Following the crash of the Terra ecosystem earlier this year, the introduction of a new cryptocurrency was needed to retain investors’ and developers’ interest in the Terra crypto project. This new token was known as Terra LUNA or Terra 2.0.

LUNA is still considered a relatively new cryptocurrency but with good prospects for price growth and market expansion. It is also a staking asset that offers high-interest rates to its numerous investors looking to earn a passive income with their holdings.

This guide is curated to provide information on how to stake LUNA, where to stake LUNA, and how much one can earn staking LUNA.

What is LUNA Staking?

To stake LUNA simply means to lock up your LUNA coins on the Terra blockchain to facilitate transaction validation and maintain the network’s security. When investors stake any asset, these tokens cannot be traded until they are unstaked. In return, investors are usually rewarded with interest on their tokens as well as DAO voting rights to create and confirm network upgrade proposals.

How to Stake LUNA?

Become a Validator

For investors seeking to stake LUNA, you can choose to either delegate your coins to a validator or set up a validator by yourself. A network validator refers to anyone who verifies transactions on a blockchain network. On Terra, there is no minimum amount of LUNA required to set up a validator. However, it’s important to note that the network allows only the top 130 validators to verify transactions and earn rewards.

Delegate Your Tokens

In ranking validators, Terra employs the total stake weight of each validator. This means the higher the amount of LUNA bonded to a validator, the higher its rank on the validator list. Thus, it is advisable to delegate your LUNA tokens to validators with a large stake weight in order to stand a chance of earning some interest. Like other Proof-of-Stake (PoS) assets, staking LUNA via delegation is done using a crypto wallet.

Stake on a Centralized Exchange

That said, another different way of staking LUNA is by subscribing to staking plans on centralized exchanges. Staking plans usually come with a flexible (liquid staking) or fixed-term, each with respective interest rates. Staking on centralized exchanges is usually recommended for beginners as it is easy and accessible.

Where Can You Stake LUNA?

LUNA staking is available on multiple CeFi exchanges and DeFi platforms. The following are some of the most popular places to stake your LUNA.

- Binance: World’s biggest cryptocurrency exchange.

- Terra Station: Official wallet app of the Terra blockchain.

- Stader: Multichain smart contract staking platform.

- KuCoin: Global cryptocurrency exchange with over 6 million users.

In the next section, we’ll go through how to stake on both Binance and Terra Station.

How to Stake LUNA on Binance?

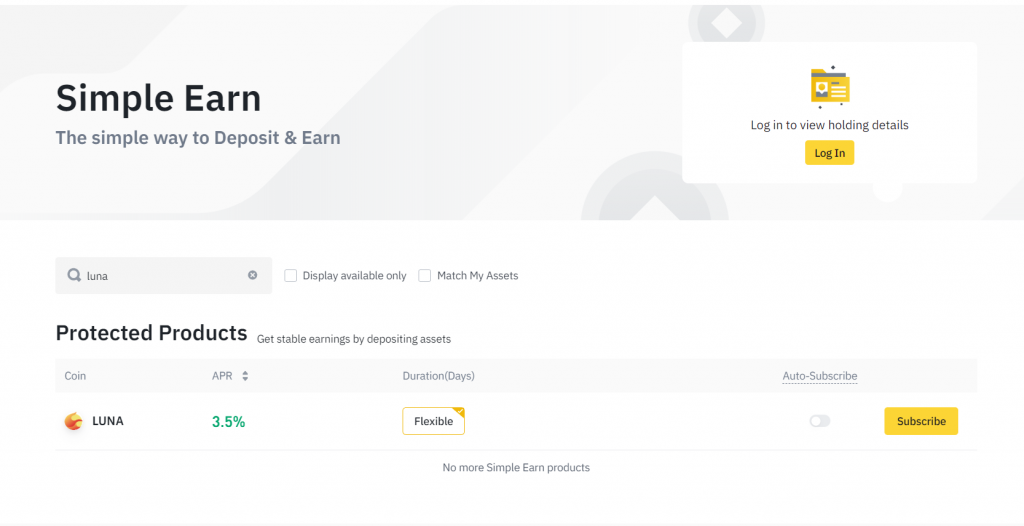

Binance is the most prominent cryptocurrency exchange, with a daily trading volume of over $10 billion. Asides from trading, the Binance exchange also allows investors to earn interest on their tokens via its ‘Simple Earn’ staking program. There are over 50 cryptocurrencies, including LUNA, with staking support on Binance.

That said, Binance offers only a flexible LUNA staking plan, which allows investors to stake and unstake their LUNA tokens freely. This is because there is no stipulated lockup period as with fixed staking plans.

To subscribe to the LUNA staking plan, you will need a minimum subscription amount of 0.1 LUNA. By staking LUNA on Binance, you earn interest at an annual percentage rate (APR) of 3.5%. Interest is paid daily and can be withdrawn at any time as this is a flexible staking plan.

To begin staking LUNA on Binance, you must first register an account with the exchange and undergo its identity verification process. Thereafter, you will need to deposit some LUNA tokens into your Binance account. To complete this step, you can buy LUNA tokens from Binance or transfer LUNA from another crypto wallet.

After acquiring LUNA, select the ‘Earn’ feature on the Binance dashboard, and click on ‘Simple Earn.’ On the next page, search for ‘LUNA’ and click on ‘Subscribe’ to start staking and earning your interest.

Staking LUNA on Binance is quite straightforward. However, you should note that when you stake on Binance, the staked LUNA tokens are in complete custody of the exchange. Thus, if Binance goes insolvent or is attacked, you could lose your tokens.

Pros of Staking LUNA on Binance

- Offers a flexible staking plan

- Simple staking process

- Offers an APR of 3.5%

- Low minimum staking requirement

Cons of Staking LUNA on Binance

- Risk of asset loss if Binance is attacked or closes down

How to Stake LUNA on Terra Station Wallet

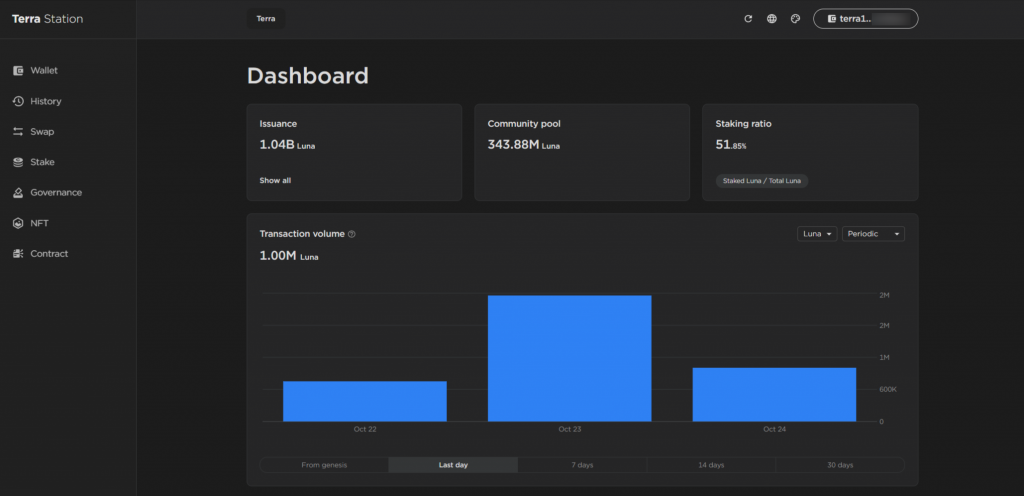

Terra Station is the official wallet of the Terra blockchain built for storing all Terra-based assets. Asides from this primary function, Terra Station is also equipped with other functionalities such as staking, governance, coin swap, and access to all decentralized applications in the Terra ecosystem.

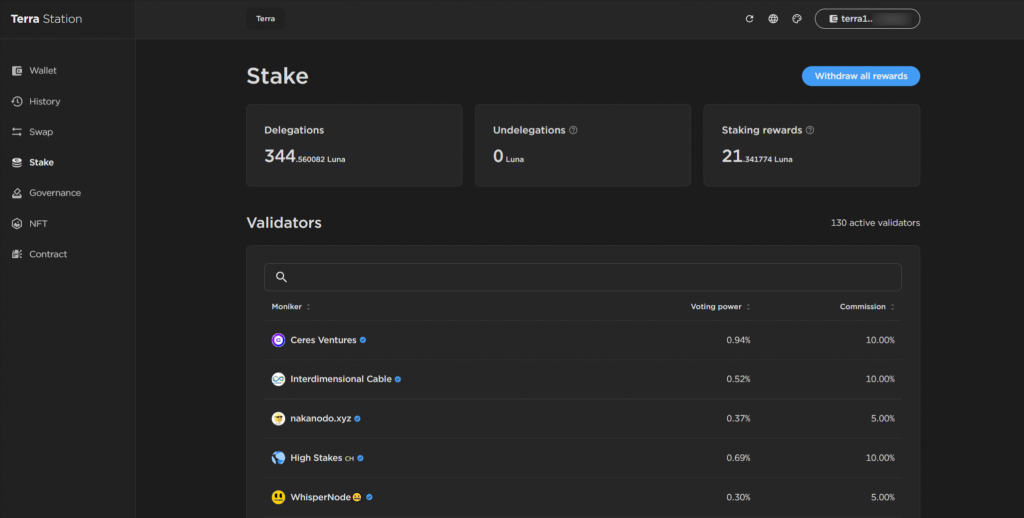

LUNA staking on Terra Station occurs via delegation to a network validator. When you delegate your tokens to a validator, you retain full custody of them, thus protecting your investment from any losses via an attack on the validator or Terra Station.

When choosing a validator to delegate your LUNA, it is essential to consider factors such as stake weight and commission fee. Each validator charges a commission fee starting from 2% on their delegators’ rewards.

You should also research a validator’s track record to take note of their slashing history. Slashing occurs when a validator displays malicious behavior, which results in the partial or complete loss of staked LUNA tokens.

To begin staking on the Terra Station wallet, you will first need to create a wallet on the platform and transfer some LUNA tokens into it. Alternatively, you can connect Terra Station to any Ledger hardware wallet already containing your LUNA tokens.

On the Terra Station dashboard, click on the staking tab (“Stake”) and select the validator you most prefer. After selecting a validator, click on ‘Delegate,’ then enter the amount of LUNA tokens you want to stake and click confirm to start staking.

Using the Terra Station, investors earn interest at an APR of 14.59% via LUNA staking. You are also allowed to unstake your LUNA whenever you want. However, if you choose to undelegate your LUNA tokens from a validator, it will require a 21-day unstaking period. That said, investors can withdraw their earned rewards immediately at any time.

Pros of Staking on Terra Station Wallet

- Native crypto wallet to Terra blockchain

- Annualised interest rate of 14.59%

- Withdrawal of staking rewards at any time

Cons of Staking on Terra Station Wallet

- Unstaking requires a 21-day waiting period

- Commission fees from validator

- Risk of slashing

How Much Can You Earn Staking LUNA?

LUNA staking provides investors with an excellent means of passive income. However, earnings via staking differ based on each platform. The table below provides information on how much you can earn staking LUNA on various platforms.

| Platform | Platform Type | Staking Rewards (APR/APY) |

|---|---|---|

| Binance | Centralized Exchange | 3.5% |

| Terra Station | Wallet | 14.59% |

| Stader | DeFi Protocol | 15.59% |

| KuCoin | Centralized Exchange | 5% |

What is Terra LUNA (Terra 2.0)?

Terra LUNA or Terra 2.0 is a public blockchain protocol built to facilitate the operations of Web3 products and services. It was launched in May 2022 as a fork off the Terra Classic chain. Initially, Terra Classic was the original Terra blockchain launched in 2019 by Terraform labs, a blockchain-based company co-founded by Do Kwon and Daniel Shin.

Terra Classic vs Terra 2.0

Terra Classic had a native token named LUNA, which was also employed in stabilizing the value of the TerraUSD (UST) token – an algorithmic stablecoin pegged to the U.S Dollar. In May 2022, TerraUSD lost its peg leading to a massive devaluation of the stablecoin and its Twin asset – Luna (LUNA). In order to revive the crypto project, the original Terra blockchain was split into two chains with separate operations.

The first chain is the initial Terra blockchain which was rebranded as Terra Classic, and its native LUNA token as Luna Classic (LUNC). This blockchain protocol remains operational, with LUNC still functioning as a price stability mechanism for UST, which is currently still de-pegged and priced at $0.036.

The second chain is Terra 2.0, which is now publicly known as the Terra blockchain, and its native token is LUNA. This LUNA token does not have a stablecoin pair allowing investors to invest freely without the risks of an algorithmic stablecoin failure.

The Terra blockchain functions as a secure smart contract platform, enabling developers to build and deploy decentralized applications easily. It employs a Tendermint proof-of-stake consensus algorithm which requires investors to stake LUNA tokens to verify transactions and create new blocks.

FAQs

How long does it take to unstake LUNA?

On Terra Station, it requires 21 days to unstake your LUNA tokens. However, most exchanges allow investors to unstake LUNA immediately whenever they want.

Is staking Terra LUNA worth it?

Staking LUNA allows you to earn a good amount of interest; thus, it can be considered a worthwhile venture. Moreover, LUNA, as a cryptocurrency, has good prospects for future price appreciation.

Where can I buy LUNA?

You can purchase LUNA on various exchanges, including Binance, Bitfinex, FTX, Gemini Huobi Kraken, and KuCoin.

Where is the best place to stake LUNA?

The best place to stake LUNA currently is on Stader which has an APY of 15.59%, followed by Terra Station at 14.59%, KuCoin at 5%, and Binance at 3.5%.

Can I stake Luna Classic (LUNC)?

Yes, LUNC staking is still supported in Terra Station. To stake Luna Classic make sure to switch chains in the Terra Station wallet to ‘Classic’ and then follow the same steps as you would with LUNA.

Final Words

LUNA is one cryptocurrency with lots of curiosity around it due to its origin. For now, it appears to be a promising project with favourable growth potential. And by choosing to stake LUNA, investors can create a sustainable source of passive income for themselves. Fortunately, this guide has provided the valuable information needed by all to go about the LUNA staking process.