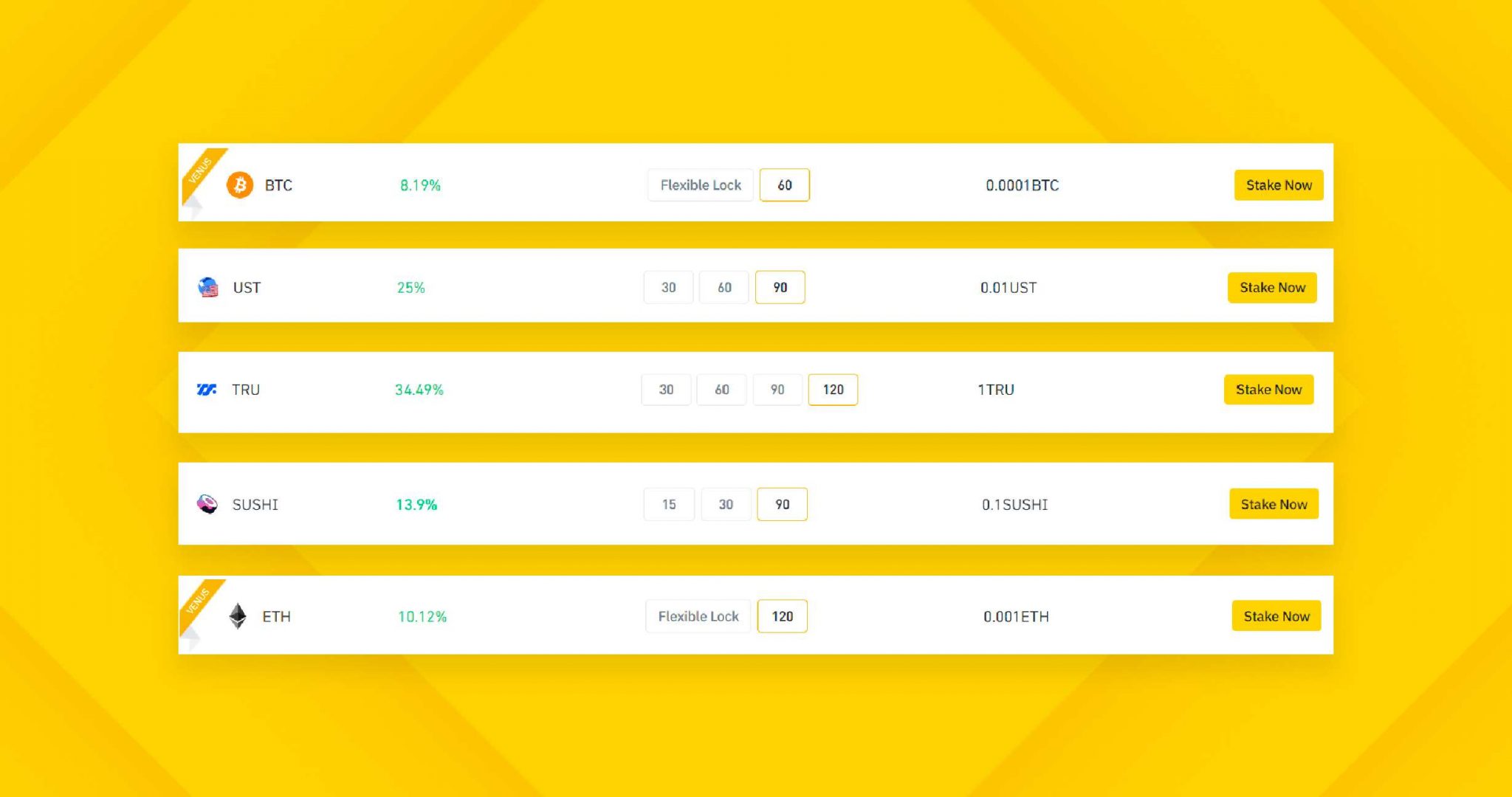

Staking is commonplace on many exchange sites and apps. Some exchanges will specialise in particular staking pools or coins, so analysing your options and the best fees is always beneficial – particularly if you’re fairly new to investing.

Here are some of the best exchanges to stake crypto:

| Exchange | Supported Cryptos |

|---|---|

| Binance | BUSD, ETH, BTC, BNB, etc. |

| Coinbase | ETH, XTZ, ATOM, DAI, USDC, etc. |

| Huobi Global | LUNA, SOL, ZIL, ELF, XPRT, etc. |

| Gate.io | USDT, ETH, BTC, etc. |

| KuCoin | ONE, XTZ, ATOM, ZIL, ONT, etc. |

| Kraken | ETH, SOL, FLOW, DOT, etc. |

Is Crypto Staking Worth it?

Staking is most profitable for those focused on long term gains rather than short term wins. You will be able to compare various staking pools to find the best rewards and lowest fees for the coin you’d like to stake – and this will help you to maximise profits.