Polygon is one of the biggest blockchain networks, with a vast ecosystem consisting of over 37,000 decentralized applications. Its large community of users emanates from its Ethereum scaling solutions, which allow developers to build highly scalable crypto projects while retaining the security of the Ethereum blockchain.

Polygon is powered by its native token MATIC, which is a favorite amongst most investors due to Polygon’s massive adoption levels and low cost transaction fees. Moreover, MATIC has a staking function, giving several investors the option to earn rewards via interest on their holdings while they hold for the long term.

In this article, we will provide a comprehensive guide on how to stake MATIC, where you can stake MATIC, and how much you can earn (in rewards) by staking it.

What is Polygon (MATIC) Staking?

Polygon staking refers to the process whereby investors lock up their MATIC tokens on the Polygon network to enable transaction validation and strengthen the network’s overall security.

Similar to Ethereum, Polygon is a Proof-of-Stake (PoS) blockchain protocol, meaning it requires the staking of its native asset – MATIC – to function efficiently.

Whenever investors stake an asset, it cannot be traded or transferred until it is unstaked. In return for locking up your asset, PoS networks reward stakers with interest in their tokens and voting rights to participate in network governance.

How to Stake MATIC?

Staking MATIC is an excellent way of earning passive income, especially for long-term investors. Like other PoS protocols, you can stake MATIC directly on the Polygon network by being a validator or a delegator.

Become a Validator

Validators are network participants that are actively involved in the transaction verification process and are compensated with staking rewards for their service.

Become a Delegator

Delegators are investors who “Delegate” their tokens to these validators and share in all earned rewards. With the delegation mechanism, several investors can participate in staking without active participation in the network. On Polygon, there is no fixed minimum amount for delegation, however, validators are allowed to set up a minimum limit of tokens accepted from delegators.

Stake Via a Centralized Exchange

Investors can also choose to stake their tokens via centralized exchanges (CEX). In addition to trading, most CEXes offer flexible and fixed staking products with respective interest rates. Staking with a CEX is usually easy; thus, it is highly recommended for beginners.

Where Can You Stake Polygon (MATIC)?

MATIC is a prominent cryptocurrency with staking support on several CeFi and DeFi platforms. The following are some of the best places to stake polygon.

- Binance: the world’s biggest cryptocurrency exchange

- Lido: Prominent DeFi staking protocol

- Polygon staking network: Direct staking interface of the Polygon platform.

- KuCoin: Global cryptocurrency exchange with over 6 million users.

Now, lets go over how to stake your MATIC tokens on Binance and the Polygon Network.

How to Stake MATIC on Binance?

The Binance Exchange is regarded as the world’s largest cryptocurrency trading platform. It’s home to over 90 million users resulting in a daily trading volume of over $76 billion. Aside from its trading services, Binance is also a credible platform for staking, lending, and other crypto-based ventures.

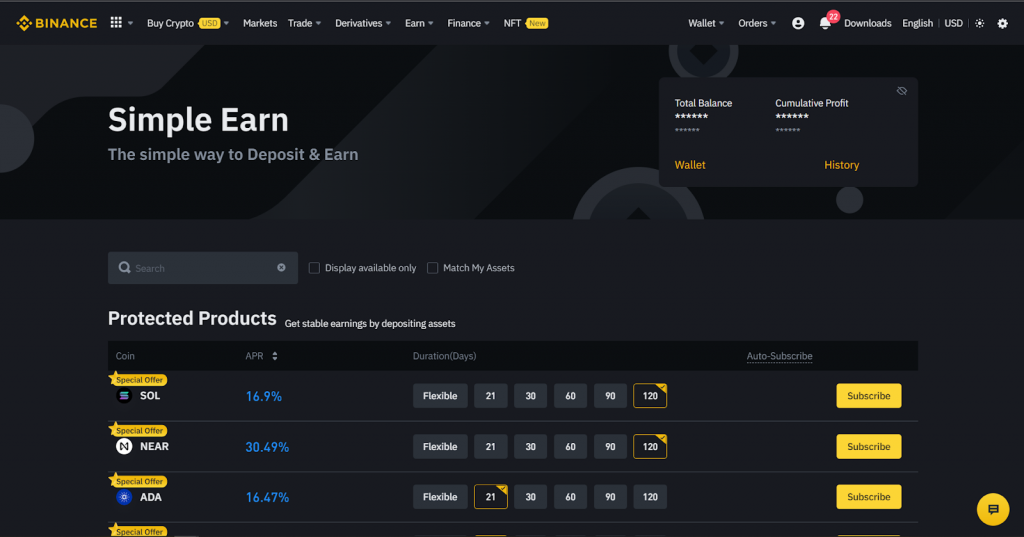

On Binance, you can stake MATIC tokens by subscribing to one of its four MATIC staking products. These include a flexible staking product and three staking products with a fixed term. Using the table below, you can learn about each MATIC staking product on Binance, its respective APR, and the minimum subscription amount.

| Staking Product | Annual Percentage Rate (APR) | Minimum Subscription Amount |

|---|---|---|

| Flexible | 2% | 1 MATIC |

| 30 days | 4.66% | 1 MATIC |

| 60 days | 6.47% | 1 MATIC |

| 90 days | 13.9% | 0.001 MATIC |

The flexible product allows you to participate in staking without needing to lock up your tokens for a specific period of time. Meanwhile, the fixed staking products all require investors to lock up their tokens for the stipulated period of time, i.e. 30, 60, and 90 days. During this period, investors cannot access their staked MATIC tokens or any interest earned.

To begin staking Polygon on Binance, you must create a Binance account and complete the verification process. Then, you need to acquire some MATIC tokens either directly from the exchange or by transferring from an existing wallet such as MetaMask.

After depositing MATIC tokens in your account, click on the “Earn” feature located on the Binance dashboard and select “Simple Earn.” Under this section, search for MATIC, pick your preferred staking product, and click on “Subscribe” to begin staking. On Binance, interest is earned daily starting the next day after your subscription begins.

Pros of Staking MATIC on Binance

- Offers a flexible staking plan

- Offers a maximum APR of 13.9%

- Low Minimum staking requirements

- Interest is earned daily

Cons of Staking MATIC on Binance

- Fixed staking plans come with a lock-up period

- Risk of asset loss if Binance suffers any attack or bank run

How to Stake MATIC on the Polygon Network (via MetaMask)

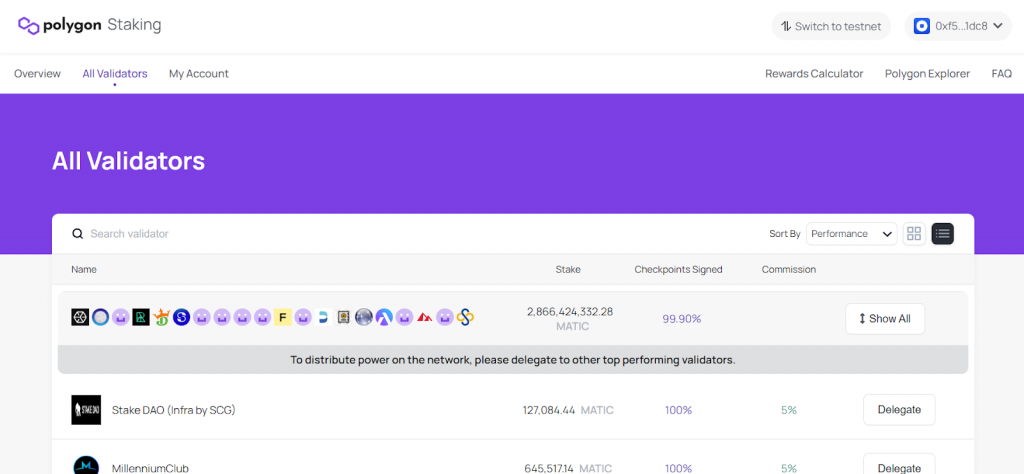

The Polygon Network allows investors to directly stake MATIC on the network as a validator or a delegator. As an investor just looking for some passive income, it is advisable you delegate your tokens to an existing validator node rather than setting up a node yourself. This way, you can participate in staking without the concerns of running and maintaining a validator (which can be quite tricky).

However, while delegation might be an easy way of staking, it is worth noting that each validator usually charges a commission on the staking rewards of its delegators. There is also the risk of slashing, which refers to the partial or total loss of staked tokens if a validator behaves in a manner recognized as malicious by the network. In staking, slashing functions as a control mechanism to ensure the integrity of the network.

That said, you can calculate your projected earnings for staking MATIC using the polygon staking calculator. Currently, choosing to stake MATIC directly on the Polygon network offers an annual percentage rate of 4.92%. However, this figure is indicative and is subject to change based on the total locked supply in the network.

To begin staking on the Polygon Network, you first need to connect to staking.polygon.technology. From there, click on the “Connect Wallet” to connect a crypto wallet containing MATIC tokens to the polygon staking interface. Currently, the Polygon Network is only compatible with MetaMask wallet, Bitski, WalletConnect, Torus, and Coinbase wallet.

After completing this step, click on “Become a delegator” and pick a validator from the list available to you, considering factors such as commission fee and performance. To select a validator, click on the “Delegate” feature linked to its name. Then, proceed to enter the amount of MATIC tokens you want to delegate and click on “Continue” to lock up your tokens.

Pros of Staking on the Polygon Network

- Allows for delegation

- Compatible with popular crypto wallets

- Highly secure method of staking polygon

Cons of Staking on the Polygon Network

- Commission fees

- Slashing risk if your chosen validator behaves maliciously

- Not ideal for beginners

How Much Can You Earn Staking Polygon (MATIC) Tokens?

With Polygon staking, investors can earn interest at ridiculously good rates and get their hands on some juicy staking rewards. The table below shows how much you can earn by staking MATIC tokens on different platforms.

| Name of Platform | Type of Platform | Maximum APR/APY |

|---|---|---|

| Binance | Centralized Exchange | 13.90% |

| Polygon Network | On-chain Staking Medium | 4.92% |

| Lido | DeFi Protocol | 6.3% |

| KuCoin | Centralized Exchange | 12.34% |

If you’d like to calculate your potential return on investment for purchasing MATIC, you can do so using our Polygon profit calculator.

What is Polygon (MATIC)?

Polygon is a Layer-2 scaling solution designed to create a multichain ecosystem compatible with the Ethereum blockchain. It was launched in 2017 under the name Matic Network by co-founders Jaynti Kamari, Sandeep Nailwal, and Anurag Arjun.

Polygon is based on a Proof-of-Stake (PoS) consensus algorithm. Its native cryptocurrency is MATIC, an ERC-20 token, which is used for payment transaction (gas) fees and governance of the Polygon network.

Polygon aims to improve the scalability and speed of Ethereum-based projects while connecting them to one another. Using the Polygon scaling platform, these projects can operate with a high level of flexibility, scalability, and sovereignty while maintaining access to the security, interoperability, and all infrastructural benefits of the Ethereum network.

Polygon can enable such stellar operations via the deployment of layer-2 solutions, which help decongest the network activity on the Ethereum Mainnet. Examples of common Polygon solutions include the Polygon PoS – an EVM-compatible sidechain, Polygon Hermez – An open-source zk Rollup, and Polygon Edge – A modular and extensible framework.

FAQs

Is staking MATIC worth it?

Staking MATIC provides an easy way to earn rewards and passive income at high-interest rates. Therefore, it is considered a worthy venture by many investors. Moreover, MATIC is one of the most highly-rated blockchain cryptocurrencies with massive potential for price appreciation in the coming years.

What is the best place to stake MATIC?

For beginners, it is best to stake MATIC tokens (or any other asset) using centralized exchanges like Binance, KuCoin, OKX etc. That said, veteran investors can explore the Polygon staking network and DeFi staking protocols such as Lido.

How long does it take to unstake MATIC?

Using the Polygon staking network takes about 3-4 days to unstake MATIC from a validator. However, centralized exchanges like Binance allow you to unstake your MATIC tokens within a day.

Final Words

MATIC staking is quite beneficial to investors in terms of interest rates and the potential price growth of the investment. With this guide, you have gained valuable knowledge on how to stake MATIC using two of the best platforms out there. However, remember to take into consideration all risks involved before participating in this blockchain-earning venture.