More and more people have recently started to pay attention to protocols that are distributing rewards to stakeholders based on the revenue generated.

As we are in a bear market, investors realized that the huge inflationary incentives offered by numerous projects are diluting the price of their tokens without providing long-term benefits.

But how did this new trend emerge? What does qualify a DApp as a Real Yield protocol?

The narrative inception

After DeFi 2.0 protocols started to collapse one by one, the need for a new sustainable economic model has become evident.

DeFi 2.0. was one of the main trends of 2021 bull market, where projects used to pay 5-digit APYs rewards for staking their token.

Obviously, the DeFi 2.0. projects didn’t survive a long time, and once the crypto market started to show weakness, their tokens went to all-time lows.

You’ll be surprised to find out that a fork of Olympus DAO, the most popular DeFi 2.0 protocol that offered huge inflationary staking rewards, became a pillar of the Real Yield narrative by starting to generate sustainable rewards for stakers without token emissions.

The project I’m talking about is called Umami Finance.

When the signs of a possible bear market became clear, the team decided to completely cut off the emissions and use the treasury funds(nearly $5M at this moment) to generate sustainable yield by providing liquidity on other protocols, starting leaning into the real yield trend.

But the project team didn’t stop here.

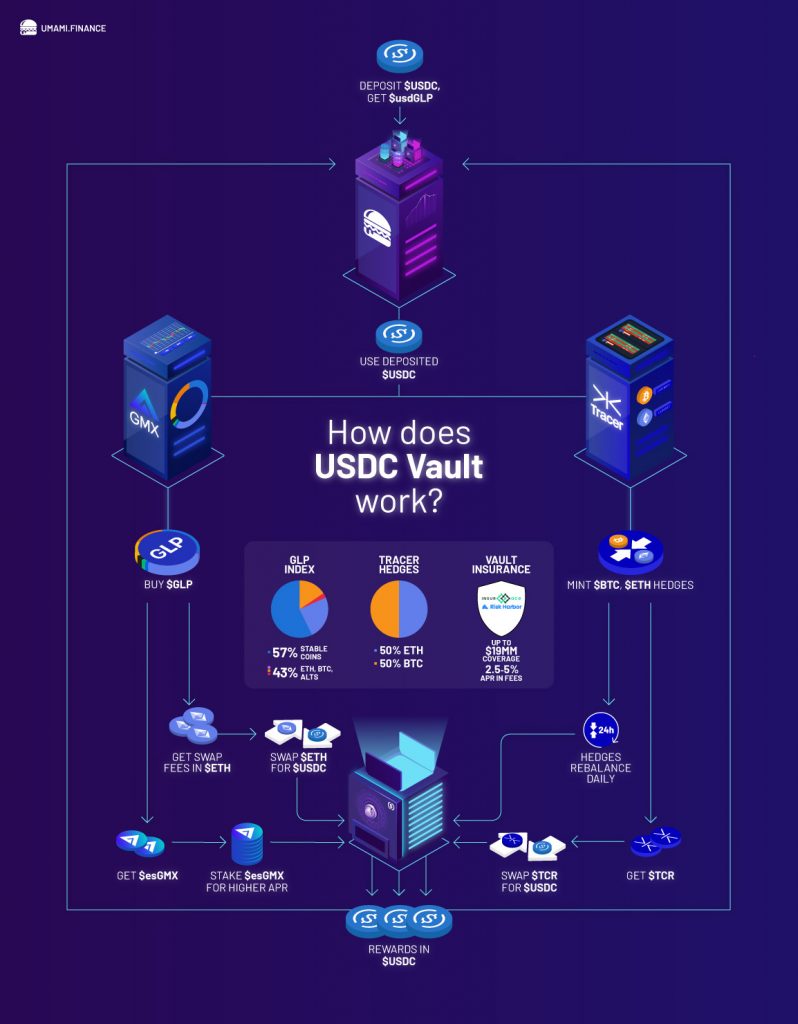

In May, they announced that they are working on a USDC Vault, the first vault capable to generate 20% APR rewards for depositors without requiring token emissions.

This product went live at the beginning of this month and uses a complex delta-neutral strategy to offer these impressive rewards.

Real Yield eligibility criteria

Projects that qualify for this new DeFi standard don’t require inflationary emissions in order to remain relevant over time.

The tokens of the majority of real yield projects don’t have all of their supply in circulation because of the large vesting schedules for early investors and the team.

That’s not necessarily a big issue, but if the token emissions are used to pay the users of the protocol products this should be considered a red flag.

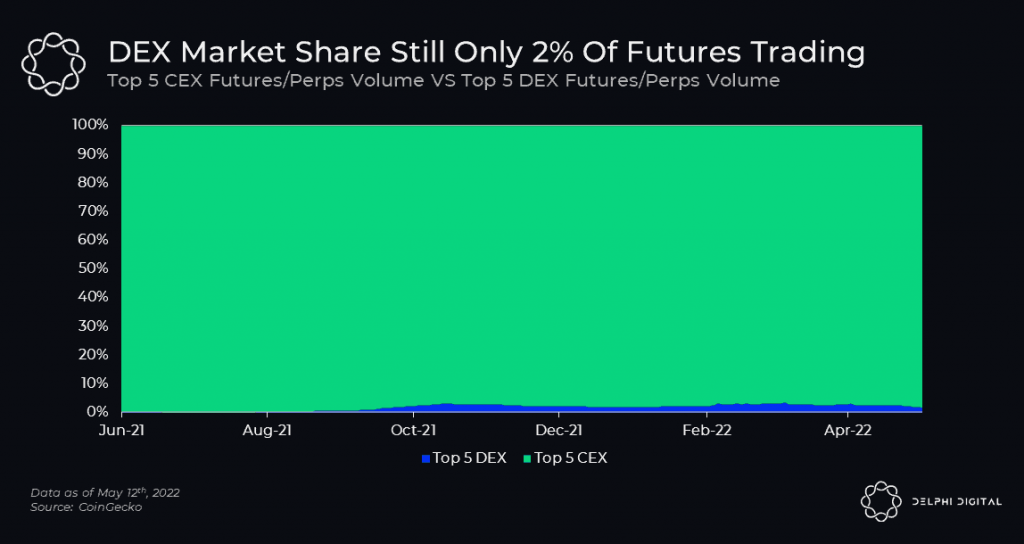

Another thing that I’m watching for in a real yield protocol is the demand for similar products.

For example, the DEX market share of futures trading is only 2% right now according to Delphi Digital. This means that the potential of perpetual DEXes is huge.

Considering that the projects that joined this narrative seek to achieve long-term sustainability, I’d expect real yield projects to become the pillars of the next bull market.