Key Takeaways

- DeFiLlama is a decentralized finance analytics dashboard

- DeFiLlama provides data on different decentralized protocols like Uniswap and Compound

- DeFiLlama uses metrics such as total value locked (TVL), volume, and liquidations

When you heard about DeFi Llama, you probably asked “what is DeFi Llama?.” You did wonder what decentralized finance has to do with a longnecked animal in South America? Well, clear that thought, as DeFi Llama is a completely different concept.

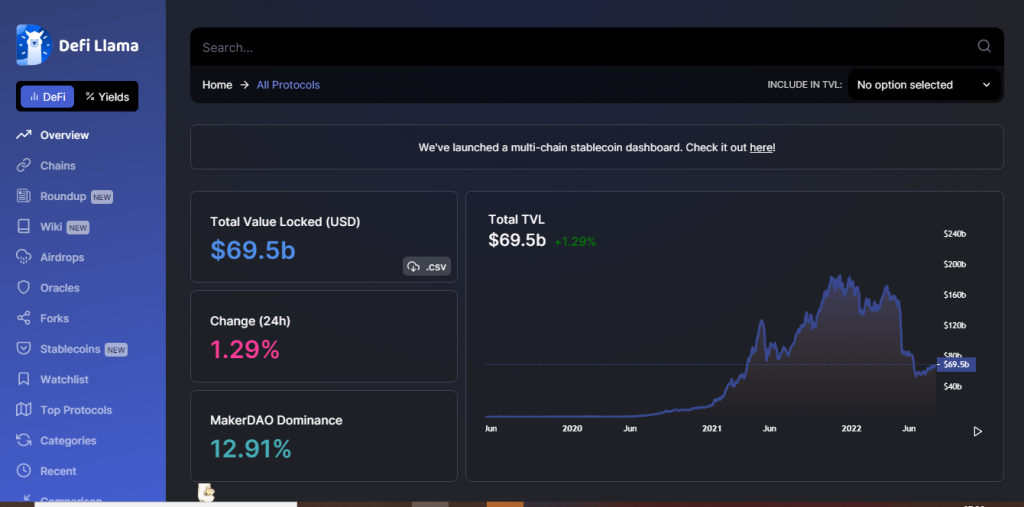

DeFi Llama is a multi-chain decentralized finance analytics dashboard by providing real time data and metrics of various DeFi projects in the market.

DeFi Llama was created to track data, such as Total Value Locked (TVL), from over 1750 DeFi protocols as of 2022.

In this article, you will learn about DeFi Llama, its features, and how it works including the benefits of using such a powerful tool.

Pcmag aptly refers to DeFi Llama as “a website that shows the current price levels of DeFi cryptocurrencies.” It regularly updates the DeFi protocols, the blockchains they are built on, the total value locked (TVL) and other relevant information on DeFi protocols, e.g. airdrops, oracles and forks.

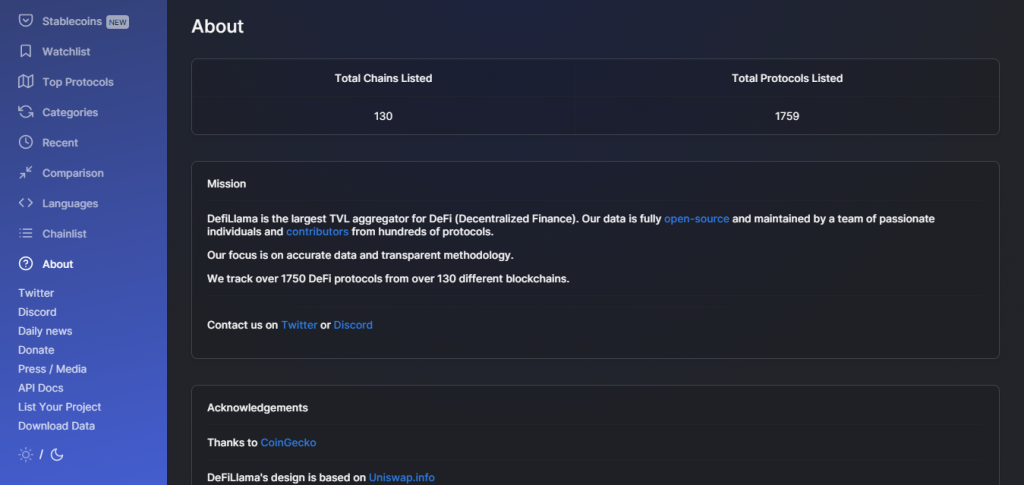

The DeFi Llama website also acquaints us with other facts:

Having known some facts about the DeFi Llama platform, let us consider some of its features. The unique features of DeFi Llama make it a go-to platform for investors and individuals who want to stay updated on DeFi protocols.

The platform features a menu of options/tabs on the left and a dashboard on the right. The dashboard is different for the various options. However, one common feature on most tabs is the total value locked (TVL) on the top dashboard page and individual TVLs of different protocols below. They also come with search and filter options.

Let’s go through some of the features of the dashboard.

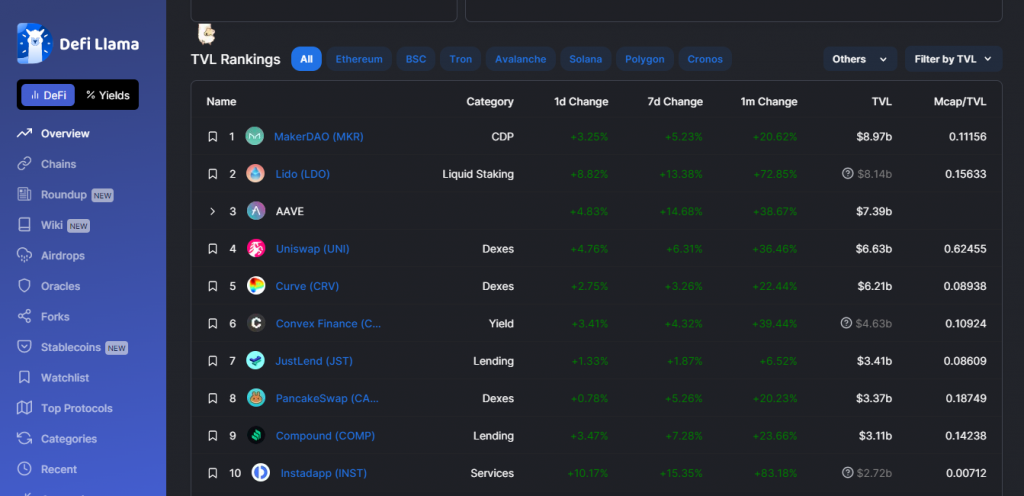

This tab gives a general overview of the different protocols on the platform. The user can either view statistics on all or choose any of the blockchains listed to view their statistics. To ease users the stress of comparing TVL, the protocols are ranked according to their TVL.

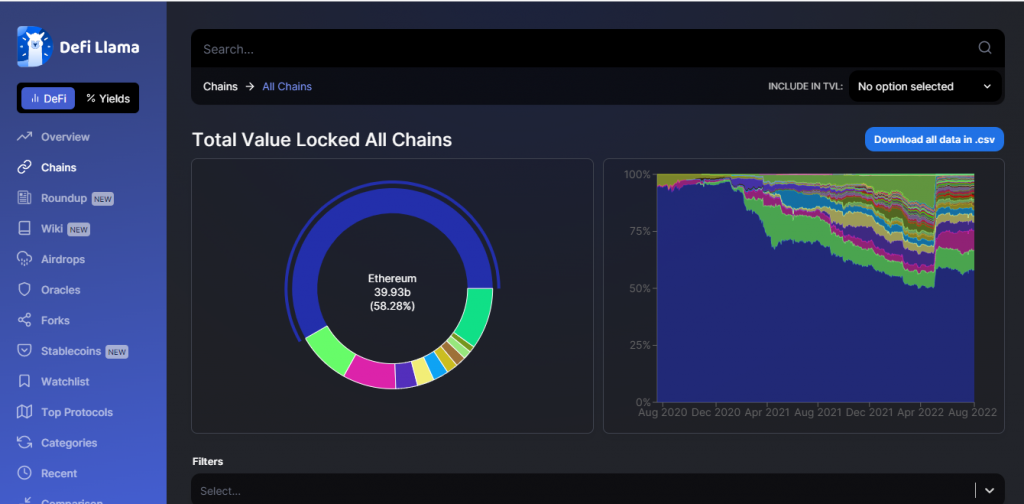

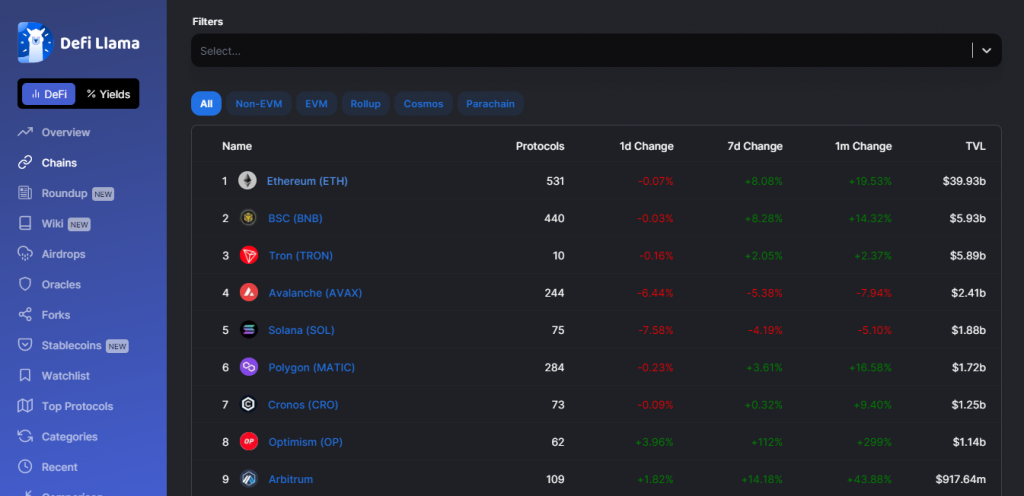

This tab shows statistics on the blockchains registered on the platform and the TVL of the total and each of them. Other columns also show the percentage change in the TVL of these blockchains on different timeframes.

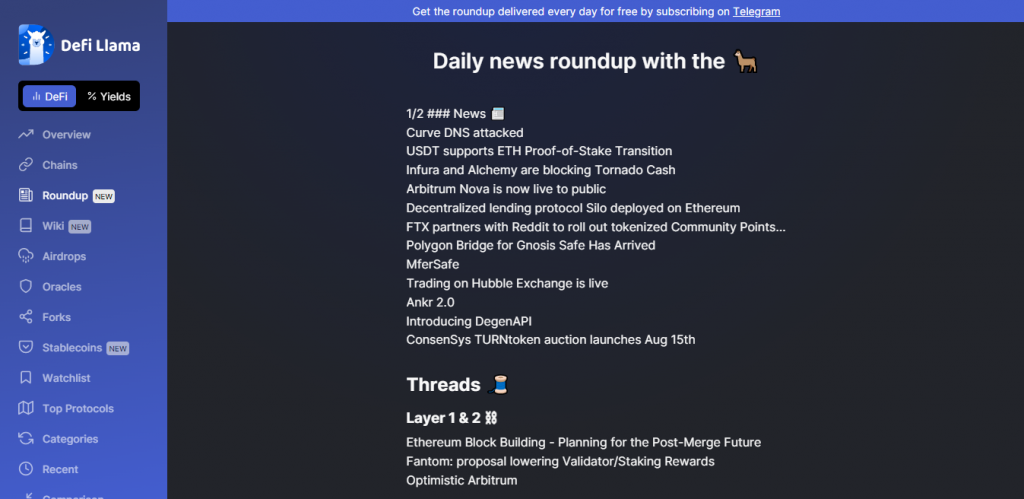

Roundup is a part of the DeFi Llama platform where users can find the latest about DeFi news and the market. Information is compiled daily on this page to keep users informed.

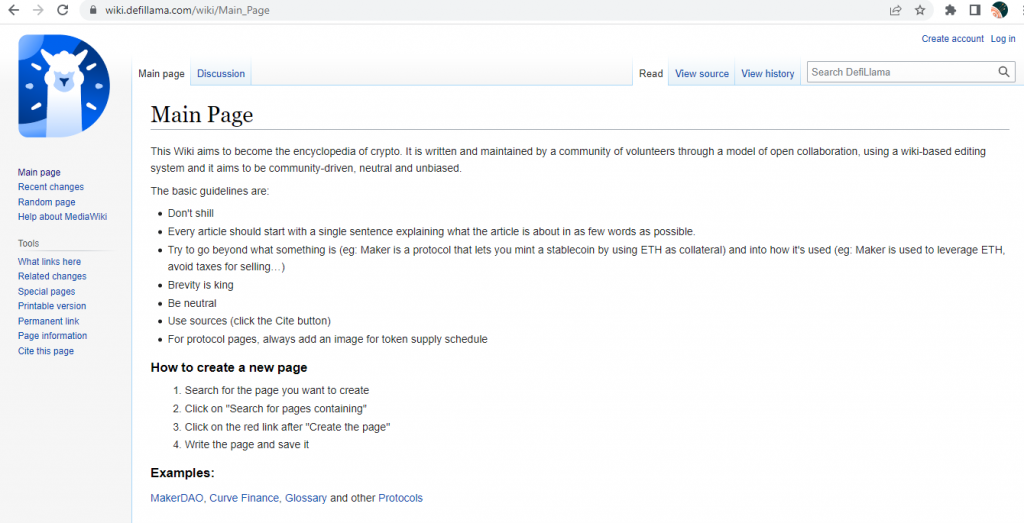

Wiki is an encyclopedia-like link from the DeFi Llama platform. Just like Wikipedia, this website encourages volunteers to write up the latest information on DeFi projects to keep the public up to date. It is a relatively new concept on the platform, and users can find detailed instructions on how to post on it on the main page.

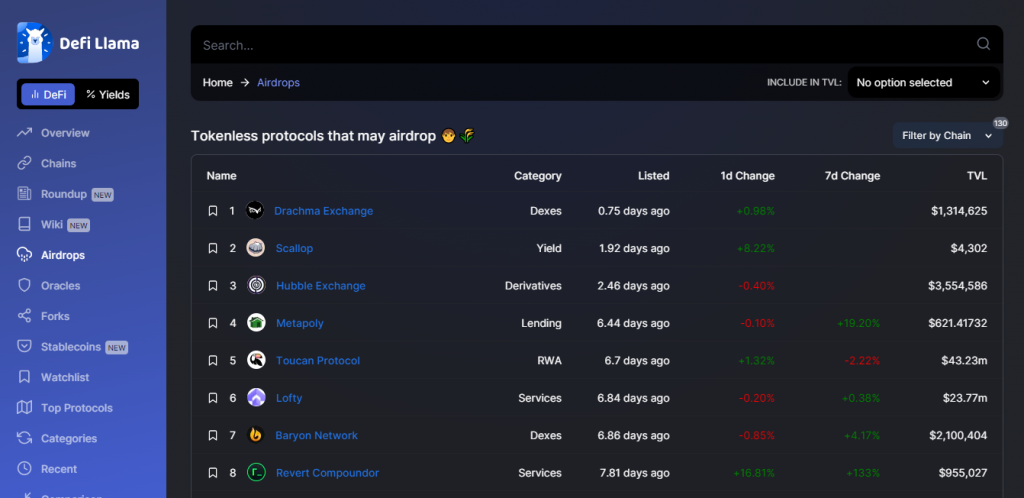

This part of the platform informs users about the DeFi protocols where airdrops are ongoing or soon to start. Users thus are set to take advantage of the freebies in time.

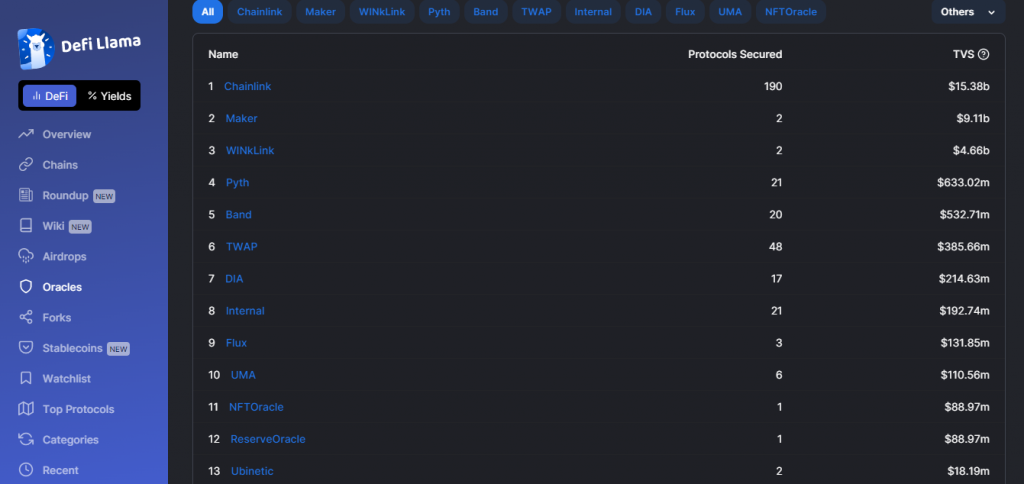

Oracles are a specific category of DeFi protocols. Users can keep track of their price movement via this tab and act on the information they get.

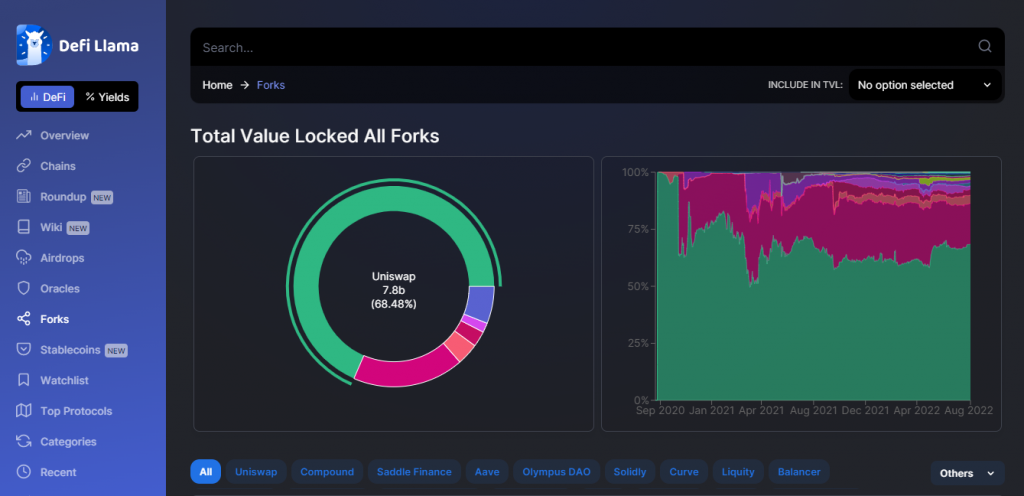

These are mostly Layer 2 DeFi protocols that emerged from finding solutions to Ethereum’s scalability issues. Users can also track these specific protocols via this tab.

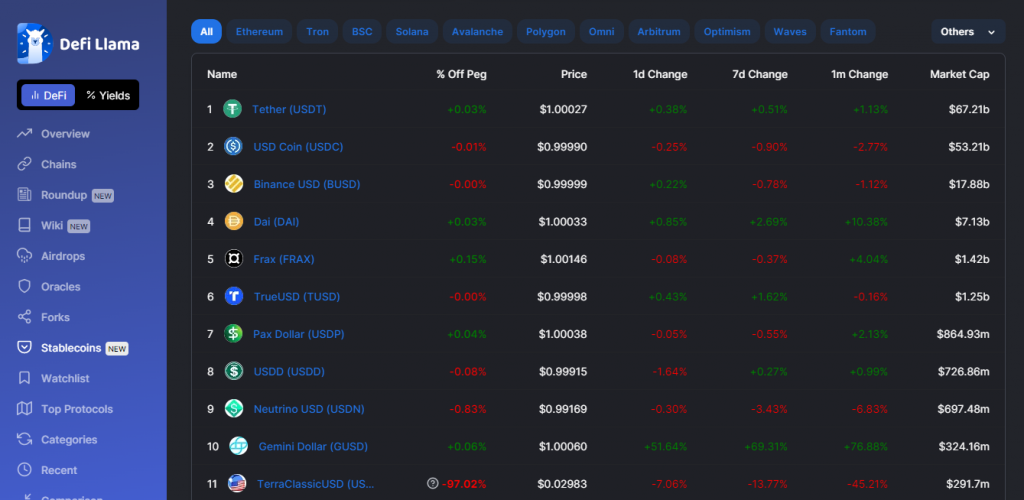

This tab helps users keep track of stablecoins. Users might need this info for several reasons, including knowing which stable coin to convert to when they either make a profit or loss. Unlike other tabs focusing on TVL, this tab records the market cap and other important factors affecting stablecoins, like the percentage off from the pegged value.

Users can use this tab to monitor specific coins they intend to trade in the future or the ones they already have. This way, they can know when to buy or pull their funds out of the market.

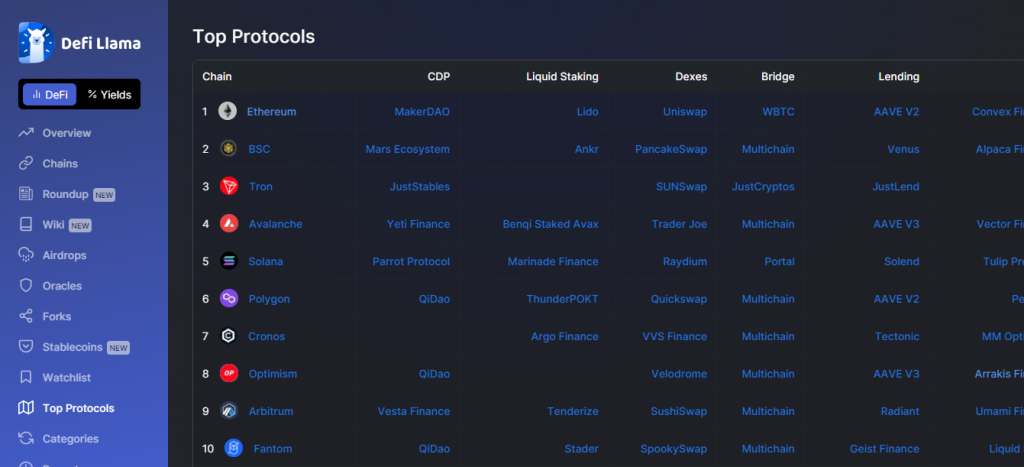

Top protocols give a clear ranking of all categories in the order of TVL from highest to smallest. This way, users can see at a glance which protocol is doing better at that moment. Users can thus check protocols on specific DeFi categories like DEXes, lending platforms, etc. that are doing well.

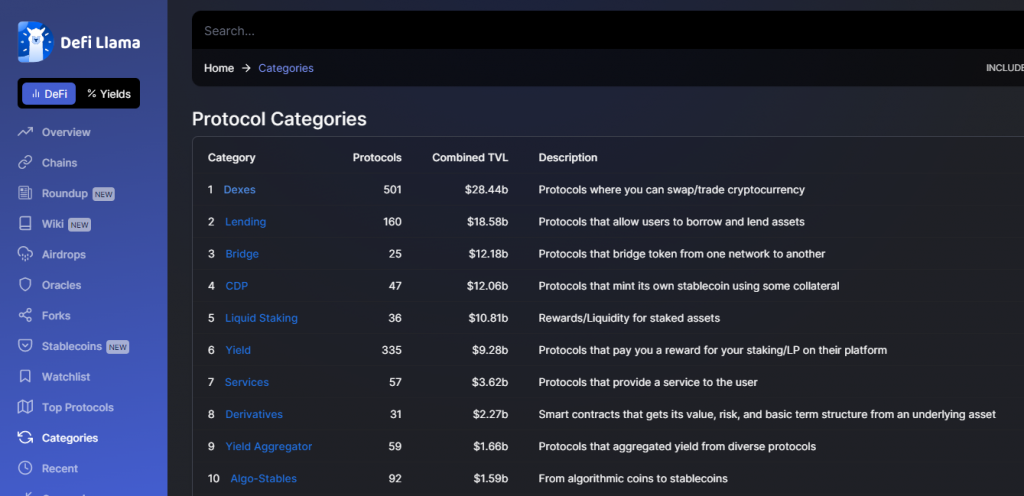

The categories tab shows each category in a listicle form, the number of protocols under each of them, and their TVL. In the case of those new to the different types of DeFi protocols, DeFi Llama was kind enough to give a short explanation of how each category worked.

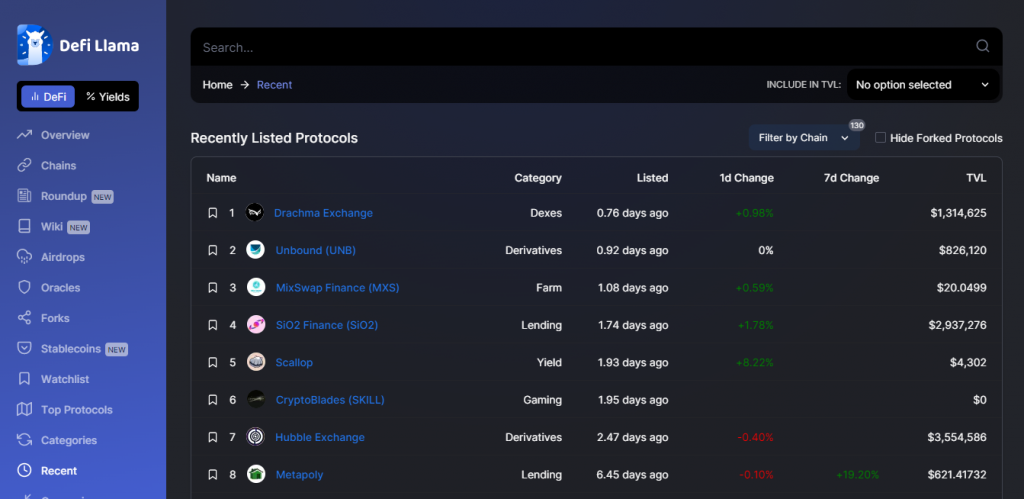

As the name suggests, the “recent” tab shows recent or new protocols as they are added to the Defi Llama platform. Users can use this tab to update themselves with some of the new Defi protocols that could be potential investment avenues.

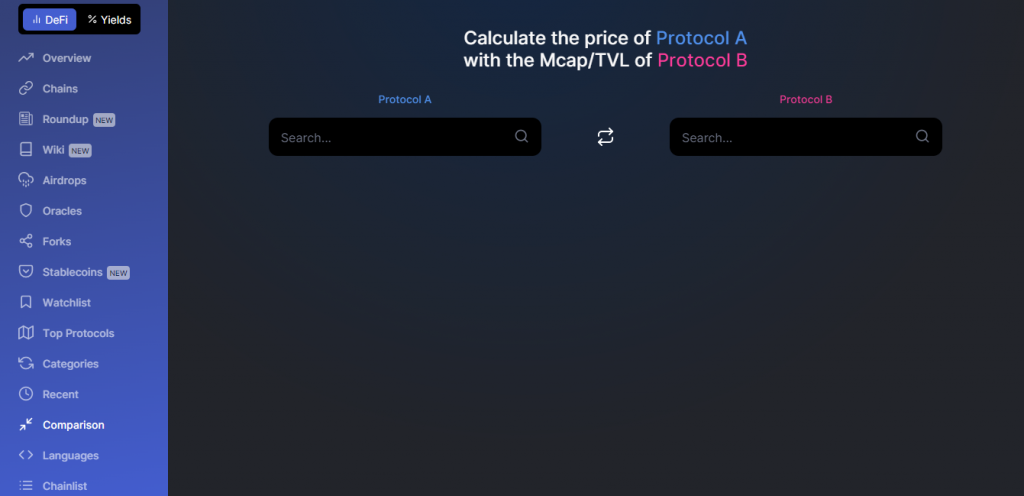

As indicated by the name, this tab allows users to compare protocols. In addition, on the dashboard, an automatic calculator has been placed to calculate the price of protocol A with reference to that of protocol B.

Unlike how easy it was to decipher some of the pre-mentioned tabs by their names, the language tab is not a way to choose the page language. Rather, the language tab calculates the TVL of smart contract languages. This is seen in graphs on the dashboard.

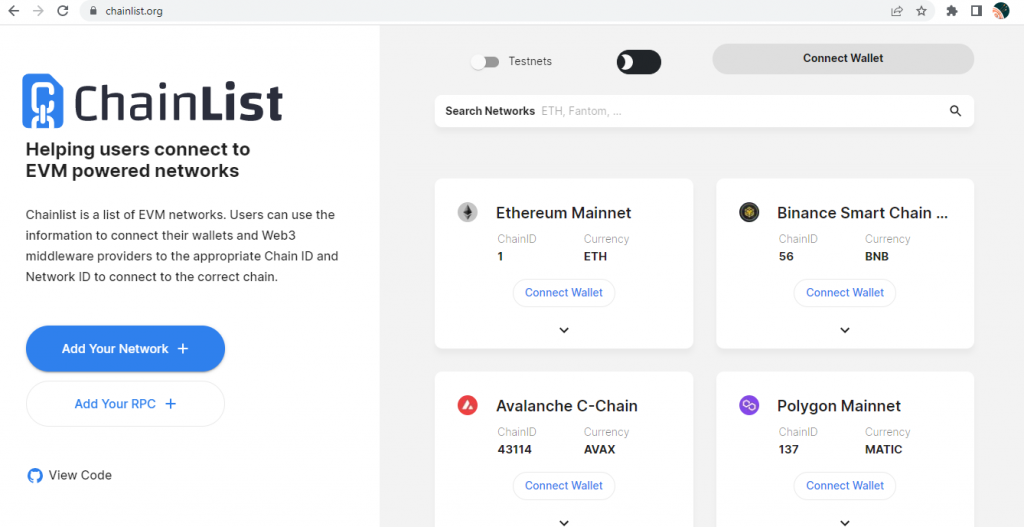

The chainlist tab allows users to connect their wallets to any of the listed EVM networks on the page for more exploration.

Were you wondering where the information volunteered at the overview was gotten from? Well, the about page statistically updates itself and lets us exactly how many protocols you can have access to on the page.

As seen in the image above, other small features on the menu relate to how to contact the platform, donate or list your project as a DeFi protocol.

DeFi Llama presents data that can help investors of any scale. Unlike other statistics platforms, the DeFi Llama delivers accurate data (TVL) on DeFi in different shades. Doing so gives the user several vantage points to view these protocols. If used wisely, perhaps in combination with other statistical sites, the user makes informed decisions on DeFi protocols to invest in.

Some users visit the platform to check on how certain blockchains are doing. Some others check how specific categories, e.g., DEXes, are doing. Finally, some go further to check on certain cryptocurrencies. In most cases though, users choose to combine all these, in combination with other statistical sites to make a sound financial decision.

Suffice it to say, individuals make choices differently. Therefore, using the intuitive features above, users can navigate the DeFi Llama platforms for their individual needs.

An example of a way to use the platform is shown in the video here. The video shows how to make research on DEXes using some of the features. Users can choose a different method to carry out their own research or learn one that works for them with time.

A simple search on google would reveal that some other platforms are in direct competition with DeFi Llama as they offer the same services. Some of those platforms include DeFi Pulse and DeFi Rise.

A brief scan of those websites reveals that the DeFi Llama platform offers a more varied approach to the statistics of DeFi. Thus, while these other platforms offer similar services, they pale compared to how many angles DeFi Llama allows a user to explore.

The DeFi Llama platform is a useful statistical product for investors and general updates on DeFi protocols. Created with a wide range of audiences in mind, it has various tabs that suit the needs of individual preferences.

DeFi Llama majorly presents prices in TVL. However, as long as the user makes wise use of some or all of these tabs, they can make an informed decision on protocols they intend to invest in or follow up with those they have invested in.

Disclaimer

All articles published on Coinmash are strictly for informational purposes only. Coinmash has no involvement with any assets discussed and urges everyone to do their own research before making any financial decisions. Read our disclaimer to learn more.

DISCLAIMER: Coinmash is only an informational website. None of the information expressed by the writers on Coinmash should be regarded as investment advice. We advise you to conduct your own research and exercise caution before making investment decisions based on the information provided. Any reliance you place on such information is strictly at your own risk.