Since its inception, decentralization has been one important watchword of blockchain technology. Freedom of ownership and growing financial independence through DeFi opportunities have boosted the adoption of cryptocurrencies and blockchain technology for years.

However, unlike Centralized Exchanges, which allow users to trade within a closed, controlled organization, Decentralized Exchanges (DEXes) like PancakeSwap have been instrumental in upholding the Decentralized feature of blockchain technology.

PancakeSwap has since been a popular go-to spot for DeFi and smart contract transactions. This article will take you through everything about PancakeSwap, how it works, how to use it, and how you can earn with it.

What is Pancake Swap Decentralized Exchange?

PancakeSwap is a decentralized exchange built on the Binance Smart Chain. PancakeSwap has gained enormous recognition as the most reputable and most popular DEX, thanks to Binance Smart Chain’s use cases and application.

Launched in 2020, the DEX boasts a high number of users that helps contribute to its huge trading liquidity. PancakeSwap offers myriads of earning opportunities and features that allow users to trade cryptocurrencies in a decentralized way. Essentially, transactions are executed through smart contracts. Therefore, it cuts out the involvement of intermediaries in Centralized Exchanges and promotes freedom of asset ownership and transaction.

PancakeSwap features a BEP-20 native token, $CAKE. It is the native utility token that serves many purposes within PancakeSwap’s ecosystem. It is useful for staking, farming, lottery, and as a governance token within PancakeSwap. You can buy the PancakeSwap token on major DEXes and CEXes.

How Does PancakeSwap Work?

Essentially, PancakeSwap allows open and permission-less digital asset trading. In contrast to traditional exchanges’ way of pairing trading parties, DEXes like PancakeSwap allow users to exchange tokens via an Automated Market Maker model. This implies it doesn’t use an order matching system, order books, or limit/market order in a buyer/seller market. Instead, it solely depends on drawing and balancing liquidity from pools to stabilize trading.

In DEXes like PancakeSwap, the trading liquidity is accrued from users who add some values of their assets to liquidity pools. These pools serve as an avenue for trade execution. In return, liquidity providers earn a share of the flat 0.25% transaction fee when any trade is executed in the pool.

Using PancakeSwap Exchange

PancakeSwap exchange is a Decentralized Application (DApp) built on the BNB Chain. Therefore, it can be accessed via the dApp browser on crypto wallets like mobile-first Trust Wallet, Coinbase, Metamask, or Binance chain wallet.

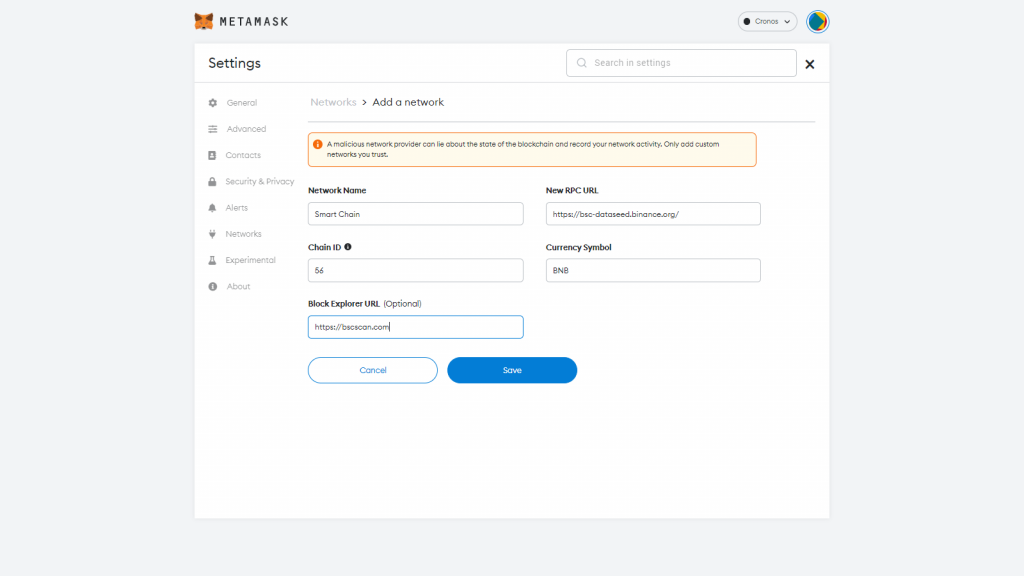

Connecting with PancakeSwap on Metamask requires users to add the BNB Chain mainnet network to their Metamask. You can do this by simply adding a new network user Settings > Network and inputting its network information as follows:

- Network Name: Smart Chain

- New RPC URL: https://bsc-dataseed.binance.org/

- Chain ID: 56

- Symbol: BNB

- Block Explorer URL: https://bscscan.com

Once everything is set, users can interact with PancakeSwap’s app by connecting their crypto wallets.

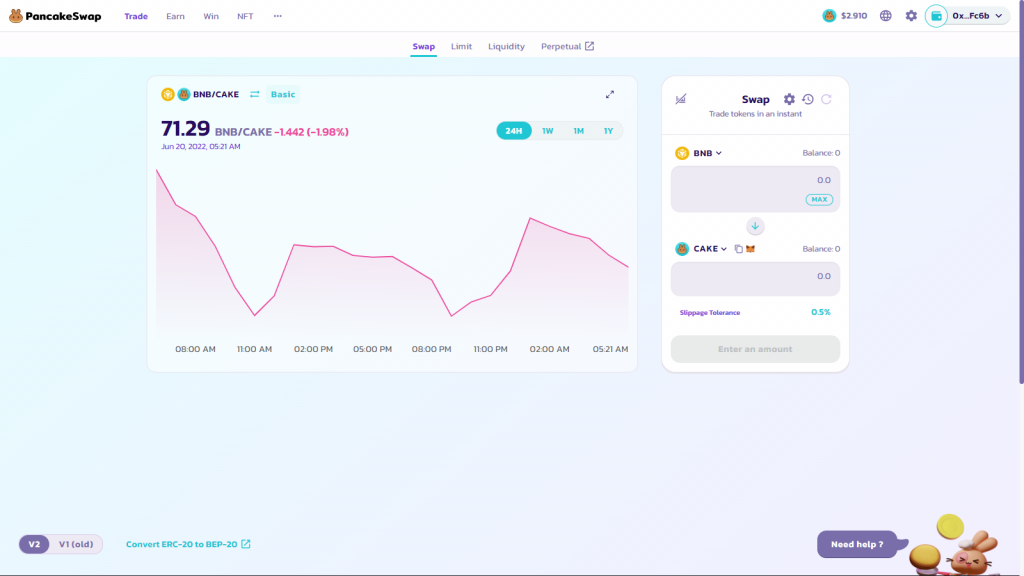

Swapping Tokens on PancakeSwap

One of the most basic things to do on the PancakeSwap platform is swapping BNB Chain-based BEP-20 tokens. In fact, more than $500 million volume of digital assets are traded on PancakeSwap daily.

To swap tokens on Pancakeswap:

- Navigate to pancakeswap.finance and connect your Binance Smart Chain-enabled crypto wallet.

- Click on SWAP from the trading menu and add the tokens you want to exchange.

Alternatively, you can add tokens, especially DeFi (Decentralized Finance) projects, with your contract address. It is important to take note of the slippage tolerance before executing your swap. Also, ensure you have enough BNB for your transaction and gas fees. Finally, tap SWAP and approve the prompt in your wallet to confirm the transaction.

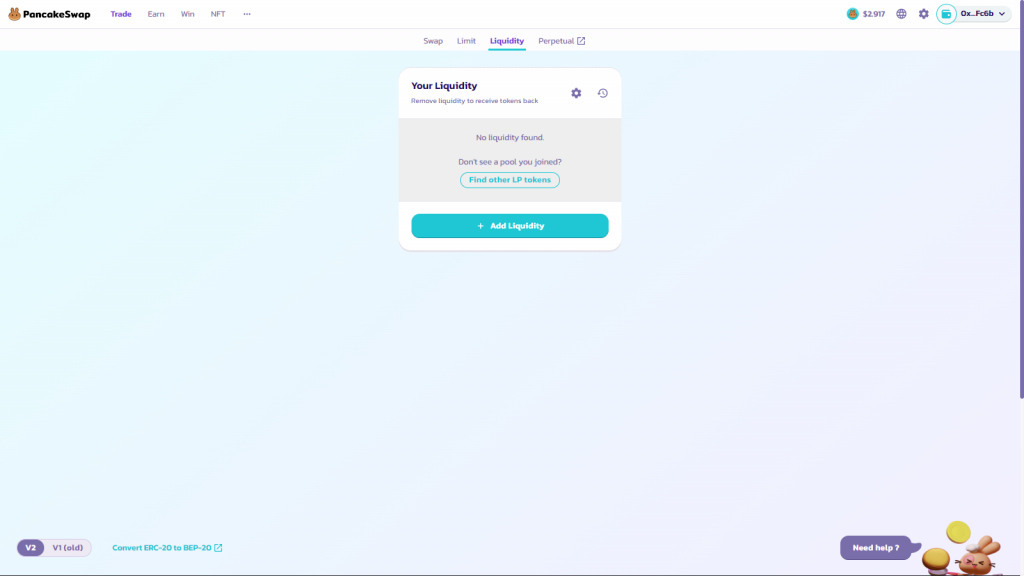

Providing Liquidity to Liquidity Pools on PancakeSwap

As mentioned earlier, liquidity and liquidity pools are the foundation of decentralized exchanges. Therefore, it provides a platform for traders and users to add liquidity in pools freely. These pools are a collection of assets locked in a smart contract.

To add liquidity on PancakeSwap:

- Navigate to LIQUIDITY in the trading menu.

- Connect wallet and proceed to add liquidity.

- Select the token pair you want to add liquidity for and input the amount.

- Enable both coins by signing a prompt in your wallet.

- Confirm the transaction and add the tokens to the pool.

Note that providing liquidity means you are providing an equal value of two tokens. However, once you input the amount of one, the other one is calculated automatically. After adding liquidity, the user will receive LP tokens, proof of contribution to a liquidity pool. Yield rewards depend on the amount of liquidity provider LP tokens a provider is holding.

Yield Farming & LP Tokens

LP token provides ways to earn rewards within PancakeSwap. Therefore, you can earn a small percentage from transaction fees once you’re an LP token holder.

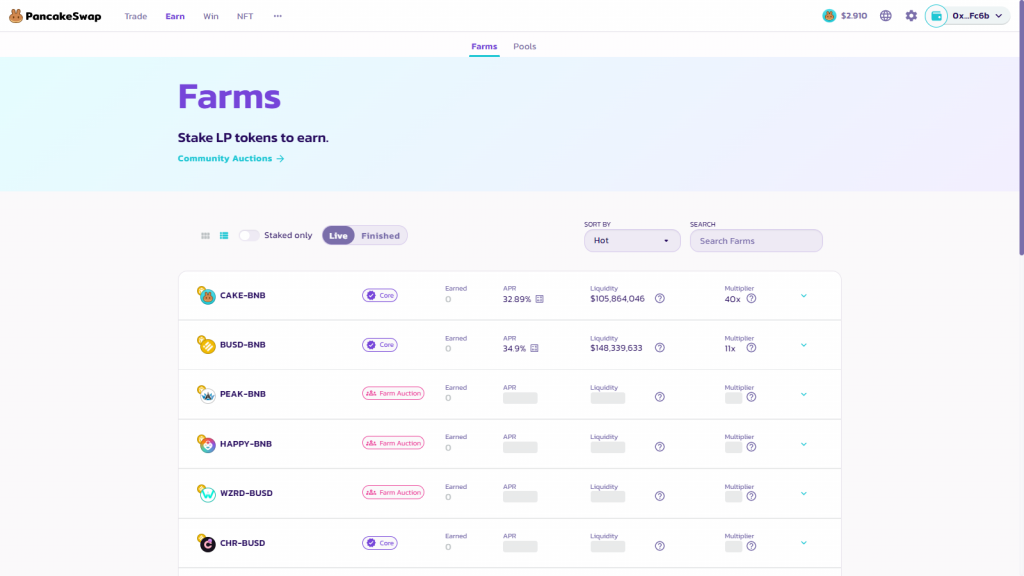

Farming liquidity provider tokens on PancakeSwap is another way to earn passive income. On farms, holders can stake their tokens in staking pools to earn CAKE tokens.

To start earning on PancakeSwap Farm:

- Go to PancakeSwap and click EARN > FARMS on the top navigation bar. On the farm, you can explore available farms or simply search for the one you have LP tokens for. If you just want to check out the farm to have an idea of the LP token you should buy, you can check the APR yields.

- After selecting a suitable farm, tap ENABLE and confirm the prompt in your wallet.

- Click STAKE LP. Enter the amount of LP tokens you’d like to stake in the farm and tap CONFIRM.

- Confirm the transaction in your wallet, and that’s all.

Farming tokens attract extremely low transaction fees, which are basically negligible gas fees. After staking your LP tokens, you see details about your stakings, including balance and earned amount on the farm. You can also unstake your LP tokens by clicking HARVEST. Confirm harvest in your wallet to withdraw the tokens.

Another way to earn with cake-bnb liquidity provider (LP) token is via Initial Farm Offering. This is an ICO model of farmed token that allows participants to buy new tokens.

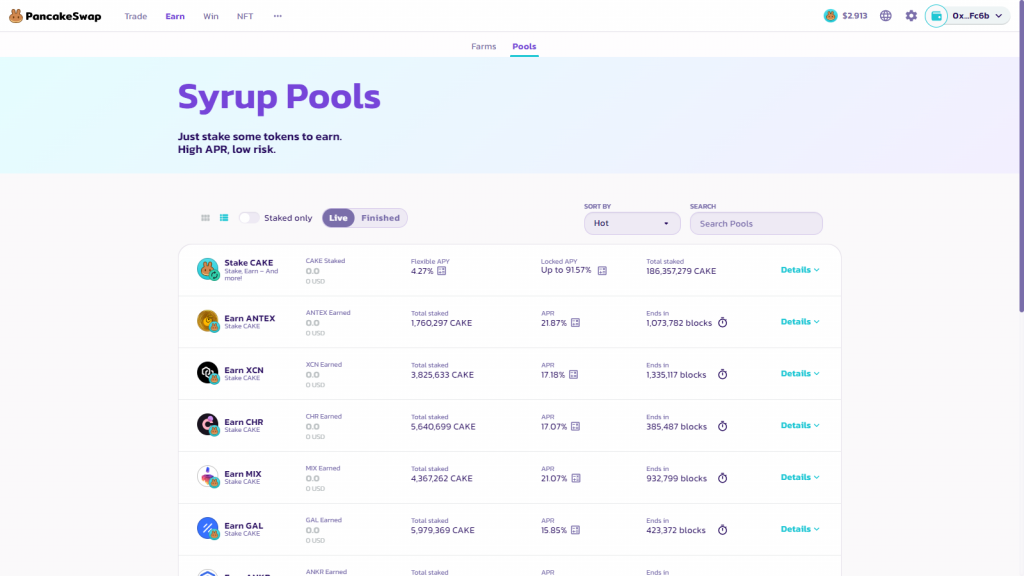

Staking CAKE Token

Staking works almost like Farm in PancakeSwap . The only difference here is that you’re staking CAKE tokens instead of LP token. CAKE holders can earn APR or APR rewards when they stake their tokens in Syrup Pools. There is a provision for flexible CAKE staking that allows stakers to withdraw their tokens and rewards anytime they want freely.

To stake Cake in Syrup Pools:

- Go to the Pool section on PancakeSwap. You can go through the list of tokens available for staking and their APY or APR.

- Select any pool you want and click ENABLE, and confirm the action in your wallet.

- After that, specify the number of CAKE tokens you wish to stake and tap CONFIRM. You can monitor your stakings and harvest your reward token from time to time.

PancakeSwap Lottery

Another way you can earn on PancakeSwap is by winning the PancakeSwap jackpot. The DEX has a lottery system where participants can buy tickets and participate in lucky draws.

You must buy lottery tickets for $1 each before participating in a lottery session. Each ticket contains a random four-digit combination, with each number ranging from 1 to 9.

The lottery system features an innovative VRF Chainlink integration that gives everyone an equal chance of winning. A holder wins 50% of the lottery pool when the numbers on their ticket match the winning ticket. Meanwhile, there are still some rewards for holders whose combination matches some of the ones in the winning ticket.

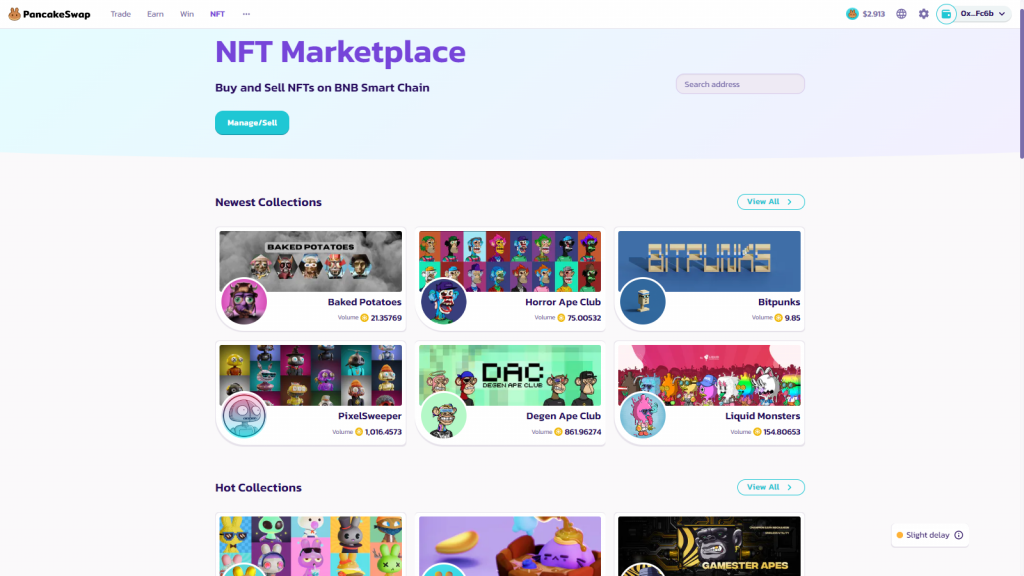

PancakeSwap NFT Marketplace

Apart from its exchange and DeFi services, PancakeSwap also features a vibrant and growing marketplace for NFTs on BNB Chain. It is the largest BNB Chain NFT marketplace after the Binance marketplace.

The marketplace has a simple and easy-to-use user interface that allows collectors to trade unique NFT assets. However, unlike other NFT platforms, users cannot freely mint NFTs without screening or application.

Only 2% is subtracted as trading fees from all NFT transactions, making it one of the best low-fee marketplaces.

Wrap Up on PancakeSwap

PancakeSwap has grown into an open-source ecosystem of DeFi tools and opportunities. It has been certified by many security-focused blockchain firms like Slowmist, Peckshield, and even Certik.

PancakeSwap provides an enabling platform for everyone to enjoy a decentralized ecosystem of limitless earning opportunities. From staking to yield farming, a lottery system, and providing liquidity, PancakeSwap is an excellent ecosystem for growing DeFi on the BNB Chain.